IEEFA update: Fiduciary duty and fossil fuel divestment

Investment managers have cited fiduciary duty to justify their inaction on fossil fuel divestment. At best, these managers misunderstand the meaning of fiduciary duty. At worst, they use a flawed view to justify a business-as-usual approach. By failing in their duty to make impartial decisions about the financial interests of all their clients – no matter at what age or work/life stage – these managers are in breach of their fundamental responsibilities.

Fiduciaries must put the interests of all beneficiaries above their own and protect assets equally

Fiduciary duty requires both the obligation of prudence – to advise in a way that would best serve a careful investor – but also a duty of impartiality. Fiduciaries must put the interests of all their beneficiaries above their own interests and must protect the assets of their beneficiaries equally, both those currently retired and collecting pensions as well as those just starting out in the workforce.

The relevant laws require that fiduciaries seek to impartially balance the interests of different fund participant groups, such as different generations of participants, without unreasonably favoring one group over another, according to Keith L. Johnson, from Reinhart Boerner Van Deuren, a law firm that represents pension funds and institutional investors on fiduciary, investment, securities litigation and corporate governance issues.

For example, actions that increase income now at the cost of impairing returns later would clearly violate the duty of impartiality. It would be putting the interests of those collecting pensions now ahead of those who will begin collecting pensions in 50 or 60 years or more.

For a small fraction of beneficiaries (think, 90-year-olds with looming terminal illnesses), investments in oil and gas companies that pay high dividends might be deemed appropriate. For most beneficiaries, however, fossil-fuel investments are too risky, with potentially negative returns over the medium- and long-term. And for young beneficiaries, investments in oil and gas companies are almost impossible to defend.

FOSSIL FUEL COMPANIES ARE CLEARLY A MISGUIDED LONG-TERM INVESTMENT

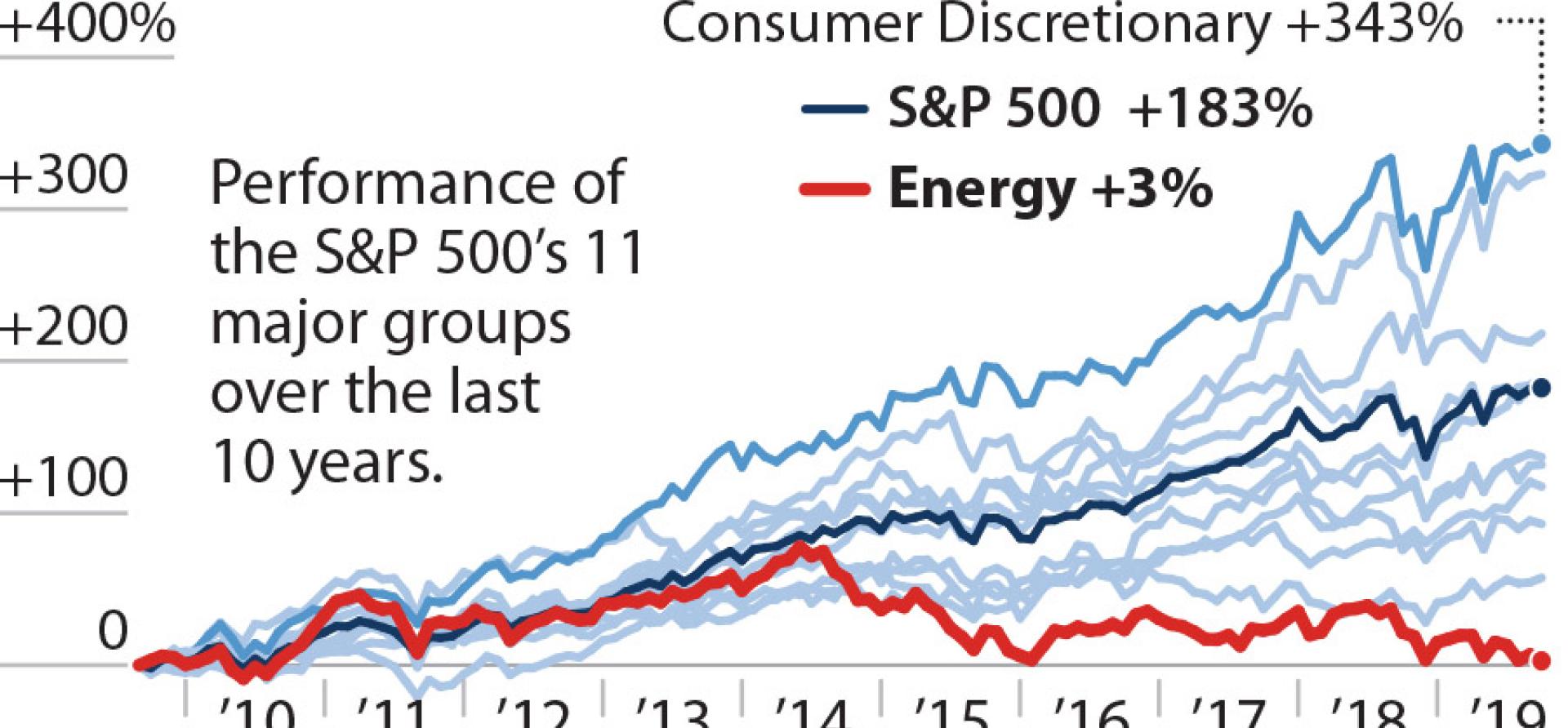

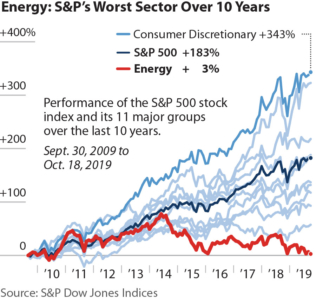

This is not breaking news. Once a market leader, the fossil fuel sector has been a poor investment for a decade. Financial returns have been abysmal. The energy sector, which does not include renewable energy, finished dead last among sectors in the Standard & Poor’s 500 in 2018, in the wake of years of underperformance. In 1980, seven of the top 10-ranked companies in the Standard & Poor’s index were oil and gas companies. Today, there are none. In 1980, energy companies comprised 28% the S&P 500. Today, it is closer to 4%. The outlook for oil and gas companies is weak, at best.

This is not breaking news. Once a market leader, the fossil fuel sector has been a poor investment for a decade. Financial returns have been abysmal. The energy sector, which does not include renewable energy, finished dead last among sectors in the Standard & Poor’s 500 in 2018, in the wake of years of underperformance. In 1980, seven of the top 10-ranked companies in the Standard & Poor’s index were oil and gas companies. Today, there are none. In 1980, energy companies comprised 28% the S&P 500. Today, it is closer to 4%. The outlook for oil and gas companies is weak, at best.

In short, the financial case for fossil fuel divestment is well-established. When an industry faces existential risk, there is no floor price, according to equity research firm Redburn. Not known for being “starry-eyed idealists,” Redburn analyts conclude that oil and gas companies are facing existential risk. Their shares have no floor. The only question is not whether, but when the bottom will drop out.

Many investment advisers were slow to get out of relatively small holdings in coal and lost their clients millions, as a consequence. The losses that will accumulate from staying too long in oil and gas will be even greater.

Risk of class action lawsuits rises from younger generation of investors

The youth-led climate movement illustrates the profound disconnect between the needs of young people in contrast to the entrenched interests of fossil fuel companies and the investment community, which continues to bet on them. Financial managers who persist in investing in fossil fuel companies – after a decade of poor financial returns – may face class action lawsuits by this younger cohort of investors. The fiduciary duty to be impartial requires that managers investing funds for today’s young workers divest from enterprises that pose high risks. Young workers may rightly conclude that their investment managers are failing in their fiduciary duty by not protecting their long-term financial interests.

Investing is all about looking ahead towards the future. Investment managers who remain stuck in the thrall of fossil fuels are looking backwards and failing younger beneficiaries. They are failing to be impartial. They are in breach of their financial duty to these young clients. They should be held to account.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

RELATED ITEMS

IEEFA update: Six real-world rebuttals to divestment naysayers

IEEFA report: Financial case builds for fossil fuel divestment

IEEFA report: Fund trustees face growing fiduciary pressure to divest from fossil fuels