Key Findings

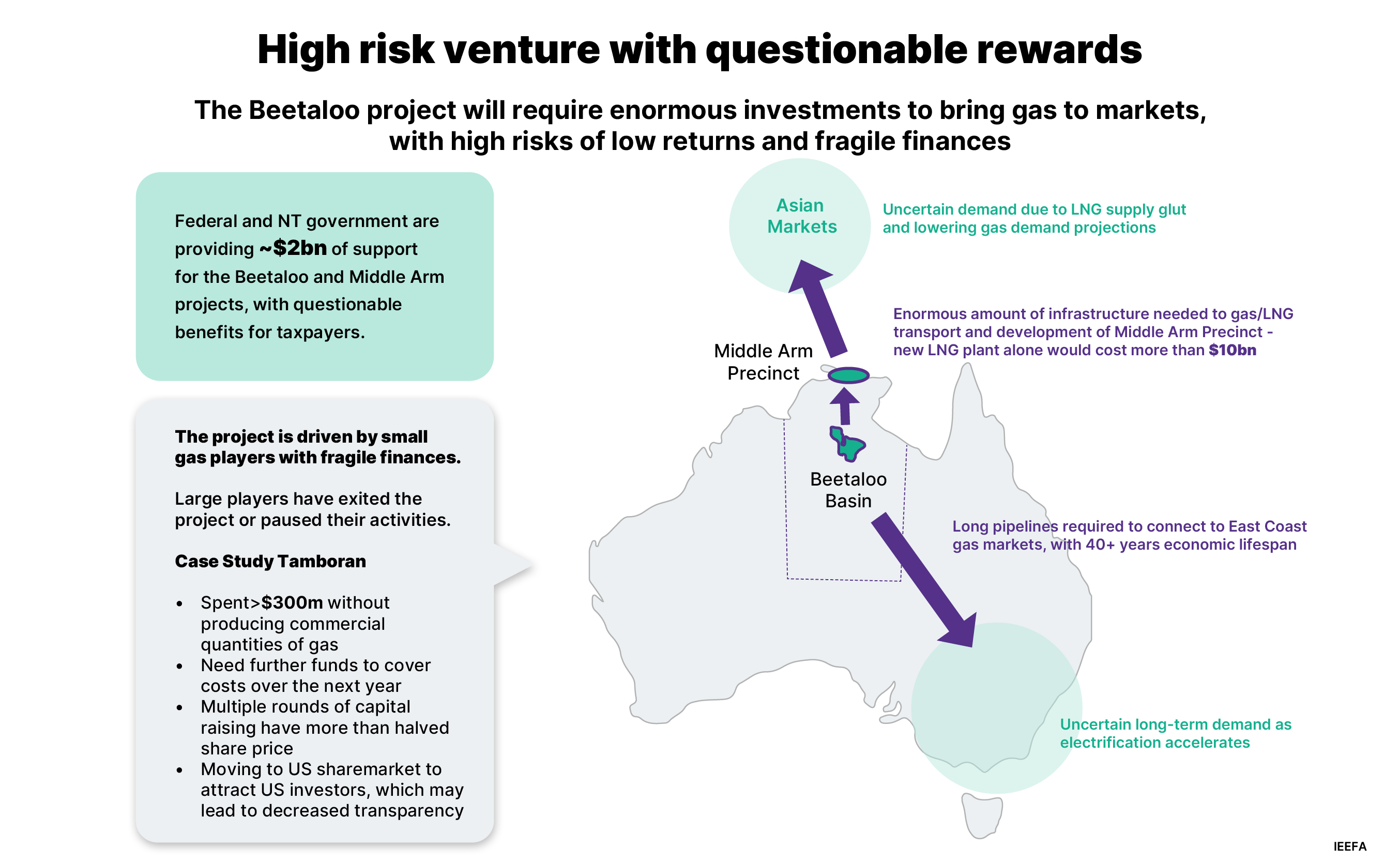

Gas from the Beetaloo Basin in the NT is unlikely to be competitive. The unprecedented increase in LNG supply under construction means global LNG markets are likely to face a glut in the second half of this decade.

Australia’s relatively high LNG costs will likely make it uncompetitive with lower-cost Qatar and the US, which are driving new capacity additions.

Three small companies – Tamboran Resources, Empire Energy and Falcon Oil and Gas – are trying to commercialise their interests in the Beetaloo. Each will need significant external funding to realise their plans.

Beetaloo gas is crucial to the development of the Middle Arm Sustainable Development Precinct in Darwin, but it will rely heavily on taxpayer funds, and provide poor returns for public finances.

Tamboran’s proposed NTLNG project at Darwin will produce 6.6 million tonnes of fossil gas a year and could cost more than A$10 billion. It will require significant funding at a time when the International Energy Agency is warning that most LNG projects under construction will not make a return on their cost of capital in a net zero emissions scenario.

Executive Summary

This Analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

The Beetaloo Basin in the Northern Territory (NT) has been touted as a promising, world-class shale gas resource. Reflecting this potential, the Australian government announced in January 2021 its intention to support the development of the Beetaloo Basin as part of the Beetaloo Strategic Basin Plan and the National Gas Infrastructure Plan.

This included the government establishing a A$50 million fund to support A$200 million of exploration activity by mid-2022, to stimulate the search for commercial gas resources in this remote part of Australia (where roads and other infrastructure are lacking). This is in addition to almost A$1.5 billion allocated to the Middle Arm Sustainable Development Precinct (MASDP) and related regional logistics hubs in the NT. Documents released under Freedom of Information (FOI) show the capital costs of Middle Arm of up to A$3.7 billion.

Our analysis suggests that these projects may have low economic value, with high costs and risks, and uncertain returns.

The precinct plan includes the construction of the 6.6 million tonnes a year (Mtpa) NTLNG production and export terminal, with feed gas slated to come from the Beetaloo Basin.

The Middle Arm precinct could receive taxpayer funding from the Australian and NT governments. Both governments have signed several other agreements over the years to stimulate development of the territory’s gas resources. In 2013, they signed a memorandum of understanding to develop the territory’s onshore gas resources to supply Rio Tinto’s alumina refinery on the Gove peninsula. Rio Tinto abandoned those plans later that year and closed its refinery in 2014.

Despite hundreds of millions of dollars spent on exploration over more than a decade, the Beetaloo is yet to produce any commercial quantities of gas. There are only three relatively small companies – Tamboran Resources, Empire Energy and Falcon Oil and gas – actively seeking to commercialise their interests in the area.

Several large energy and chemical companies were once active in the Beetaloo, including major gas player Origin Energy. However, they have since walked away. The sole exception is Santos, which continues to undertake the work required to maintain its exploration permits.

The remoteness of the Beetaloo, about 500km south-east of the NT capital and port of Darwin, means that significant new infrastructure investment will be required to process gas and transport it to end users, particularly along Australia’s east coast. The NTLNG project will require an even larger investment, likely exceeding US$10 billion, given the high costs associated with greenfield fossil gas projects.

Beetaloo would also likely enter the LNG market at a time when the International Energy Agency (IEA) expects gas demand to peak and LNG markets saturated with unprecedented supply following significant new capacity from Qatar and the US. LNG projects in Australia has also proved costly – of the 10 existing LNG projects in Australia, seven have destroyed shareholder value due to cost overruns and construction delays.

Development of the Beetaloo basin will rely on fracking, a high-risk technology. In the US, fracking has created water and land contamination controversies while investors lost billions. The Beetaloo will require water supply for drilling and fracking, and pose risks of contamination that could affect the primary water source for the region and its agriculture.

Our previous analysis of the Middle Arm found that “a new supply of natural gas is not enough of a financial incentive to offset the costs of new agrichemical and petrochemical facilities, new roads, pipelines, ports, water systems, power plants, housing, schools and community facilities”.

There are two main potential demand markets for the Beetaloo gas: the Australian east coast gas market, and in particular the Southern states which face a gas supply gap, and LNG export markets primarily in Asia. Major uncertainties exist on whether those markets will present long-term demand for Beetaloo gas.

Globally, LNG markets face a supply glut at a time when LNG has gained a reputation as an unreliable fuel in key growth markets, raising questions about whether future demand growth expectations will be realised. While the domestic market faces the prospect of shortfalls, there are downside demand risks from a range of factors, including the growing pace of electrification due to government policy changes in some jurisdictions.

Australia’s eastern states are setting ambitious emissions reduction targets and increasing their support for electrification – which could eliminate residential gas demand within two decades. The Australian Energy Market Operator (AEMO) expects that gas use for power generation is also likely to decrease, and industrial gas use could also be reduced materially through energy productivity, electrification and demand destruction driven by high gas prices.

This investment will be costly and subject to stranded asset risk given the potential for future gas demand to be lower than anticipated.

This investment will be costly and subject to stranded asset risk given the potential for future gas demand to be lower than anticipated.

Beetaloo gas is unlikely to be competitive. The unprecedented increase in LNG supply under construction means that global LNG markets are likely to face a glut in the second half of this decade. Australia’s relatively high LNG costs will likely make it uncompetitive with lower cost Qatar and the US which are driving new capacity additions. There is also great uncertainty about the long-term demand outlook for LNG in emerging Asian markets, which are expected to replace Australia’s main markets for LNG exports.

Junior exploration company Tamboran has emerged as a key player in the Beetaloo Basin following several permit acquisitions that culminated in the purchase of Origin Energy’s permits in the region.

This report examines Tamboran’s financial situation in detail and finds it to be dependent on a handful of deep pocketed shareholders. Tamboran raised more than A$365 million in six years from investors, but already spent more than A$300 million on exploration without producing any commercial quantities of gas.

Since Tamboran listed on 1 July 2021, its share price has more than halved, largely due to multiple share issues to raise funds to keep the company operating.

While Tamboran has plans to develop a pilot project, its financial position suggests it will require additional funding to produce Beetaloo gas commercially. Even after Tamboran’s latest fundraising in December 2023, it will need further capital to cover its obligations in 2024.

Tamboran has relied on investors in the US shale gas sector for most of its funding. The company announced plans in late 2023 to change its primary sharemarket listing from Australia to the US (incorporated in the state of Delaware) to gain access to a broader pool of investors. While a move to Delaware may help Tamboran raise additional funds, Delaware’s corporate rules of anonymity also raise questions about whether the move will impact on the level of transparency available to investors (at a time when they are likely to want more transparency about the company’s activities). Any decrease in transparency, should that arise, may be a sensitive issue for Australian investors and taxpayers, particularly given the levels of past and proposed taxpayer support for the development of the Beetaloo Basin and Middle Arm Precinct.

There are significant questions on the financial and economic benefits that will be delivered by the development of the Beetaloo Basin, for investors as well as for governments. The proposed public financial support offered to the project and the Middle Arm precinct should be revisited in light of the changing domestic and global outlook for both gas demand and supply.