IEEFA report: Fund trustees face growing fiduciary pressure to divest from fossil fuels

July 10, 2018 (IEEFA) — A paper published today by the Institute for Energy Economics and Financial Analysis details the growing rationale for divesting from the fossil fuel industry.

The paper—“The Financial Case for Fossil Fuel Divestment”—is aimed primarily at trustees of investment funds that continue to hold stakes in a sector that is freighted with risk and is not likely to perform nearly as well in the future as it has historically—regardless of whether oil prices rise or fall.

Kathy Hipple, an IEEFA financial analyst and co-author of the report, said fund trustees everywhere have a pressing fiduciary duty to re-examine their investment commitments to fossil fuel holdings.

‘Volatile revenues, limited growth opportunities, and a negative outlook.’

“Given the sector’s lackluster rewards and daunting risks, responsible investors must ask: ‘Why are we in fossil fuels at all?’” Hipple said. “The sector is ill prepared for a low-carbon future, based both on idiosyncratic factors affecting individual companies, as well as an industry-wide failure to acknowledge, and prepare for, an energy transition that is gaining momentum and changing the very nature of how energy is produced and consumed.”

This paper describes divestment “as a proper financial response by investment trustees to current market conditions and to the outlook facing the coal, oil and gas sectors.” It concludes that “future returns from the fossil fuel sector will not replicate past performance.”

It details how the global economy is shifting toward less energy-intensive models of growth, how fracking has driven down commodity and energy costs and prices, and how renewable energy and electric vehicles are gaining market share.

And it cautions that fossil fuel companies’ exposure to litigation on climate change and other environmental issues is expanding and notes that campaigns in opposition to fossil fuel industries have become increasingly sophisticated and potent.

Key points from the paper:

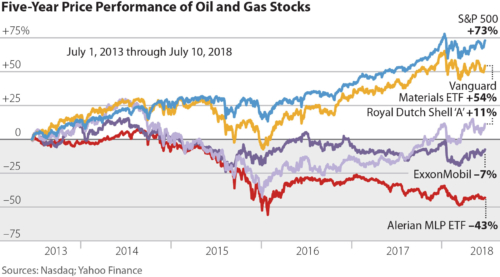

- “The fossil fuel sector is shrinking financially, and the rationale for investing in it is untenable. Over the past three and five years, respectively, global stock indexes without fossil fuel holdings have outperformed otherwise identical indexes that include fossil fuel companies. Fossil fuel companies once led the economy and world stock markets. They now lag.”

- “A cumulative set of risks undermines the viability of the fossil fuel sector. Climate change is hardly the only challenge facing the fossil fuel industry. The broader factors bedevilling balance sheets stem from political conflicts between producer nations, competition, innovation, and attendant cultural change. These risks can be grouped into a few broad categories, such as “pure” financial risk; technology and innovation risk; government regulation/oversight/policy risk, and litigation risk.”

- “Objections to the divestment thesis rely upon a series of assumptions unrelated to actual fossil fuel investment performance. Detractors raise a number of objections to divestment, mostly on financial grounds, arguing that it would cause institutional funds to lose money or that it would undermine their ability to meet their investment objectives, thus ultimately harming their social mandates. Such claims form a dangerous basis for forward-looking investment and are a breach of fiduciary standards.”

Arguments against divestment are rebutted in detail. An FAQ section provides a guide to divestment.

Tom Sanzillo, IEEFA’s director of finance and the lead author of the paper, said the fossil fuel industry is afflicted by what has now become a long-standing weakness in its investment thesis, “which assumed that a company’s value was determined by the number of barrels of oil (reserves) it owned.”

“In the new investment environment, cash is king, which creates a conundrum for the industry,” Sanzillo said. “Aggressive acquisition and drilling will likely lead to more losses for investors. If oil and gas companies pull back, on the other hand, and acknowledge the likelihood of lower future returns and more modest growth patterns, their actions will only confirm the industry is shrinking financially.”

“Historically, fossil fuel companies were drivers of the world economy and major contributors to the bottom line of institutional funds. This is no longer the case,” Sanzillo said. “Whether oil prices are rising or falling the investment thesis cannot replicate the sector’s strong past performance.”

“In the new investment thesis, fossil fuel stocks are now increasingly speculative. Current financial stresses — volatile revenues, limited growth opportunities, and a negative outlook — will not merely linger, they will likely intensify. Structural headwinds will place increasing pressure on the industry, causing fossil fuel investments to become far riskier.”

The paper, published jointly with Sightline Institute was co-authored also by Sightline’s director of energy finance, Clark Williams-Derry.

Full report: The Financial Case for Fossil Fuel Divestment

Media contact:

Karl Cates [email protected] 917 439 8225