Beyond coal: Investing in Kosovo's energy future

Download Full Report

Key Findings

Electricity demand in Kosovo will increase as much as 20% by 2030, driven by income growth and gradual electrification of the wider energy sector, implying an additional 1,200 gigawatt-hour (GWh) annual demand in 2030.

The intensity of electricity demand growth can be reduced by investment in networks and energy efficiency.

The launch last year of Kosovo’s first large-scale wind and solar power projects revealed promising performance results.

Executive Summary

In this brief review, we examine the potential for meeting Kosovo’s energy demand growth, focusing on electricity. We find that Kosovo can seize on the readiness of international financial institutions and development banks to invest in the country’s energy transition beyond coal. Kosovo can use these funds to develop a world-class, energy-efficient, renewables-based economy. Technologies and market innovations to enable such a transition are already available, and include battery storage, demand-side response (DSR) and more robust interconnection.

Main Findings

Electricity demand growth and energy efficiency: We expect electricity demand will increase as much as 20% by 2030, driven by income growth and gradual electrification of the wider energy sector, implying an additional 1,200 gigawatt-hour (GWh) annual demand in 2030. However, this level of demand growth can be reduced by investment in networks and energy efficiency. A World Bank analysis indicates a conservative potential for highly cost-effective electricity savings, equivalent to at least 1,400 GWh annually by 2030. This includes savings of more than 800 GWh through investment to reduce network losses and 600GWh from investment in buildings’ energy efficiency. We note that at present, losses in the low-voltage distribution network are an extraordinary 26% (1,378 GWh) of total distribution network demand, shared equally between technical losses and “unbilled energy.”

There are three main sources of energy Kosovo can potentially use to satisfy this demand—lignite, gas and renewables.

Lignite: We no longer see any realistic prospect for external financing of a new lignite power plant in Kosovo. Meanwhile, the older of the two existing lignite power plants, Kosovo A, will have to close soon, implying a loss of 2,100 GWh annual supply, based on 2019 output.

- Kosovo’s two existing lignite power plants, Kosovo A and Kosovo B, were commissioned in the early 1970s and mid-1980s. Their advanced age and inflexibility, coupled with their dominance of the grid, contribute to Kosovo’s poor quality of electricity supply.

- ContourGlobal, a London-listed investor, and the World Bank recently withdrew equity and credit support respectively for a proposed new lignite power plant in Kosovo. The reason for their withdrawal was simple: Coal is no longer the least-cost electricity option for Kosovo; the offtake price for the project would have been €80/megawatt-hour (MWh). It is also one of the highest risk technologies, because of hardening attitudes towards high-carbon power generation among policymakers, regulators and financial institutions. This is particularly evident in Europe with the EU’s 2050 net zero target and plans to introduce a carbon border tariff.

Gas:

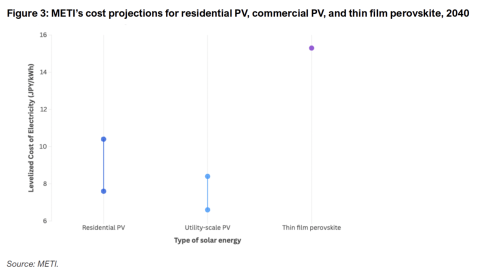

- Kosovo has no gas market or infrastructure, but wants to connect with several prospective pipeline projects, including the Trans-Adriatic Pipeline via Albania. According to the IEA, gas-fired generation has a levelised cost of energy (LCOE) of $90/MWh (~€76/MWh), but this does not include the large cost of new infrastructure that would be required to secure gas supply into Kosovo.

Renewables plus battery storage: The launch last year of Kosovo’s first large-scale wind and solar power projects revealed the first performance data for such projects. The results are promising. Electricity generation equals or outperforms peer and neighbouring countries, strengthening the case for renewables deployment. Kosovo can also exploit tumbling battery costs to bolster this resource by developing a cutting-edge supply of electricity from domestic renewables plus storage, totalling an additional 1,500 GWh annually.

- Based on the new renewables performance data, we estimate that wind and solar power capacity presently in the planning pipeline or under construction can supply an additional 400 GWh annually.

- A cost analysis completed in 2018 in the region indicates that a large-scale project combining wind and solar power with battery storage could be achieved at lower cost than new lignite-fired generation (i.e., at a LCOE of €60 to €70/MWh vs. €80/MWh). These figures will be even lower today, as costs of renewables and storage have continued to decrease. Such analysis indicates that a combined large-scale solar (400MW), wind (170MW), and battery storage (120MW/350MWh) project, could deliver an additional 1,100 GWh annually.

Balancing the grid: Kosovo would benefit from additional investment in interconnection and micro-renewables as a cost-effective way to deliver at least an additional 1,000 GWh annually by 2030.

- Expanded interconnection: In early 2020, Kosovo struck a deal with the association of European grid operators to connect with the continental European grid, allowing it to operationalise an under-used 400 kilovolt (kV) interconnection with Albania. Increased interconnection is a low-cost way for Kosovo to import flexible hydropower from Albania and export variable renewables to its neighbours. A new interconnection can add at least 1,000 GWh annually in secure imports and valuable export revenue.

- Support for prosumers: Kosovo has only a negligible rooftop solar photovoltaic (PV) market, but it does have the required legal and financial framework, including a net metering scheme. Growing the market 10-foldwith solar prosumers—customers who both generate and consume power on the grid—could deliver an additional 10 GWh annually. Encouraging private household investment in solar PV can reduce pressure on scarce state resources and reduce network losses.

Investment in demand-side response: One cost-effective way to reduce load shedding (when the power supply to a particular area is cut to protect against excessive demand) may be to establish a demand-side response (DSR) market that would contract with energy-intensive users to reduce demand when required.

Press release:

Renewables’ strong performance and falling costs can help Kosovo break from a coal-powered past

Report in Albanian:

Përtej qymyrit: Investim në të Ardhmen Energjetike të Kosovës

Press release in Albanian:

Performanca e fortë e burimeve të ripërtëritshme dhe rënia e kostove mund të ndihmojnë Kosovën të shkëputet nga e kaluara e furnizuar me qymyr