Latest Natural Gas Research

See more >

Strait of Hormuz disruption would jeopardise 10% of Europe’s LNG imports

June 27, 2025

Ana Maria Jaller-Makarewicz

Insights

Australian gas producers want “grey iron” to look green

June 26, 2025

Simon Nicholas

Insights

Mexico Pacific Limited: Delays, turmoil, and permitting errors have stymied Mexico's largest LNG project

June 24, 2025

Clark Williams-Derry

Insights

Mexico Pacific Limited: Retrasos, conflictos y errores en el proceso de obtención de permisos frenan el mayor proyecto de gnl de México

June 24, 2025

Clark Williams-Derry

Insights

The Ksi Lisims LNG project and the broader Canadian LNG sector face strategic challenges

June 12, 2025

Mark Kalegha

Report

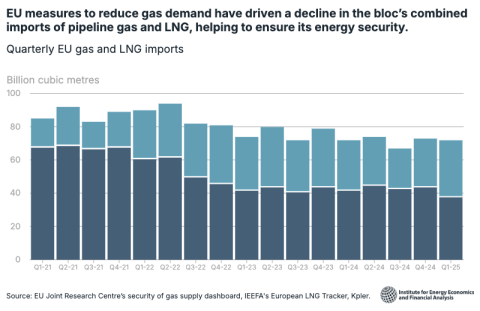

EU gas imports to fall 25% by 2030 as demand reduction target exceeded once again

June 04, 2025

Ana Maria Jaller-Makarewicz

Insights

New fossil fuel developments: A net economic benefit or cost for Australia?

June 03, 2025

Amandine Denis-Ryan

Fact Sheet

Reliance on gas for iron and steel making in South Australia faces major risks

May 12, 2025

Simon Nicholas

Insights

South Australia: Long-term reliance on gas for iron and steelmaking faces significant risks

May 08, 2025

Simon Nicholas

Briefing Note

Fast-tracking federal gas approvals unlikely to increase gas supply this decade

April 15, 2025

Josh Runciman

Insights

LNG build-out in Mexico based on U.S. gas: Rising risks for consumers in the U.S. and Mexico

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Expansión del GNL en México con gas importado de EE. UU.: Nuevos riesgos para los consumidores en EE. UU. y México

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Latest Natural Gas Reports

See more >

The Ksi Lisims LNG project and the broader Canadian LNG sector face strategic challenges

June 12, 2025

Mark Kalegha

Report

LNG build-out in Mexico based on U.S. gas: Rising risks for consumers in the U.S. and Mexico

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Expansión del GNL en México con gas importado de EE. UU.: Nuevos riesgos para los consumidores en EE. UU. y México

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

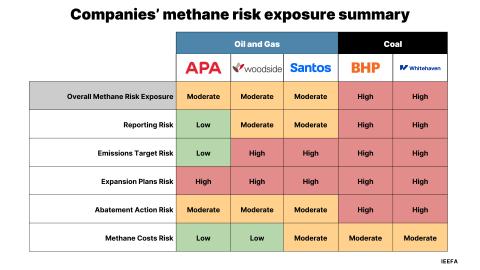

Methane: A ticking time bomb for Australian investors

March 28, 2025

Anne-Louise Knight, Josh Runciman, Andrew Gorringe...

Report

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Cathy Kunkel

Report

Enbridge should consider closing its old, troubled Line 5 pipeline

January 07, 2025

Suzanne Mattei, Tom Sanzillo, David Schlissel...

Report

The declining significance of the petrochemical industry in Louisiana

October 28, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Report

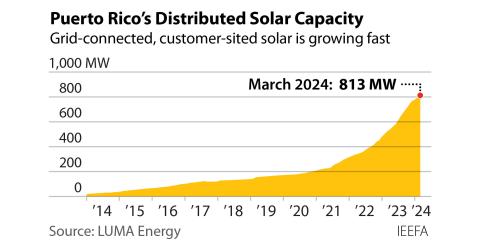

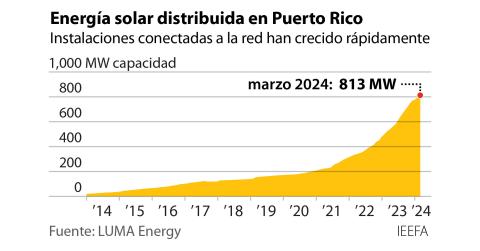

Solar at a crossroads in Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

La encrucijada que enfrenta la implantación de la energía solar en Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

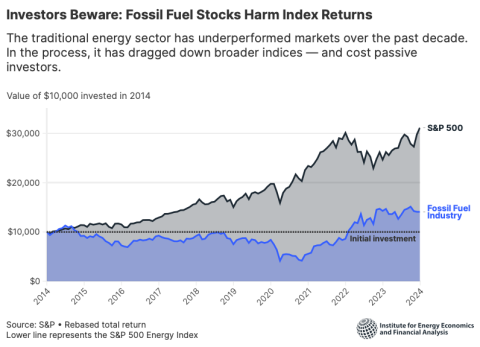

Passive investing in a warming world

February 08, 2024

Connor Chung, Dan Cohn

Report

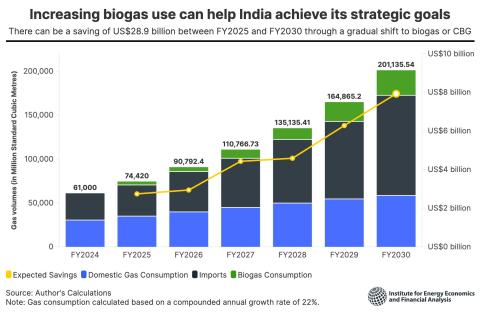

Biogas: A possible solution for India’s energy security and decarbonisation goals

October 26, 2023

Purva Jain

Report

Calcasieu Pass LNG: Unreliable operations result in excessive pollution and profits

October 25, 2023

Trey Cowan

Report

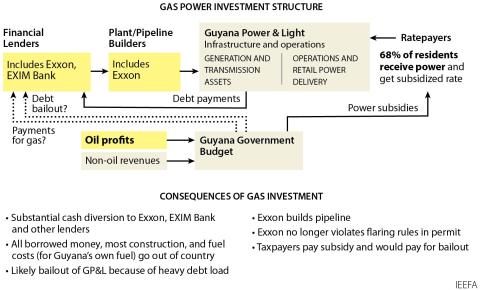

Guyana Gas to Energy Project is unnecessary and financially unsustainable

October 04, 2023

Tom Sanzillo, Cathy Kunkel

Report

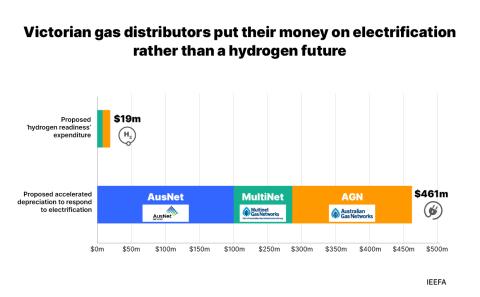

‘Renewable gas’ campaigns leave Victorian gas distribution networks and consumers at risk

August 17, 2023

Jay Gordon, Kevin Morrison

Report

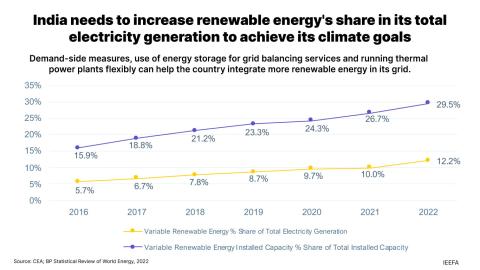

Integrating higher shares of variable renewable energy in India

July 13, 2023

Charith Konda

Report

Latest Natural Gas Press Releases

See more >

New rules are positive step to cut Victoria’s reliance on gas

June 24, 2025

Press Release

The Ksi Lisims LNG project faces significant infrastructure, regulatory and financial risks

June 12, 2025

Press Release

South Australia’s reliance on gas for iron and steelmaking carries major risks

May 08, 2025

Press Release

EU combined gas and LNG imports fall due to reduced demand

April 30, 2025

Press Release

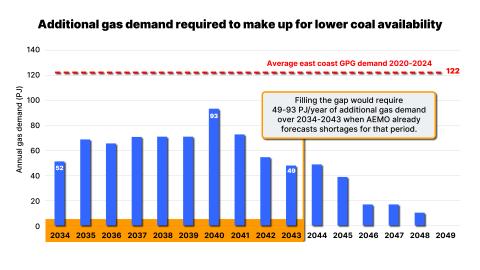

Prolonging the retirement age of coal generators puts affordable power supply at risk

April 16, 2025

Press Release

LNG buildout in Mexico could mean rising risks for consumers in the U.S. and Mexico

April 02, 2025

Press Release

La expansión del GNL en México podría implicar mayores riesgos para los consumidores de EE. UU. y México

April 02, 2025

Press Release

Australian investors urged to tackle fossil fuel companies’ methane time bomb

March 28, 2025

Press Release

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Press Release

Another bad year – and decade – for fossil fuel stocks

January 27, 2025

Press Release

Enbridge should consider closing old, troubled Line 5 Pipeline

January 07, 2025

Press Release

Floating LNG import terminals face cost, climate, and energy security risks in Asia

December 02, 2024

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.