Latest Climate Risk Research

See more >

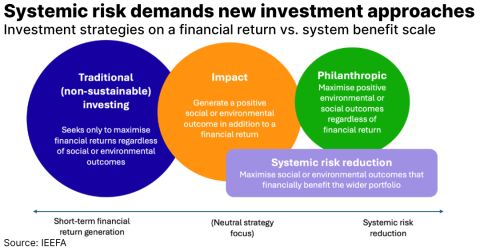

Systemic risk reduction funds: Why impact investing needs to get selfish

June 16, 2025

Alasdair Docherty

Report

Quitting climate alliances risks trust and transparency for banks

April 09, 2025

Ramnath N. Iyer, Shu Xuan Tan

Insights

Climate risks underplayed in recent credit rating actions

March 19, 2025

Shu Xuan Tan

Insights

European oil: Navigating credit risk towards net zero

March 13, 2025

Kevin Leung

Report

Women at the centre of the energy transition: My story

March 11, 2025

Vibhuti Garg

Insights

Confronting climate change: Rising insurance costs can curb economic growth

January 14, 2025

Labanya Prakash Jena, Aayush Anand

Insights

Sustainability in Asset Management in Asia: An Institutional Investor Perspective

November 18, 2024

Saurabh Trivedi, Labanya Prakash Jena

Insights

Deciphering climate finance

November 10, 2024

Labanya Prakash Jena

Insights

Bridging the financing gap to triple renewable energy capacity

November 08, 2024

Shafiqul Alam, Vibhuti Garg, Labanya Prakash Jena...

Briefing Note

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

Engagement and divestment: Shareholders transcend a false binary

September 12, 2024

Connor Chung, Dan Cohn

Briefing Note

Climate Change: Implications for Monetary Policy

September 12, 2024

Labanya Prakash Jena, Dhruba Purkayastha

Insights

Latest Climate Risk Reports

See more >

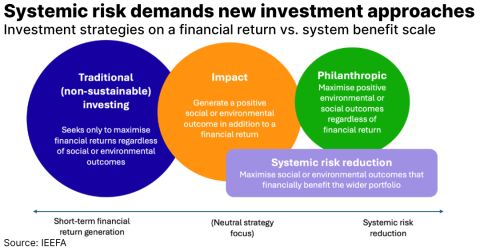

Systemic risk reduction funds: Why impact investing needs to get selfish

June 16, 2025

Alasdair Docherty

Report

European oil: Navigating credit risk towards net zero

March 13, 2025

Kevin Leung

Report

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

Universal ownership: A call for practical implementation

May 08, 2024

Alasdair Docherty

Report

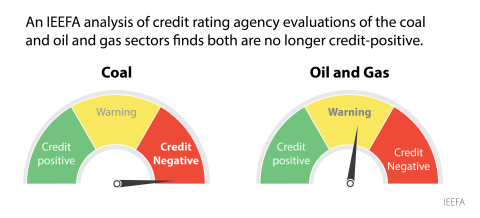

A matter of opinion: Credit rating agencies evolve on climate change, fossil fuel risk

March 14, 2024

Tom Sanzillo

Report

RBC net-zero engagement policy: A promising start that falls short on key element

February 13, 2024

Mark Kalegha

Report

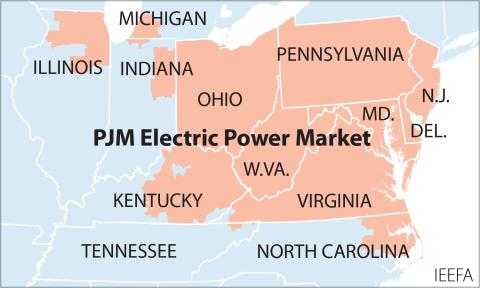

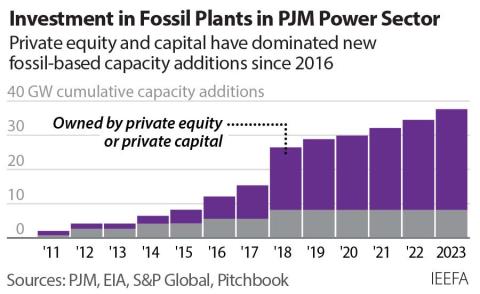

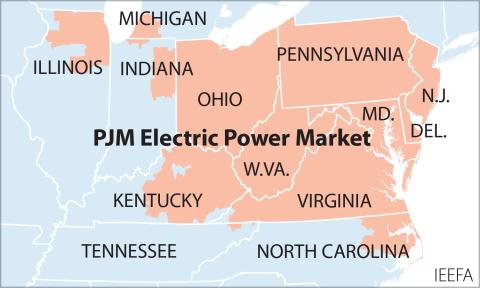

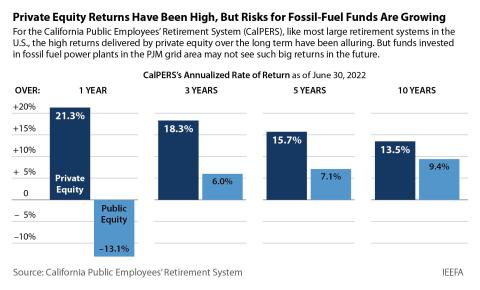

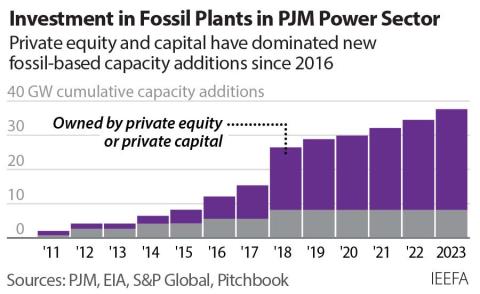

Private equity in PJM: Growing risks for communities

December 07, 2023

Dennis Wamsted

Report

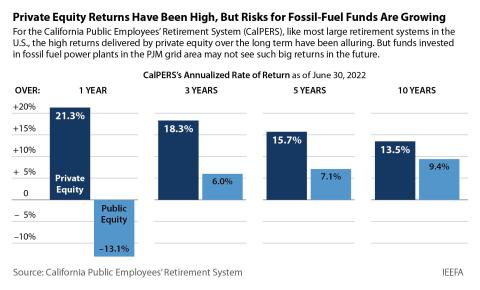

Private equity in PJM: New risks for limited partners, private capital

October 11, 2023

Dennis Wamsted

Report

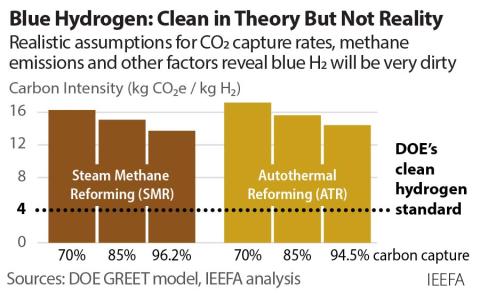

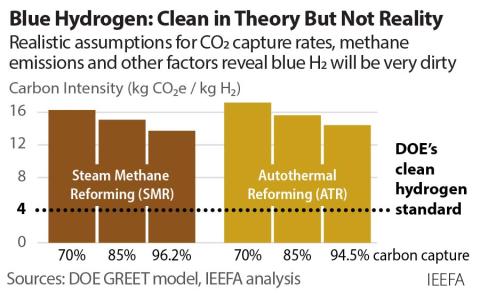

Blue hydrogen: Not clean, not low carbon, not a solution

September 12, 2023

David Schlissel, Anika Juhn

Report

Royal Bank of Canada: Falling short on climate change

August 29, 2023

Mark Kalegha, Tom Sanzillo, Suzanne Mattei...

Report

Private equity in PJM: Growing financial risks

August 22, 2023

Dennis Wamsted

Report

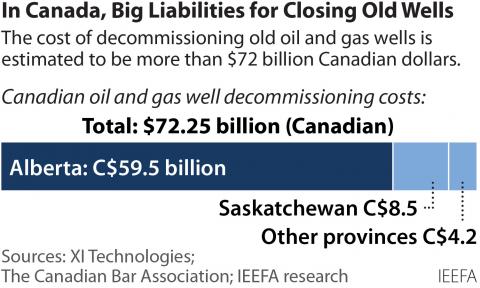

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

Latest Climate Risk Press Releases

See more >

Credit ratings have yet to effectively capture energy transition risks facing European oil and gas sector

March 13, 2025

Press Release

COP29 should create clear policy roadmap to spur bank lending for renewable energy

November 08, 2024

Press Release

Asset owners need investment products that prioritise decarbonisation over short-term returns

September 26, 2024

Press Release

Institutional investors increasingly pair engagement and divestment to address climate-related financial risk

September 12, 2024

Press Release

Universal owner wealth to erode at alarming rate due to carbon pollution of investments

May 08, 2024

Press Release

Credit rating agency evolution on climate change risk and fossil fuel financial viability

March 14, 2024

Press Release

IEEFA Canada: Royal Bank of Canada falls short on client engagement strategy

February 13, 2024

Press Release

IEEFA U.S.: Private equity reshapes nation’s largest power market, leaving communities at risk

December 07, 2023

Press Release

IEEFA U.S.: Private equity reshapes nation’s largest power market while raising investor risk

October 11, 2023

Press Release

Blue Hydrogen: Not clean, not low carbon, not a solution

September 12, 2023

Press Release

IEEFA Canada: Royal Bank of Canada is falling short on climate change pledges

August 29, 2023

Press Release

IEEFA U.S.: Decade of strong growth is over for PE gas plant developers in PJM

August 22, 2023

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.