IEEFA U.S.: More red flags on fracking-focused companies

The U.S. fracking sector continued to spill alarming volumes of red ink in the first half of 2018.

We detail the trend in a research brief published jointly today by IEEFA and Sightline Institute that describes how fracking companies continue to struggle.

Even after two and a half years of rising oil prices and growing expectations for improved financial results, a review of 33 publicly traded oil and gas fracking companies shows the companies posting negative free cash flows through June.

Some of our key findings:

- In the first half of 2018, U.S. fracking-focused oil and gas companies continued their eight-year losing streak.

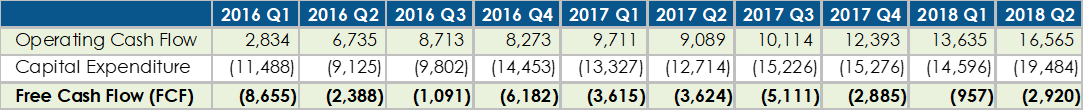

- The 33 small and mid-size exploration and production companies (E&Ps) we examined reported $3.9 billion in negative cash flows through June. (See Table 1.)

- E&Ps dipped into cash reserves in the first half of the year to fund capital expenditures and shareholder payouts.

These disappointing results come on the heels of a decade of bleak financial performance by the fracking sector, which has consistently failed to produce enough cash to satisfy its thirst for capital.

The industry instead has been forced time and again to raise new money from capital markets—racking up enormous long-term debts and creating growing frustration among investors.

In industry sector that has consistently spent more on drilling than it has generated from selling oil and gas.

Negative cash flows in early 2018, though disappointing, represented an improvement over early 2016 and 2017, when these companies racked up negative free cash flows of $11 billion and $7.2 billion, respectively.

The run-up in oil prices during the third quarter of this year may help oil and gas companies improve cash flows.

But as oil and gas companies prepare to release third quarter results, a key question remains: Will fracking companies produce enough cash, and for long enough, to cover both capital outlays and payouts to investors?

By definition, a healthy, mature industry consists of companies that generate enough cash to pay for new capital spending while also paying down old debts and rewarding equity investors. Yet fracking companies, in aggregate, are producing weak cash flow, so investors will struggle to identify individual firms within the sector that can produce blue-chip results.

Table 1: Free Cash Flow, Selected E&P Companies, Last 10 Quarters

Only nine of the 33 companies had positive free cash flows for the first half of the year. Poor performance spanned the sector: sub-groupings of oil-focused, gas-focused, and diversified companies all failed to cover their capital expenditures with operational cash flows.

Our review shows also that the companies we examined have depleted $5 billion in cash reserves from January through June to keep capital projects on track while sustaining distributions to investors.

Moving forward, capturing investment gains from the sector will require diligent, company-by-company evaluation of each firm’s financial and geological fundamentals.

Until the industry as a whole improves, producing both sustained profits and consistently positive cash flows, careful investors would be wise to view fracking companies as speculative investments.

Full research brief: “Energy Market Update: Red Flags on Fracking”

Lead author Clark Williams-Derry is director of energy finance at Sightline Institute. He can be reached at [email protected]. Tom Sanzillo is IEEFA’s director of finance, and Kathy Hipple is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA Canada: Ill-advised oil sands project faces rough future

IEEFA update: Whether prices are high or low, the oil and gas industry is freighted with risk

IEEFA report: Fund trustees face growing fiduciary pressure to divest from fossil fuels