Latest Renewables Research

See more >

Just Transition financing ecosystem: Stakeholder consultation report

July 07, 2025

Gaurav Upadhyay, Labanya Prakash Jena, Sangeeth Raja Selvaraju...

Report

Catalysing renewable energy finance in Bangladesh

June 25, 2025

Shafiqul Alam, Labanya Prakash Jena

Report

Strategic state insights: Energy, coal, minerals

June 25, 2025

Saloni Sachdeva Michael, Kaira Rakheja, Tanya Rana...

Fact Sheet

The risks of fossil fuel dependence in Indonesia’s Electricity Supply Business Plan (RUPTL) 2025–2034

June 23, 2025

Mutya Yustika

Insights

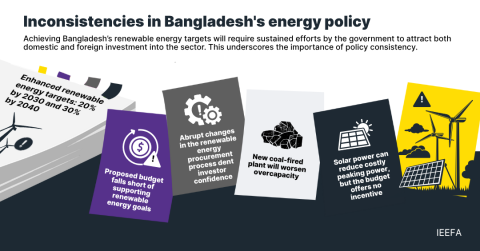

Bangladesh’s energy policy changes raise more questions than they answer

June 18, 2025

Shafiqul Alam

Insights

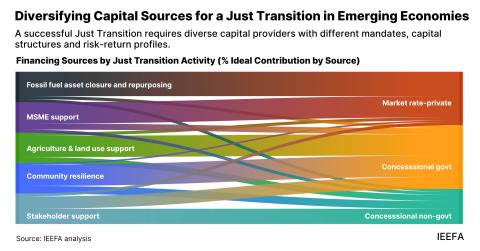

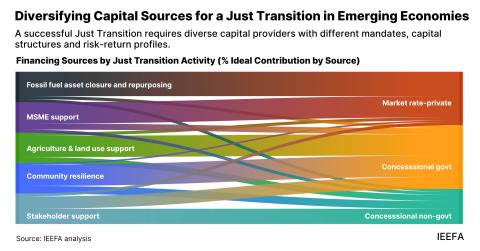

Financing Just Transitions in emerging economies

June 17, 2025

Shantanu Srivastava, Soni Tiwari

Report

Policy trends and insights from Asian markets

June 09, 2025

Vibhuti Garg

Slides

India’s power-hungry data centre sector at a crossroads

June 06, 2025

Vibhuti Garg

Insights

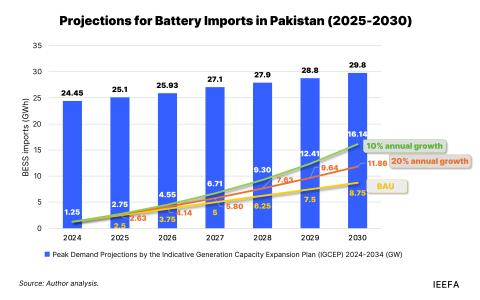

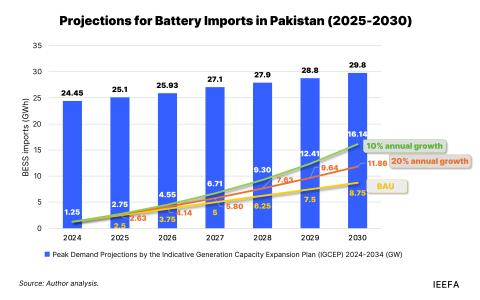

Battery storage and the future of Pakistan's electricity grid

June 05, 2025

Haneea Isaad, Syed Faizan Ali Shah

Report

Mapping coal phaseouts in key Asian markets

June 02, 2025

Ghee Peh

Insights

Budgeting for Bangladesh’s energy transition

June 01, 2025

Shafiqul Alam

Insights

From incentives to adoption: A decadal review of India's EV subsidy effectiveness

May 28, 2025

Saurabh Trivedi, Charith Konda, Subham Shrivastava...

Report

Latest Renewables Reports

See more >

Just Transition financing ecosystem: Stakeholder consultation report

July 07, 2025

Gaurav Upadhyay, Labanya Prakash Jena, Sangeeth Raja Selvaraju...

Report

Catalysing renewable energy finance in Bangladesh

June 25, 2025

Shafiqul Alam, Labanya Prakash Jena

Report

Financing Just Transitions in emerging economies

June 17, 2025

Shantanu Srivastava, Soni Tiwari

Report

Battery storage and the future of Pakistan's electricity grid

June 05, 2025

Haneea Isaad, Syed Faizan Ali Shah

Report

From incentives to adoption: A decadal review of India's EV subsidy effectiveness

May 28, 2025

Saurabh Trivedi, Charith Konda, Subham Shrivastava...

Report

Challenges in India’s tender-driven renewable energy market

March 06, 2025

Vibhuti Garg, Prabhakar Sharma, Ashita Srivastava...

Report

Hydrogen gas does not belong in your home: Hydrogen faces a diminishing future as a heating and cooking fuel

January 21, 2025

Suzanne Mattei

Report

Impact of Green Energy Open Access Rules, 2022

December 11, 2024

Prabhakar Sharma, Aman Gupta, Pulkit Moudgil...

Report

Fixing Bangladesh's power sector

December 04, 2024

Shafiqul Alam

Report

Cambodia at a crossroads: An economic assessment of LNG-to-power plans

November 26, 2024

Sam Reynolds, Christopher Doleman

Report

Indian solar PV exports surging

November 11, 2024

Prabhakar Sharma, Jyoti Gulia, Vibhuti Garg...

Report

Indonesia’s nickel companies: The need for renewable energy amid increasing production

October 24, 2024

Ghee Peh

Report

Unleashing the residential rooftop solar potential

October 16, 2024

Prabhakar Sharma, Jyoti Gulia, Vibhuti Garg...

Report

A Just Transition financing pathway for Jharkhand

September 19, 2024

Gaurav Upadhyay, Shantanu Srivastava

Report

The future of net-metered solar power in Pakistan

August 21, 2024

Haneea Isaad, Syed Faizan Ali Shah

Report

Latest Renewables Press Releases

See more >

Aligning climate ambition with equity: India’s Just Transition needs to be inclusive

July 07, 2025

Press Release

Private investment key to unlocking Bangladesh’s renewable energy ambitions

June 25, 2025

Press Release

How Targeted Co-Financing can Enable a Just Transition in Emerging Economies

June 17, 2025

Press Release

Increased battery energy storage system (BESS) adoption presents opportunities for grid modernization and system planning in Pakistan

June 05, 2025

Press Release

Reopening closed coal plants makes no economic sense

April 10, 2025

Press Release

France risks missing offshore wind target

April 07, 2025

Press Release

La France risque de ne pas atteindre son objectif en matière d'éoliennes en mer

April 07, 2025

Press Release

India issues record 73 gigawatts of utility-scale renewable energy tenders in 2024

March 06, 2025

Press Release

World Economic Forum sessions highlight LNG’s economic, energy security, and climate risks

January 31, 2025

Press Release

Hydrogen gas does not belong in your home

January 21, 2025

Press Release

Regulatory clarity helped green energy open access installed capacity grow by 90% between FY2023 and FY2024

December 11, 2024

Press Release

Bangladesh Power Development Board can save US$1.2 billion annually through key electricity sector reforms

December 04, 2024

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.