Latest US Coal Markets Research

See more >

Who will pay for forcing the Campbell Coal plant to stay open?

June 05, 2025

Dennis Wamsted, Seth Feaster

Insights

Reopening closed coal plants makes no economic sense

April 10, 2025

Dennis Wamsted, Seth Feaster

Briefing Note

Mountain of coal at U.S. power plants a new threat to coal industry

December 16, 2024

Seth Feaster, Dennis Wamsted

Insights

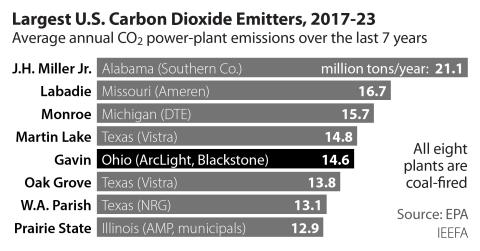

Private equity firm that is a “leading investor in the energy transition” to buy Gavin coal plant

October 10, 2024

Dennis Wamsted, Seth Feaster

Insights

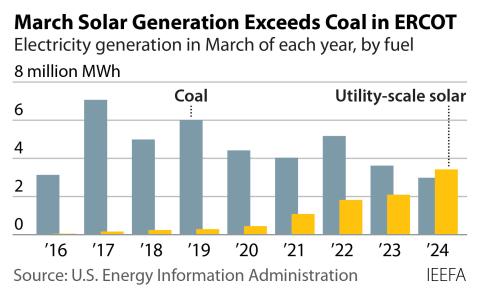

Texas marks milestone on the road to a greener grid as solar tops coal in March

April 05, 2024

Dennis Wamsted, Seth Feaster

Insights

Closure of last New England coal plant marks significant energy transition milestone

April 02, 2024

Dennis Wamsted, Seth Feaster

Insights

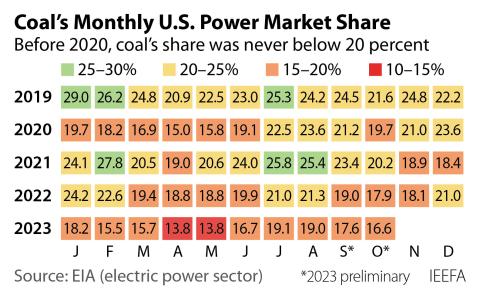

Coal use at U.S. power plants continues downward spiral; full impact on mines to be felt in 2024

November 02, 2023

Seth Feaster

Insights

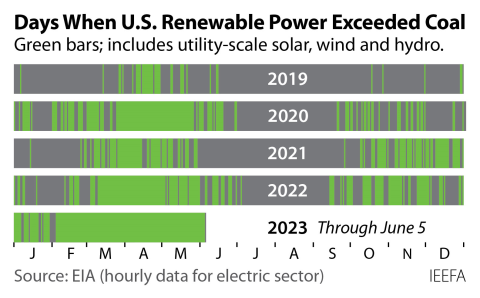

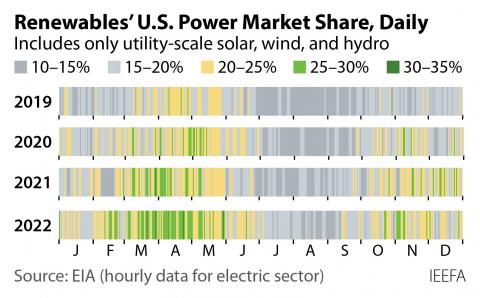

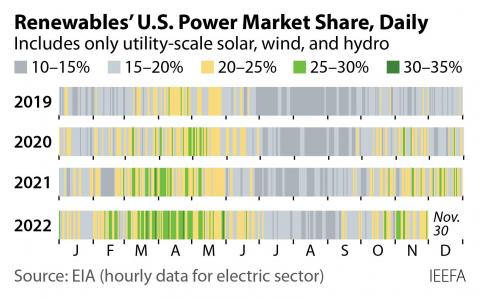

April was a milestone month for the renewable energy transition

June 12, 2023

Dennis Wamsted, Seth Feaster

Insights

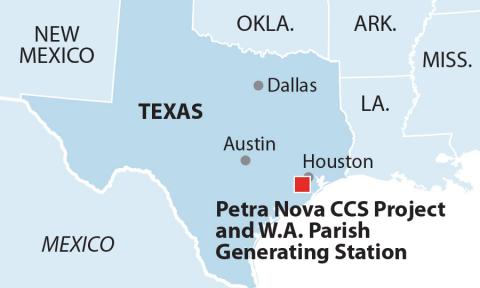

Proposed CCS projects need careful review for cost, technology risks

May 10, 2023

Dennis Wamsted, David Schlissel

Insights

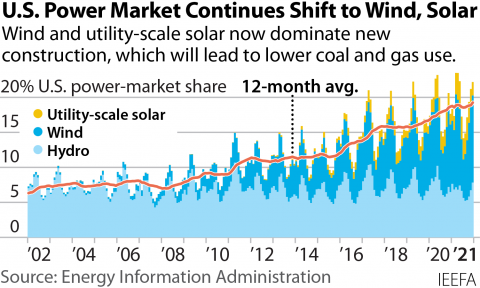

U.S. energy transition powered forward in 2022

January 05, 2023

Seth Feaster

Insights

Transformative impact of Inflation Reduction Act is coming into focus

December 07, 2022

Dennis Wamsted

Insights

Overshadowed by pandemic, war and economic concerns, the electric power transition has become a juggernaut in the U.S.

December 06, 2022

Dennis Wamsted, Seth Feaster

Insights

Latest US Coal Markets Reports

See more >

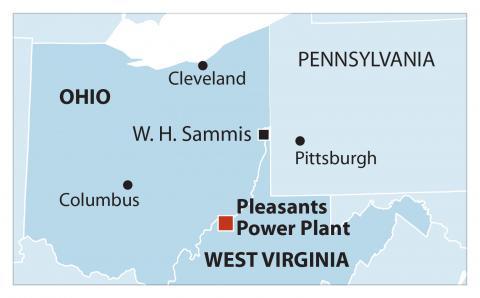

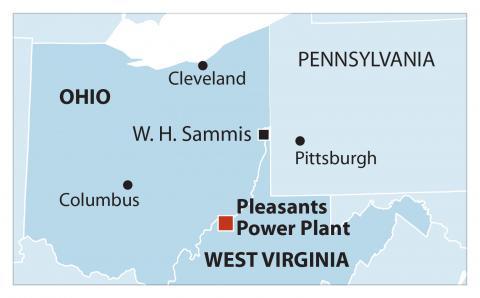

Pleasants coal plant purchase would be high risk, low reward

September 19, 2022

Dennis Wamsted, Seth Feaster

Report

Two years behind schedule, Boundary Dam 3 coal plant achieves goal of capturing 4 million metric tons of CO2

April 21, 2021

David Schlissel

Report

Energy transition to renewables likely to accelerate over next two to three years

March 01, 2021

Dennis Wamsted, Seth Feaster, David Schlissel...

Report

Bad news for coal in the southwest power pool

February 11, 2021

David Schlissel

Report

Virginia coal plant’s future isn’t bright: Preparation for transition should commence now

December 01, 2020

Karl Cates, Brent Israelsen, Seth Feaster...

Report

With long-term fossil commitments, Colorado electricity wholesaler is alienating cost-conscious co-ops

November 01, 2020

Karl Cates

Report

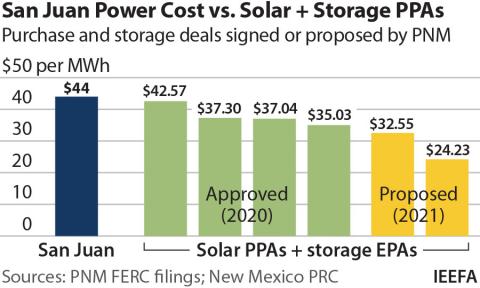

Biggest Utility in New Mexico Moves Forcefully Toward Solar

October 01, 2020

Karl Cates

Report

Project Tundra - A step in the wrong direction

September 22, 2020

David Schlissel, Dennis Wamsted

Report

Long-term power plant contracts saddle AMP communities with high electricity prices

September 21, 2020

David Schlissel

Report

Buying power from AMP's Prairie State and combined hydro project has been a financial disaster for Cleveland Public Power and its ratepayers

September 01, 2020

David Schlissel

Report

Utah bailout of bankrupt California coal-export project would likely fail

August 19, 2020

Karl Cates, Brent Israelsen, Clark Williams-Derry...

Report

Petra Nova mothballing post-mortem: Closure of Texas carbon capture plant is a warning sign

August 03, 2020

Dennis Wamsted, David Schlissel

Report

Solar surge set to drive much of remaining Texas coal-fired fleet offline

July 15, 2020

Dennis Wamsted, Seth Feaster, Karl Cates...

Report

Another expensive mistake by NTEC: Wasting more of the Navajo Nation's resources at Four Corners

July 01, 2020

David Schlissel

Report

It's time to retire, not bail out, OVEC's ageing and expensive coal plants

April 01, 2020

David Schlissel

Report

Latest US Coal Markets Press Releases

See more >

Reopening closed coal plants makes no economic sense

April 10, 2025

Press Release

IEEFA U.S.: Pleasants coal plant purchase would be high-risk, low-reward

September 19, 2022

Press Release

Surging energy prices accelerating pace of wind, solar and battery adoption

April 04, 2022

Press Release

IEEFA Europe: Zeebrugge terminal serves as hub for transport of Russian gas to non-European markets

March 21, 2022

Press Release

IEEFA U.S.: Experts offer testimony on Maine fossil fuel divestment planning

February 28, 2022

Press Release

Federal blue hydrogen incentives: No reliable past, present or future

February 08, 2022

Press Release

IEEFA: Review of U.S. coal leasing program misses the point, may slow energy transition

October 01, 2021

Press Release

IEEFA U.S.: Municipal ratepayers face mounting costs from expensive American Municipal Power projects

September 09, 2021

Press Release

IEEFA Energy Finance 2021: Week two in review

June 25, 2021

Press Release

IEEFA: Gas power plants assuming a constant capacity factor are being financially overvalued

June 24, 2021

Press Release

IEEFA U.S.: Investors hesitate to fund San Juan Generating Station CCS retrofit

May 27, 2021

Press Release

IEEFA webinar: U.S. transition to renewables is likely to accelerate over next two to three years

April 06, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.