IEEFA: India may face unbudgeted energy transition risk of nearly $9 billion

India is at the forefront of new global energy trends with renewable energy generation continuing to replace coal-based power.

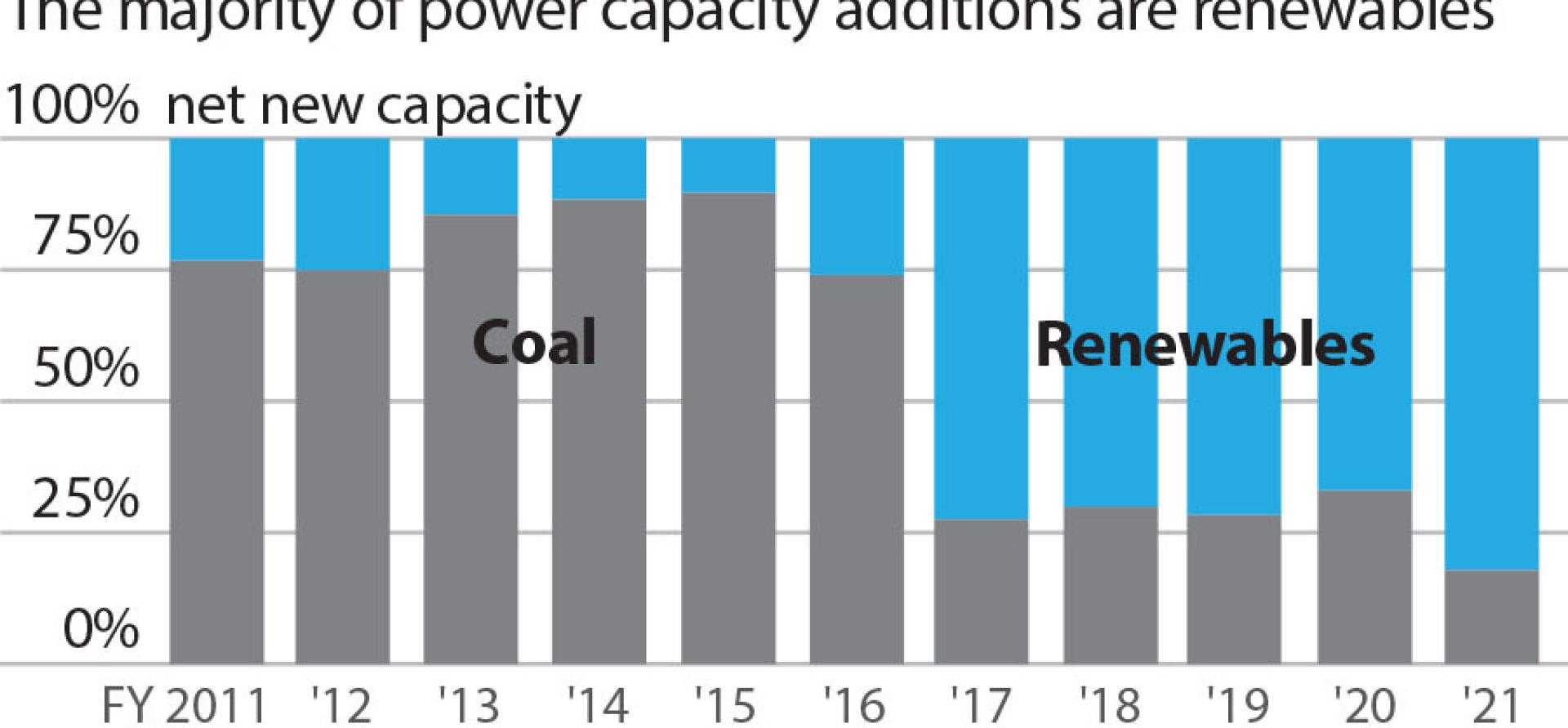

Since 2017 renewable energy has outpaced coal capacity additions by more than two to one

Since 2017, renewable energy has outpaced coal capacity additions by more than two to one (Figure 1). This trend is expected to continue going forward to expand to almost 100% of net new capacity as and when end-of-life coal plant closures are enforced. India is also well on course to reach its 2030 Nationally Determined Contributions (NDC) target of 40% power capacity share from non-fossil sources by mid-2021-22.

This dramatic growth in renewable energy capacity reinforces the fact that India is witnessing an unprecedented energy transition to low-carbon development, and the economic case suggests this is set to accelerate as the country comes out of COVID-19.

(FY21* corresponds to data for 8 months.)

To continue supporting this trend, in 2019, PM Narendra Modi announced upscaling of India’s renewable energy targets to 450 gigawatts (GW) by 2030. And in October 2020, Indian power minister R. K. Singh remarked, “India had promised in COP-21 that, by 2030, 40% of the country’s energy capacity would be from non-fossil fuel sources. We are already at 38.5% and by 2030, 60% of our energy capacity is expected to be from non-fossil fuel sources.”

While the current energy transition helps to mitigate emissions as well as the physical impacts of climate change, it presents significant financial risks for corporations.

The current energy transition presents significant financial risks for corporations

The increasing penetration of low cost renewable energy into India’s power system and the subsequent declining share of coal power could adversely affect the revenues, cash flows and financial health of coal dominated enterprises. A significant decline in value of these large entities could well cascade into serious knock-on consequences for investors as well for the broader economy. Going forward, companies may need to formulate firm-level response strategies for integrating the transition risks.

As part of a team at the Center for Climate Finance and Investment at the Imperial College, we recently investigated the potential financial risk of the energy transition on the performance of three key actors in the Indian coal value chain:

- NTPC, the largest power company in India in terms of generation capacity, has the bulk of its capacity in coal plants.

- Coal India Limited (CIL), the single largest coal producer in the world, produces around 83% of India’s overall coal production, with more than 602 million tons during 2019-20 alone.

- Indian Railways (IR), one of the largest railways systems in the world, is heavily dependent on coal, being the largest freight commodity it transports both in terms of volume (48%) and revenue (45%).

These actors are particularly exposed to transition risks due to the ongoing decline in the value of their core business as demand for high carbon products drops as a result of higher renewable energy penetration. Given the systemic importance of these firms to the Indian economy, the firm-level risks may pose spillover risks to the Indian sovereign as well. These firms also bring key management, engineering and financing capacities that are helping India navigate the energy transition. This was starkly evident when Coal India recently announced a planned diversification into solar wafer manufacturing.

In our study, we considered two scenarios for these key actors based on India’s power generation mix:

- a business-as-usual scenario based on current trends, and

- a downside scenario based on ambitious renewable energy deployment of 450GW by 2030.

Working from system-level to firm-level, we adopted the metric of cash flow at risk (CFaR) to capture firm-level financial impacts in present value terms. Our results revealed that the firms in question face substantial transition risk in the downside scenario.

We also considered two possible strategies for each firm:

- business-as-usual (Response A), where the firm stays on a predetermined course; and

- strategic response (Response B), where the firm takes strategic action.

NTPC could increase planned renewable energy capacity additions from 39GW to 49GW

For instance, as part of their strategic action to address the energy transition occurring, NTPC could increase planned renewable energy capacity additions from 39GW to 49GW and decrease coal capacity from 91GW to 81GW; CIL could increase domestic coal production to replace imports; and IR could utilise spare capacity to transport other commodities and industrial freight, thereby reducing road congestion from trucking whilst improving India’s energy security via reduced reliance on imported oil.

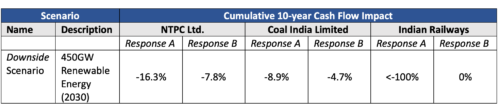

We found that, by following the business-as-usual strategy, each firm faces significant transition risks if the downside scenario materialises (Table 1). NTPC faces potential CFaR of 16.3%; CIL 8.9%; and IR, more than 100%. Our results also indicate that for NTPC, CIL and IR, at least half of the CFaR can be mitigated by adopting appropriate strategic response strategies. However, firm specific adaptation measures would be needed to mitigate the risks associated with the changes captured in the downside scenario.

Table 1: Summary of Results

Coal mines closures for CIL, a drop in coal transportation demand for IR, and/or the early retirement or idling of coal plants for NTPC could all have potential compounding shocks for the economy, leveraged by the public sector banks’ heaving financial exposure to coal , particularly Power Finance Corporation (PFC) and the State Bank of India (SBI). At present, the Indian government holds a majority stake in each of the three entities, with a 51.02% share in NTPC, 66.13% in CIL, and 100% in IR. Due to this, the Indian government may face an unbudgeted transition risk of nearly US$9 billion in the downside scenario, which could put pressure on the country’s investment grade status.

There is mounting pressure on the coal value chain in India

Our results highlight the following. First, there is mounting pressure on the coal value chain in India with a combined CFaR of US$9 billion over the next decade, as domestic coal production, transportation and coal-fired power generation have significant exposure to transition risks stemming from the aspirational target of 450GW of renewable energy capacity by 2030. Second, financial institutions and the Government of India could both lose in a scenario of increased renewable energy deployment if coal-dependent companies fail to adapt to the changing business environment. Third, without strategic responses, the firms included in our analysis face significant reductions in their free cash flows. The impact is moderate for CIL and NTPC but quite severe for IR.

Overall, while the accelerating energy transition risk continues to erode the hegemonic position of coal in India, the silver lining is that, for CIL, NTPC and IR, an appropriate strategic response will reduce the potential CFaR by at least half. And there are signs these firms are now making significant efforts to align their operations and make the appropriate changes required to address the current energy transition. Innovative financial instruments, like transition bonds and securitisation, could further help smooth the process.

Gireesh Shrimali and Abhinav Jindal are IEEFA guest contributors