IEEFA update: UK reforms are killing solar market despite sector’s potential growth

(LONDON) – The UK government has stalled its solar market with a series of reforms and new proposed taxes and charges as well as withdrawn key support, even as solar has become more affordable and the sector’s potential grows.

Britain all but ended its large-scale solar market two years ago, when it issued the last green certificates for ground-mounted solar farms. Competitive auctions for funds to support large solar projects ended two years previously, in 2015.

Now the government is also cutting support for residential solar. In March, it terminated a feed-in tariff scheme for roof-top solar power without any replacement, meaning new projects would receive nothing in exchange for exporting power to the grid.

And the government is now planning further costs. First, it plans to raise value added tax (VAT) on solar panels to the standard 20%, from a reduced 5% which has applied until now.

And second, the energy regulator Ofgem (Office of Gas and Electricity Markets) has proposed to reform the way households are charged for using the grid, applying a flat-rate fee of £64 annually rather than a charge per unit of consumption. As a result, those who generate their own solar power and use less mains power will see their electricity bills rise. Figure 1 shows how the new flat rate (or “fixed charge”) will raise bills above their historical “baseline” for households with solar panels.

Figure 1. How Ofgem’s proposed fixed network charges will raise bills for solar households

Ofgem wants to make sure everyone pays something towards the cost of running the electric grid, including households that can afford solar panels. While that makes sense, the timing is poor. It would have been better to introduce new measures to recognise the value to local networks of zero-carbon power.

IEEFA showed two weeks ago how electric vehicles reinforce the business case for rooftop solar and battery storage, together decarbonising transport and electricity.

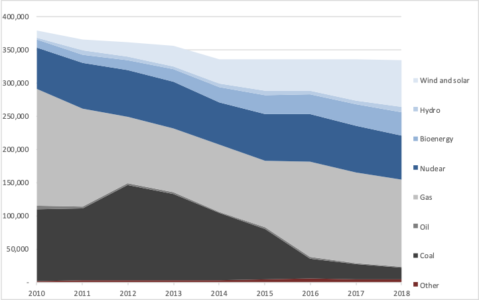

Variable renewables including wind and solar power have helped drive polluting coal generation off the grid. In 2018, UK coal generation fell by 25% (by 5.7 terawatt hours) while wind and solar power grew by 14% (8.6 TWh) – see Figure 2.

Figure 2. UK electricity mix, 2010-2018 (GWh)

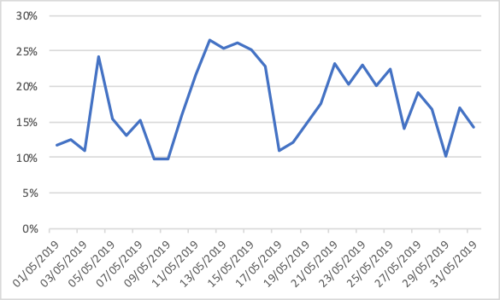

And solar power now reaches high levels of instantaneous power in Britain in summer, ranging from 10% to 25% maximum daily share of all generation last month, according to data from Gridwatch.

Figure 3. Daily maximum market share for solar PV versus all generation, May 2019

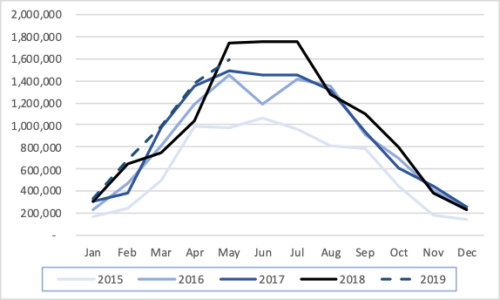

But total solar generation has only seen gradual growth since 2015, and now seems certain to stall (Figure 4).

Figure 4. Monthly solar PV generation, 2015-2019 (MWh)

The UK government has said it is considering a market alternative to the scrapped solar feed-in tariff. To avoid further harm to the industry, it should consider delaying the VAT hike and network charging plans until that expected new solar grid export income is baked in.

Gerard Wynn ([email protected]) is an IEEFA energy finance consultant.

RELATED ITEMS:

IEEFA Report: Electric Vehicles and Batteries Can Drive Growth of Residential Solar

IEEFA update: When will renewables dominate EU power markets?

IEEFA Europe: Progressive energy policies will make rooftop solar more affordable