Latest Transition Research

See more >

Critical minerals: India must step up its strategies

April 24, 2025

Saloni Sachdeva Michael

Insights

What’s holding India back in its renewable energy transition?

February 12, 2025

Saloni Sachdeva Michael

Insights

The Energy Transition: 2019-24 and Beyond

January 30, 2025

Dennis Wamsted, Seth Feaster

Insights

Mountain of coal at U.S. power plants a new threat to coal industry

December 16, 2024

Seth Feaster, Dennis Wamsted

Insights

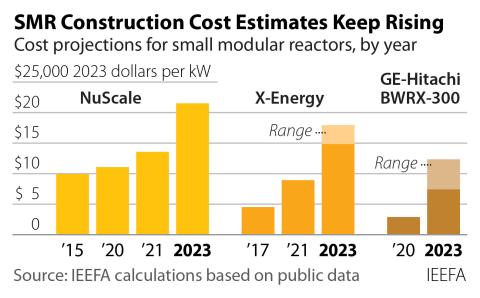

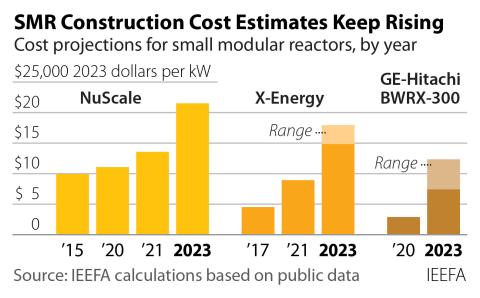

Nuclear hype ignores high cost, long timelines

November 18, 2024

Dennis Wamsted, David Schlissel

Briefing Note

Indonesia’s nickel companies: The need for renewable energy amid increasing production

October 24, 2024

Ghee Peh

Report

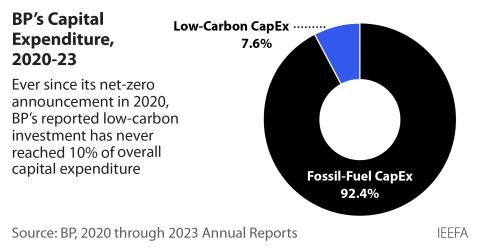

BP’s retreat is a reality check for investors

October 23, 2024

Connor Chung, Dan Cohn

Insights

Indian States' Electricity Transition (SET): 2024

September 25, 2024

Saloni Sachdeva Michael, Tanya Rana, Neshwin Rodrigues...

Fact Sheet

Why does Jharkhand need a Just Transition?

September 19, 2024

Shantanu Srivastava, Gaurav Upadhyay

Fact Sheet

A Just Transition financing pathway for Jharkhand

September 19, 2024

Gaurav Upadhyay, Shantanu Srivastava

Report

Nuclear options: New research on SMRs raises questions over Australia's energy debate

June 13, 2024

David Schlissel, Dennis Wamsted

Insights

Small Modular Reactors: Still too expensive, too slow and too risky

May 29, 2024

David Schlissel, Dennis Wamsted

Report

Latest Transition Reports

See more >

Indonesia’s nickel companies: The need for renewable energy amid increasing production

October 24, 2024

Ghee Peh

Report

A Just Transition financing pathway for Jharkhand

September 19, 2024

Gaurav Upadhyay, Shantanu Srivastava

Report

Small Modular Reactors: Still too expensive, too slow and too risky

May 29, 2024

David Schlissel, Dennis Wamsted

Report

Indian States' Electricity Transition (SET): 2024

April 23, 2024

Saloni Sachdeva Michael, Tanya Rana, Neshwin Rodrigues...

Report

India’s $2.1bn leap towards its green hydrogen vision

March 07, 2024

Jyoti Gulia, Kapil Gupta, Vibhuti Garg...

Report

RBC net-zero engagement policy: A promising start that falls short on key element

February 13, 2024

Mark Kalegha

Report

Blended Finance: Key to bridging energy transition gap in developing countries

February 08, 2024

Namita Vikas, Vibhuti Garg, Sourajit Aiyer...

Report

Royal Bank of Canada: Falling short on climate change

August 29, 2023

Mark Kalegha, Tom Sanzillo, Suzanne Mattei...

Report

Charting an electricity sector transition pathway for Bangladesh

April 05, 2023

Shafiqul Alam

Report

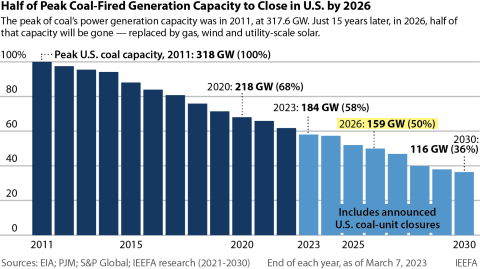

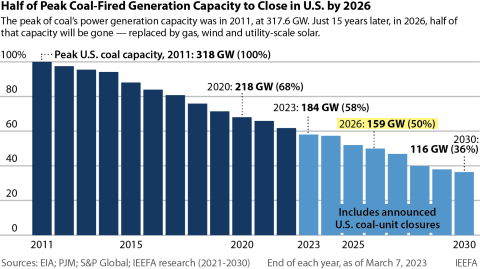

U.S. on track to close half of coal capacity by 2026

April 03, 2023

Seth Feaster

Report

Indian States' Electricity Transition (SET)

February 26, 2023

Saloni Sachdeva Michael, Aditya Lolla, Vibhuti Garg...

Report

Continued reliance on gas will weaken the UK economy

September 26, 2022

Andrew Reid, Arjun Flora

Report

Why the now-abandoned Keystone XL Pipeline was troubled from the start and today would not serve its purpose

June 24, 2022

Omar Mawji, Suzanne Mattei

Report

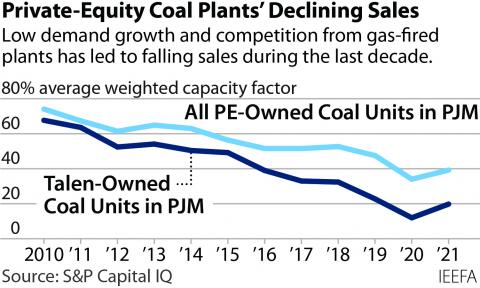

Private equity's losing bet on PJM coal plants

June 02, 2022

Dennis Wamsted, Seth Feaster, David Schlissel...

Report

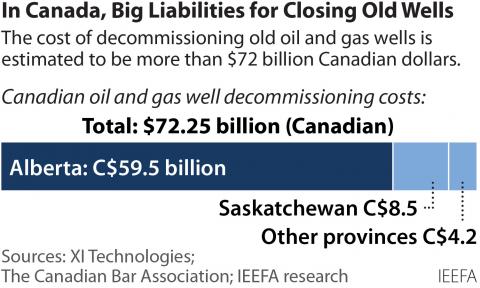

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

Latest Transition Press Releases

See more >

Enbridge should consider closing old, troubled Line 5 Pipeline

January 07, 2025

Press Release

Nuclear hype ignores high cost, long timelines

November 18, 2024

Press Release

The rapid growth in Indonesian nickel production may lead to surging greenhouse gas emissions

October 24, 2024

Press Release

IEEFA comments to New York State about National Grid 20 Year Plan

September 18, 2024

Press Release

Small modular reactors are still too expensive, too slow, and too risky

May 29, 2024

Press Release

Karnataka, Gujarat continue to exhibit strong progress towards clean electricity transition

April 23, 2024

Press Release

Early action needed to enable a just transition in Indian coal-producing states

March 26, 2024

Press Release

India’s $2.1bn push for local electrolyser manufacturing and green hydrogen production sees strong interest from large companies

March 07, 2024

Press Release

IEEFA Canada: Royal Bank of Canada falls short on client engagement strategy

February 13, 2024

Press Release

Blended Finance: A viable mechanism for financing energy transition in developing countries

February 08, 2024

Press Release

IEEFA Canada: Royal Bank of Canada is falling short on climate change pledges

August 29, 2023

Press Release

The U.S. is on track to close half of its coal-fired generation capacity by 2026

April 03, 2023

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.