Latest Nuclear Research

See more >

Delaying coal power exits: A risk we can't afford

April 16, 2025

Johanna Bowyer, Tristan Edis

Report

Unlocking France's offshore wind potential

April 07, 2025

Jonathan Bruegel

Briefing Note

Débloquer le potentiel éolien offshore de la France

April 07, 2025

Jonathan Bruegel

Briefing Note

New UK data sends nuclear warning for Australia

February 03, 2025

Tristan Edis, Johanna Bowyer

Insights

Blockbuster Saturday: Power-Packed Budget 2025

February 03, 2025

Vibhuti Garg

Insights

Nuclear hype ignores high cost, long timelines

November 18, 2024

Dennis Wamsted, David Schlissel

Briefing Note

We can’t afford to fall back on gas to fill nuclear gap

October 09, 2024

Jay Gordon

Insights

Response to the Federal Opposition on how nuclear will increase power bills

October 08, 2024

Johanna Bowyer, Tristan Edis

Insights

Nuclear proposal will increase power bills

September 26, 2024

Johanna Bowyer, Tristan Edis

Insights

Nuclear in Australia would increase household power bills

September 20, 2024

Johanna Bowyer, Tristan Edis

Report

Slides: Nuclear in Australia would increase household power bills

September 20, 2024

Johanna Bowyer, Tristan Edis

Slides

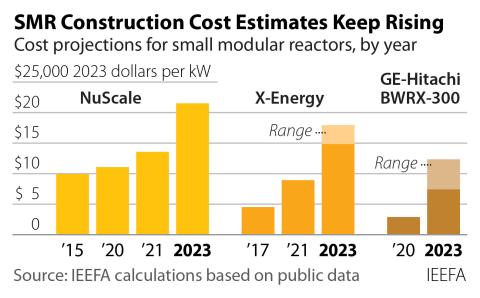

Small Modular Reactors: Still too expensive, too slow and too risky

August 06, 2024

David Schlissel

Fact Sheet

Latest Nuclear Reports

See more >

Delaying coal power exits: A risk we can't afford

April 16, 2025

Johanna Bowyer, Tristan Edis

Report

Nuclear in Australia would increase household power bills

September 20, 2024

Johanna Bowyer, Tristan Edis

Report

Small Modular Reactors: Still too expensive, too slow and too risky

May 29, 2024

David Schlissel, Dennis Wamsted

Report

European Pressurized Reactors (EPRs): Next-generation design suffers from old problems

February 02, 2023

Frank Bass

Report

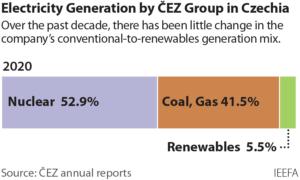

Is ČEZ Ready for Decarbonization?

January 01, 2022

Arjun Flora

Report

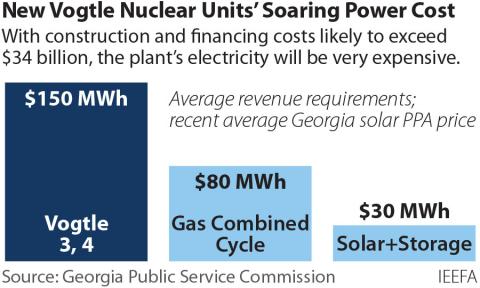

Southern Company's Troubled Vogtle Nuclear Project

January 01, 2022

David Schlissel

Report

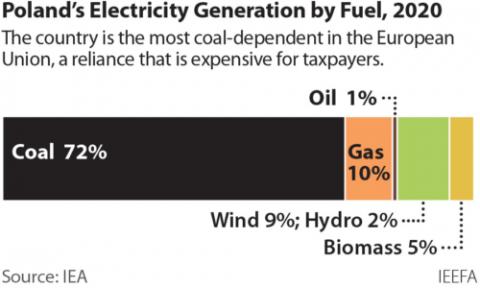

Poland's Energy Transition - Caught Between Lobbying and Common (Economic) Sense

January 01, 2022

Arjun Flora

Report

Tackling Indonesia's nuclear power euphoria

June 01, 2021

Elrika Hamdi

Report

Inquiry into the prerequisites for nuclear energy in Australia

September 10, 2019

Tim Buckley

Report

Doosan Heavy: Time for a forensic audit

September 01, 2019

Melissa Brown, Ghee Peh

Report

Bailout Bill a bonanza for FirstEnergy solutions, but a boondoggle for Ohio consumers

May 01, 2019

David Schlissel

Report

A half-built, high-priced nuclear white elephant

October 01, 2017

Gerard Wynn, David Schlissel

Report

Latest Nuclear Press Releases

See more >

France risks missing offshore wind target

April 07, 2025

Press Release

La France risque de ne pas atteindre son objectif en matière d'éoliennes en mer

April 07, 2025

Press Release

Opposition’s nuclear costings are unrealistic

December 13, 2024

Press Release

Nuclear hype ignores high cost, long timelines

November 18, 2024

Press Release

Nuclear power would raise household power bills by $665 a year

September 24, 2024

Press Release

Nuclear in Australia will increase household power bills – the question is how much?

September 20, 2024

Press Release

Significant issues with Australian nuclear proposal

June 19, 2024

Press Release

Small modular reactors are still too expensive, too slow, and too risky

May 29, 2024

Press Release

European Pressurized Reactors: Nuclear power’s latest costly and delayed disappointments

February 02, 2023

Press Release

Labelling nuclear and gas as “green” or environmentally sustainable poses a risk for investors and communities across Europe

July 06, 2022

Press Release

IEEFA U.S.: Small modular reactor “too late, too expensive, too risky and too uncertain”

February 17, 2022

Press Release

IEEFA U.S.: Price tag for new reactors at Vogtle Plant in Georgia climbs past $30 billion

January 20, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.