IEEFA Report: A Cynical Re-Regulation Strategy in West Virginia

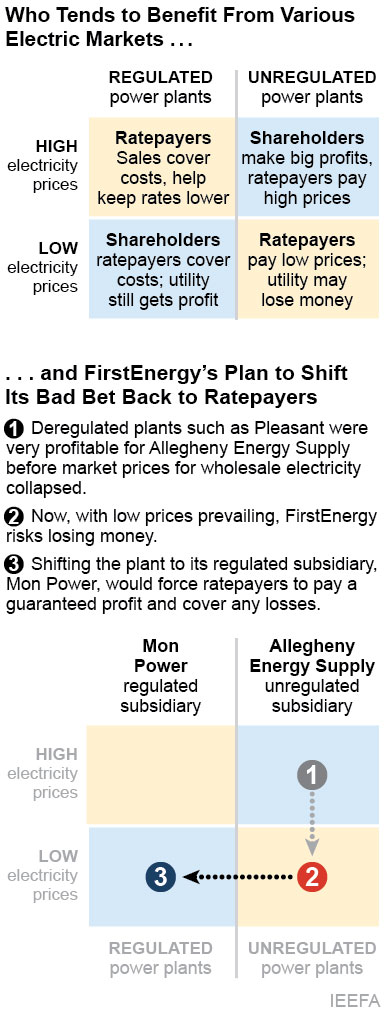

In seeking to get the West Virginia Public Service Commission to allow it to sell all or a portion of its Pleasants Power Station, Ohio-based FirstEnergy Corp. is following a strategy of re-regulation that stands to benefit shareholders at ratepayer expense.

The coal-fired 1,300-megawatt Pleasants plant is currently owned by a FirstEnergy deregulated subsidiary, Allegheny Energy Supply. Under what the company is proposing it would become largely the property of FirstEnergy subsidiary Mon Power, which is regulated and thereby guaranteed revenues that will cover its costs plus profit.

We’ve published a memorandum today (“Re-Regulating Coal Plants in West Virginia: A Boon to FirstEnergy, a Burden to Ratepayers”) that gets into the particulars. Put bluntly, the company is trying simply to shift market risk to ratepayers.

This has happened before.

Mon Power made a similar acquisition three years ago when it purchased a 79.46 percent share of the 1,984-MW coal-fired Harrison Power Station from Allegheny Energy Supply (Mon Power already owned the other 20.54 percent of the plant). In seeking Public Service Commission approval for that transaction, Mon Power argued that ownership of the additional share of Harrison would provide a net benefit to Mon Power and Potomac Edison’s customers (Potomac Edison is another FirstEnergy subsidiary, and its rates in West Virginia are set to be identical to Mon Power’s). In October 2013, the West Virginia Public Service Commission, in a 2-1 decision, approved the purchase.

FirstEnergy CEO Chuck Jones has described the Harrison transfer as a “model” for what it seeks to do with the Pleasants plant.

In our memorandum, we evaluate the operating performance of the Harrison plant and find the transaction thus far falling far short of the benefits promised to Mon Power and Potomac Edison customers. Instead, we estimate that customers have lost more than $160 million relative to what they would have otherwise paid for electricity.

The deal, in the meantime, has shielded FirstEnergy from suffering a similar loss had the plant continued to have been owned by Allegheny Energy Supply. Our analysis looks at only one aspect of the deal, whether the revenues from owning Harrison outweigh the costs, and does not consider other criticisms made at the time of the purchase, such as the failure to diversify Mon Power’s fuel mix.

Last month, the West Virginia Public Service Commission’s Staff and Consumer Advocate requested the Commission require Mon Power to issue an RFP for capacity—seeking competitive bids rather than entering into another deal with an affiliate company. Earlier this week, Mon Power requested that the commission deny this request, but our analysis shows exactly why such competitive bidding is needed to protect ratepayers.

The Pleasants transfer plan is part of a larger strategy by FirstEnergy to re-regulate unprofitable assets in deregulated markets as a way to ensure ratepayer subsidies. The company has pursued similar schemes in Ohio.

The FirstEnergy/Pleasants proposal will likely cost ratepayers dearly, much as these other deals either have, or will, if they are allowed to proceed.

Cathy Kunkel is a West Virginia-based IEEFA energy analyst.

Full memo

RELATED POSTS:

IEEFA Ohio: Damn Tradition, Bailouts Are Where It’s At

FirstEnergy Throws a Hail Mary Pass in Its Campaign to Keep Aging Power Plants Alive