IEEFA report: Kit Carson electric co-op gains from breakup with coal-centric Tri-State group

April 9, 2019 (IEEFA New Mexico) — Kit Carson, a small New Mexico power co-op has gained from its breakup with a larger and increasingly anachronistic power-generation group, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report — Case Study: How Kit Carson Electric Engineered a Cost-Effective Coal Exit — details how Kit Carson Electric Cooperative (KCEC) simultaneously created greater local control over how electricity is generated and saved millions of dollars by ending its longstanding relationship three years ago with Tri-State Generation and Transmission Association.

The report also notes that KCEC is in partnership with the National Renewable Energy Laboratory (NREL) to build a national solar energy template for other co-ops.

The report also notes that KCEC is in partnership with the National Renewable Energy Laboratory (NREL) to build a national solar energy template for other co-ops.

“The Kit Carson move suggests a model for other rural electric co-ops to follow, not just regionally but nationally as well,” said Karl Cates, IEEFA research editor and lead author of the report. “The economics of the co-op’s business model argue for change based on benefits that include greater transparency into wholesale power prices, more local choice on how electricity is generated, and lower long-term electric rates.”

KCEC in 2016 paid a $37 million “exit fee” to gain liberation from Tri-State, which has 43 member co-ops in four states (the group was named originally for its presence in Colorado, Nebraska, and Wyoming, later expanding into New Mexico).

The report notes that KCEC managers and executives had tried for years to modernize an outdated agreement with Tri-State, which was based on “at least three increasingly unacceptable flaws with the co-op’s Tri-State contract,” which was not set to expire until 2040:

- First, Tri-State’s wholesale pricing—that is, the price Tri-State charged KCEC—kept going up (by 106 percent in total from 2000-2016).

- Second, Tri-State’s cap on self-generation limited members to 5 percent of total power consumed, effectively hobbling local development of renewables.

- Third, the absence of long-term transparency prevented KCEC from knowing how often and when Tri-State would increase rates.

KCEC realized at least three major gains from partnering with Guzman:

- Pricing predictably—the Guzman contract runs for 10 years and guarantees a set wholesale price for power through the life of the contract.

- Hometown freedom to become a solar-driven co-op within a few years’ time (the Guzman deal has no self-generation cap).

- Local economic benefits tied to lower long-term electric rates and to job creation from KCEC’s solar buildout.

The report cites KCEC’s 2016 annual report in which the co-op’s chief executive stated: “Now our members have a 10-year short-term fixed-cost of power purchase contract, and a plan to develop 35 megawatts of solar power by 2022, which will allow KCEC to generate 100 percent of its year-round daytime power supply from the sun.”

A model for co-ops both regionally and nationally

KCEC executives estimate that the local direct economic benefits of its solar-capacity buildout by 2020 at $10 million annually and estimate it will support about 50 full-time-equivalent jobs per year. They estimate further that the deal with Guzman will save the co-op $50-$70 million over the 10-year life of the agreement.

The KCEC power purchase agreement with Guzman led to an immediately lower annual wholesale rate for KCEC—$67.25MWh, a 15 percent drop from the $79.17MWh Tri-State had charged the co-op the year before—and cleared the way to more solar expansion.

KCEC had endured 12 rate increases from 2000-2016 under Tri-State, increases that doubled the prices that KCEC was paying for power from Tri-State over the full 16-year period, from $39.06/MWh to $79.17/MWh.

KCEC’s new power purchase agreement sets the price bar lower than Tri-State’s 2017 wholesale average of $75MWh. The Guzman deal, by comparison, after setting 2017 rates at about $67MWh put them even lower in 2018, at $66.66MWh. From 2019-2022 the Guzman wholesale rate to KCEC will average about $75MWh as the co-op pays off its exit-fee loan. After the pay-off, the rate plummets further to an average of about $47MWh through 2026.

“Tri-State, in the meantime, has shown limited interest in developing a truly post-coal generation model,” the report states. “While it has invested some in renewables, it still gets most of its power from coal-fired generation and is heavily invested in coal plants and coal mines— with significant ownership stakes at plants and mines in Arizona, Colorado, and Wyoming.

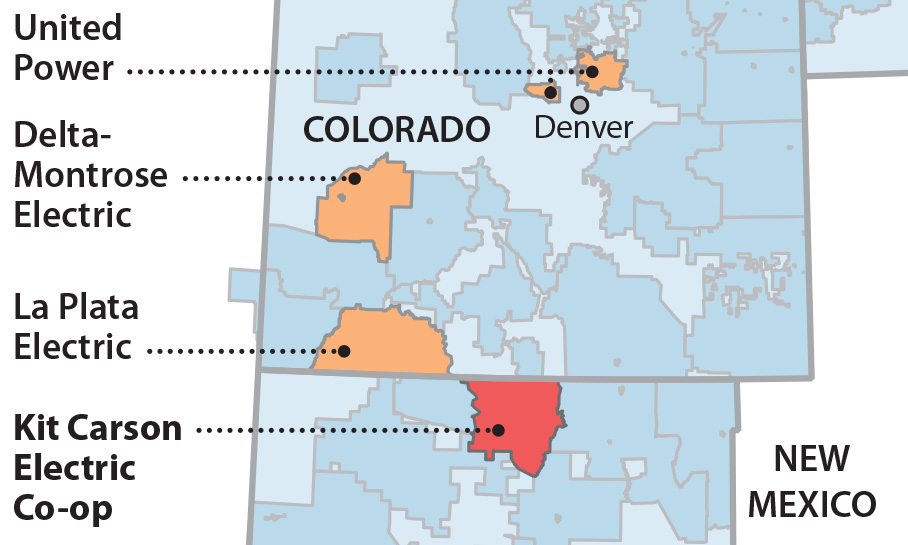

The report notes also that three Tri-State members in Colorado — Delta Montrose Electric Association, United Power in Brighton and La Plata Electric in Durango — are re-examining their relationships with Tri-State.

Full report here: Case Study: How Kit Carson Electric Engineered a Cost-Effective Coal Exit

Media Contacts

Vivienne Heston, IEEFA, [email protected], (914) 439-8921

Karl Cates (New Mexico), [email protected], (917) 439-8225 or (505) 780-8344

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.