Independent Power Producers, After a Tough 2015, Will Seek Ways to Stick Ratepayers in the New Year

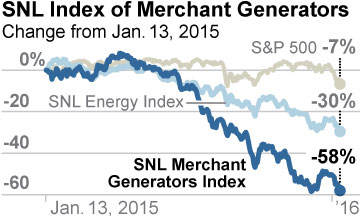

Last year was a tough one for independent power producers—companies that own power plants operating in deregulated markets. They include AES, Calpine, Dynegy, NRG, and Talen, companies whose stock prices dropped in 2015 by 30 percent to 66 percent.

Independent power producers became increasingly prominent after deregulation of the electric power industry drove regulated utilities to divest their power plants into separate companies. Power markets were set up to allow power plants to bid into the market with their operating costs; plants whose output is needed to meet demand receive the market clearing price.

Deregulation is a gamble—power plant owners are betting that the revenues they receive from selling power at market prices will be enough to recover their operating costs, as well as their fixed costs and profit. It’s a gamble that has had a rocky history: most major independent power producers have gone through bankruptcy at least once in the last 15 years (NRG, 2003; Mirant, 2003; Calpine, 2005; Dynegy, 2011; AES Eastern, 2011; Edison Mission Energy, 2014; Energy Futures Holdings, 2014).

Today, independent power producers, once again, are facing financial problems. So are utility holding companies that own both independent power producers and regulated utilities (companies like Exelon, FirstEnergy and NextEra).

The root of the problem, of course, is low wholesale electricity market prices. Gas prices continue to be low, and likely will remain so throughout this freakishly warm winter, pushing wholesale power market prices down. And electric demand continues to grow very slowly, or not at all in some regions of the country, which helps keep power prices low. Nationally, electricity demand grew only 1 percent from 2013 to 2014. By comparison, from 1980 to 2000, electricity demand grew by about 2.5 per year.

It has taken the electric utility industry a long time to adjust to the reality of slowing growth in demand. Every year from 2010 through 2014, PJM issued a load forecast that was revised downward the next year. Only in 2015 did PJM finally revise its load-forecasting methodology; its most recent load forecast shows a decline of 3.6 percent by 2019. This is a structural new reality, not simply a result of the recession, as PJM’s most recent load forecast belatedly acknowledges.

What does this mean for independent power producers in the near future? All indications are that low power prices and relatively flat electricity demand will continue for the next couple of years at least, meaning continued financial difficulties for the owners of merchant power plants.

Such an environment—in which growth is difficult—is ripe for future mergers and acquisitions. And companies that own a lot of merchant generation are desperately trying to add additional regulated operations, which have more stable earnings. (In a memorable email leaked last month, Hawaiian Electric Company’s CEO described her company as a “snack” for NextEra, the energy conglomerate on its way to a “buffet luncheon to acquire other regulated utilities.”)

The only other strategy that such companies have for turning their financial performance around is to find creative new ways to stick ratepayers with the costs of obsolete generating technologies, as FirstEnergy and AEP are currently seeking to do with their proposed ratepayer-funded bailouts in Ohio.

Cathy Kunkel is an IEEFA energy analyst.