IEEFA Update: Coal Is Dying, and EPA’s Clean Power Plan Reversal Can’t Save It

By turning the clock back on American energy policy through reversal of the Clean Power Plan, EPA Administrator Scott Pruitt — if he succeeds — will end up making electricity for everyday Americans more expensive. And as power bills rise so will the coal industry’s harmful impacts public health and the environment.

I say “if he succeeds” because his order will very likely be tied up in litigation for years to come, and signs are that much of the utility industry will simply ignore it.

Energy markets, in fact, are destroying the coal industry, whose only real hope for recovery is for government intervention. That’s the truth of what’s behind the move by Pruitt, who has been chronically loyal to the fossil-fuel sector in a long political career. It’s also what’s driving Energy Secretary Rick Perry to push for a program to prop up U.S. coal production, a proposal that is running into headwinds from many directions.

Market forces trump politics, and these forces have enormous momentum

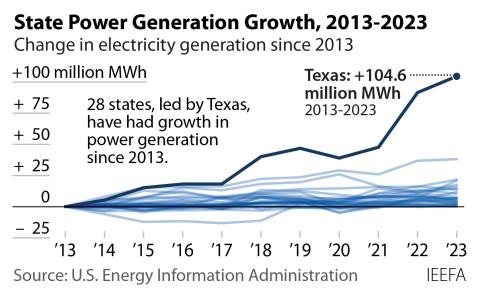

Washington, in fundamental respects, over the past several months has drifted toward irrelevance in how the U.S. utility sector is evolving. Pruitt’s announcement landed with a thud in Texas, where plans to close a coal-fired plant in San Antonio remain on course. Texas is also where the Monticello Power Plant is shutting down soon in a blow, as IEEFA reported yesterday, that will be especially hard on Peabody Energy, the largest publicly listed coal company in the world. And in an announcement out just today, Peabody will lose another big customer in Luminant’s shutdown by early next year of Big Brown Power Plant, which is also in Texas, where Luminant says it will close Sandow Power Plant too, another coal-fired facility. In New Mexico, PNM, the state’s big electricity company, sees little impact from Washington on its plans to close the Four Corners Power Plant.

Meanwhile, cities and states are picking up the sudden slack in federal policy by openly embracing an electricity-generation transition driven by the broad uptake of greener energy sources. Powerhouses that include California, New York and Virginia are staying a financially-sound course toward utility-industry transformation, and doing so in a public and deliberate way meant to defy the policies of the Trump administration.

SNL, an energy-industry trade publication, published data recently showing how “the number of scheduled or completed coal capacity retirements is increasing” — and will continue to rise through 2021. Among the big electricity providers moving away from coal: the Tennessee Valley Authority and Florida Power & Light.

Large industrial customers are contributing to this trend by contracting directly with renewable providers, and several name-brand corporations are basing their decisions on where to site new plants according to proximity to wind farms and solar resources. Among them: Amazon, Apple and Google.

Electric utilities themselves, as Moody’s Investor’s Services recently noted, are realizing that they can profit by building renewable generation and adding that capacity to their rate bases, a strategic move that freezes out coal producers. Moody’s has also published investor guidance showing how the fast-growing American wind industry puts coal-fired “at risk,” and at IEEFA we have found a similar narrative in our research.

The Clean Power Plan, years in the making, was not finalized until a few months before Donald Trump was elected, arriving at a time when a market shift had long been in motion and after deep change had already taken root.

Its reversal will not stop the trend away from coal-fired electricity.

David Schlissel is director of resource planning analysis at the Institute for Energy Economics and Financial Analysis.

Related Posts:

IEEFA Update: Fallout for Peabody’s Wyoming Coal Holdings From Shutdown of Plant in Texas

IEEFA Update: Peabody’s Recovery Plan Overstates the Market for Coal