How renewable energy holdings can contribute to the growth of Norway’s pension fund in a time of oil industry uncertainty

Download Full Report

View Press Release

Key Findings

The growth of the Fund has produced significant benefits for the people of Norway but has created an unsustainable fiscal dependency as well.

IEEFA believes it is advisable for the Storting and the Fund to act now to address the longterm fiscal stress caused by declining oil revenues and investment returns.

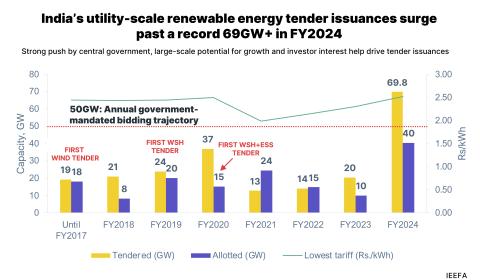

Renewable energy is driving the growth of listed and unlisted infrastructure markets. The current combined market for both is $4.8 trillion.

Executive Summary

Norway’s Government Pension Fund Global (GPFG) is facing a series of time-sensitive strategic investment decisions driven in large part by the declining financial performance of the oil industry. The Fund plays an integral role in supporting the annual budget of Norway, which counts on its contributions to maintain services and to balance the budget. The Fund’s oil investments today place Norway budgetwise on a trajectory for long-term structural decline, and must be addressed quickly.

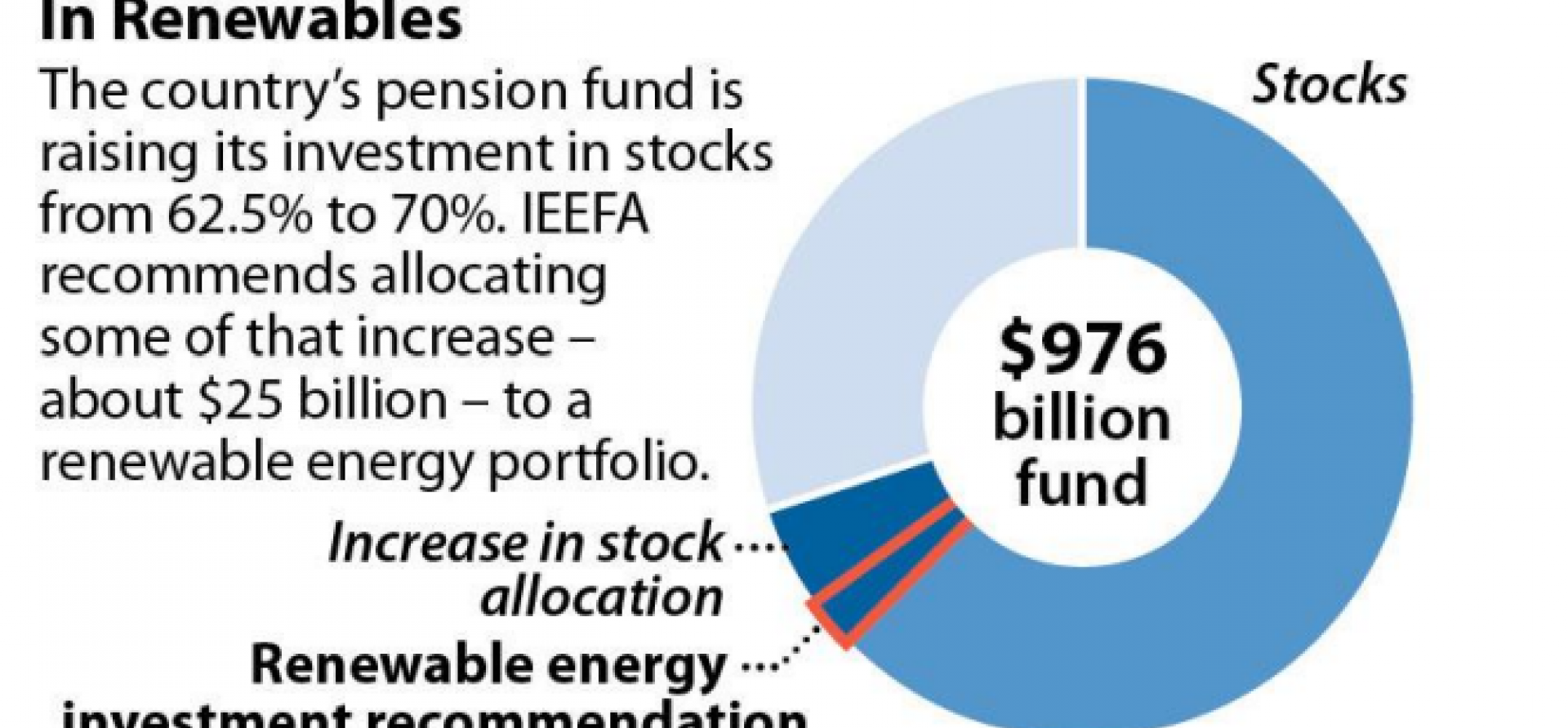

To manage the Fund in a declining oil market, the Ministry of Finance and its advisors have opted to increase the proportion of Fund assets invested in the stock market, from 62.5 percent of the Fund’s 7.5 trillion NOK (US$976 billion) in holdings to 70%.

The freed-up capital from this move of course needs to be carefully reinvested—and invested with returns in mind. One way to achieve a good outcome would to be to invest in renewable energy, a fastgrowing segment of the global energy economy and one that is now widely seen as a mainstream sector with a positive investment outlook.

The same forces driving the decline in the oil industry are also providing opportunities to profit from renewable energy. The renewable sector is producing attractive returns, is growing, and its outlook is positive. As more institutional investors take advantage of this potential, new renewable energy investment opportunities are emerging in the stock market as well as in special purpose funds. Investor risks across the renewable sector, particularly in unlisted infrastructure, are typically well-managed by competent professionals.

The Institute for Energy Economics and Financial Analysis (IEEFA) recommends that a portion of the Fund’s capital be rededicated now to expanding its position in renewable energy. The shift under consideration will require the re-allocation of approximately 554 billion NOK (US$72 billion). We recommend that the Fund allocate approximately 35% of this capital—190 billion NOK (US$25 billion)—to a renewable energy portfolio. A renewables portfolio could include a combination of increases in targeted investments to utilities and listed infrastructure companies with growing renewable portfolios; investment in indexes with exposure to renewables; and a set-aside for direct investments in listed and unlisted infrastructure projects. Each of these investment opportunities have track records with returns that meet or exceed GPFG’s historical performance. As the Fund becomes more experienced with new investment instruments the allocation of Fund assets to these areas can increase.

Equities add risk, but the Finance Ministry and its advisors have weighed them and determined that the shift under considideration would be a prudent course of action and an appropriately swift way to manage an emerging long-term fiscal problem. A timely response will allow Norway to get out in front of an emerging fiscal and political problem and to capitalize now on growth areas in the global marketplace.

How the Fund re-allocates capital will determine whether its new investment targets are met. The action recommended here offers the Fund a prudent way to diversify its investments and achieve attractive rates of return while complying with policy positions that the Norwegian Parliament, the Storting, has laid out for the Fund with regard to divestment from the coal sector.

Please view full report PDF for references and sources.