Key Findings

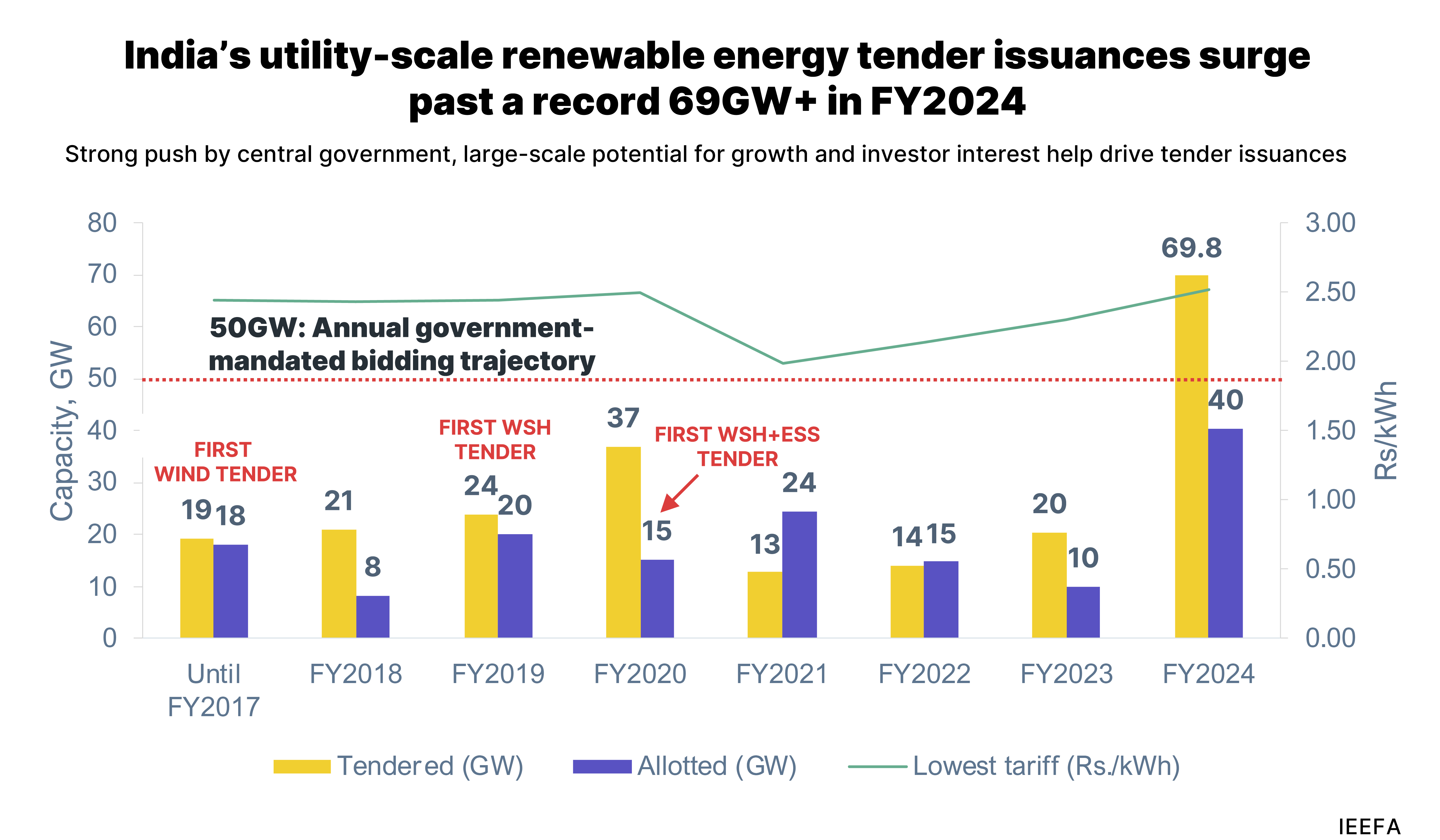

A record 69+ gigawatts (GW) of renewable energy tenders were issued in fiscal year (FY) 2024, surpassing the government-mandated target of 50GW.

Of all awarded tenders in FY2024, about 25% were from the Solar Energy Corporation of India (SECI). However, the rising prominence of other tendering agencies underlines the strength of India's renewable energy tendering ecosystem.

In two years, solar tariffs have increased marginally by ~8.5%, from an average of Rs2.3-2.4 per kilowatt-hour (kWh) to Rs2.5-2.6 per kWh, despite a ~57% fall in module prices in the same period.

From FY2020-24, the share of hybrid renewable energy tenders increased from 16% to 43%.

Executive Summary

Large-scale renewable energy projects in India have been generating interest from both domestic and international players of late. After a slump in activity between 2019 and 2022 due to global price shocks and supply-chain issues brought on by the COVID-19 pandemic and Russia’s invasion of Ukraine, the utility-scale market has rebounded and gone from strength to strength.

In FY2024, bidding for utility-scale renewable energy projects outstripped the government’s ambitious target of 50GW with a record 69GW bids. The primary reasons were the large-scale potential for market growth, central government support in terms of targets and regulatory frameworks, and higher operating margins.

Source: JMK Research

Note: Only utility-scale project development renewable energy tenders are included. Standalone ESS and PH tenders are not included.

Of the total awarded tenders in FY2024, only about a quarter are from SECI. State-level tendering authorities will play an equally important role in the utility-scale renewable energy landscape.

However, transferring that laudable figure from paper to power production still faces significant and persistent challenges in the form of 40% import duties and the requirement to purchase locally manufactured components. These initiatives, while worthy, mask the reality that local manufacturers still cannot compete on price with imports or satisfy increasing domestic demand, adding unnecessary costs and time to renewable energy projects.

Meanwhile, the government is considering reinstating reverse auctions for wind projects, which were suspended after unviable tariffs led to their cancellation. Government vacillation on this issue only creates uncertainty among market stakeholders.

Even though module prices have fallen sharply since August 2022, this trend has not translated to discovered solar tariffs in India. The reason for this is the double barrier to solar imports in the form of basic custom duties (BCD) and the approved list of models and manufacturers (ALMM).

This report examines the status of the tendering process and analyses, in detail, trends in the preceding years, their successes and setbacks, the key players and new entrants, and innovations.

Innovations include India’s first large-scale offshore wind tender totalling 4GW, issued in early 2024, with a 500MW concentrated “solar + thermal storage” tender to follow in early 2025. In addition, there has been an exponential rise in ESS tender issuance for energy storage projects, which will form a crucial part of India’s renewable energy infrastructure.

There remains some degree of risk aversion to new technologies among developers. However, the success of large-scale, pan-India projects awarded to market leaders, some with international backing, will showcase the potential of these new technologies to the broader renewable energy market.

The ability to replicate successful tender types and introduce novel tender designs will define the trajectory of utility-scale renewable energy tendering in India. SECI’s offshore wind and concentrated solar tenders will unlock their market potential, which will, in turn, be crucial for India to reach its renewable energy target of 500GW by 2030.