Tim Buckley

Tim Buckley, Director, Climate Energy Finance (CEF) has 30 years of financial market experience covering the Australian, Asian and global equity markets from both a buy and sell side perspective. Tim was formerly Director Energy Finance Studies, Australia/South Asia, IEEFA, and was a Managing Director, Head of Equity Research at Citigroup for 17 years until 2008. Tim has a Bachelor of Business majoring in Accounting and Finance from UTS Sydney (1985-87), the US SEC Series 7 (General Securities Representative Qualification Examination) and Series 24 (General Securities Principal Qualification Examination) qualifications.

Research from Tim Buckley

See all Research from Tim Buckley >

India's renewable energy journey: Short-term hiccups but long-term trajectory intact

October 12, 2022

Vibhuti Garg, Tim Buckley, Shantanu Srivastava...

Report

IEEFA Update: Financing the future of green hydrogen

January 26, 2022

Tim Buckley

Insights

IEEFA: Skyrocketing EV sales in China spell a no-turning-back step change in global energy landscape

January 19, 2022

Tim Buckley

Insights

IEEFA: Postcard from 2030. Energy is clean, finance is moral, wish you were here

December 22, 2021

Tim Buckley

Insights

IEEFA: Deutsche Bank claims responsible climate leadership while bankrolling yet more thermal coal

December 16, 2021

Tim Buckley

Insights

IEEFA Australia: How fossil fuel subsidies are thwarting Queensland’s renewable energy ambitions

November 26, 2021

Tim Buckley

Insights

IEEFA: BlackRock has moved rapidly on climate – but Adani exposures remain a major obstacle

November 19, 2021

Tim Buckley

Insights

IEEFA Update: COP26 is different to prior COPs

October 28, 2021

Tim Buckley

Insights

IEEFA Update: To be taken seriously, Australia needs a credible emissions reduction plan

October 13, 2021

Tim Buckley

Insights

India and Australia’s richest race to net zero by 2030

October 12, 2021

Tim Buckley

Insights

IEEFA Update: Solar installation surge puts India on track to cap coal-fired power as early as 2024

October 12, 2021

Tim Buckley, Charles Worringham

Insights

IEEFA: Will CEO Jane Fraser clean up Citi’s climate record?

October 04, 2021

Tim Buckley

Insights

President Xi Jinping’s profound United Nations General Assembly speech

September 22, 2021

Tim Buckley

Insights

IEEFA Australia: Comparing global commitment to renewable energy policies, programs and funding

September 08, 2021

Tim Buckley

Insights

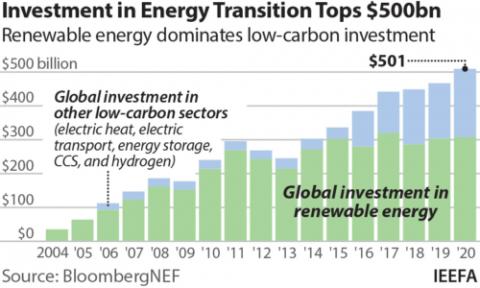

Global investors move into renewable infrastructure

July 20, 2021

Saurabh Trivedi, Tim Buckley

Report

Posts from Tim Buckley

See all Posts from Tim Buckley >

India projected to add 35-40GW of renewable energy capacity annually to FY2029/30

October 12, 2022

Press Release

Global investors are moving away from the massive climate-related risks associated with fossil fuels

July 19, 2021

Press Release

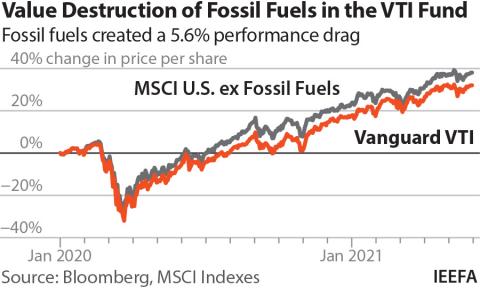

IEEFA: Vanguard funds destroy shareholder wealth with US$290bn in fossil fuels creating a 5.6% performance drag

June 22, 2021

Press Release

ANZ divesting from the world’s largest coal export port is ‘pragmatism’

February 18, 2021

Press Release

IEEFA: Global capital mobilising for India’s $500bn renewable energy infrastructure opportunity

February 16, 2021

Press Release

IEEFA: Australia should be a net-zero emissions leader

December 11, 2020

Press Release

Malaysia’s CIMB announces coal financing phase-out by 2040 as Asia’s fossil fuel divestment drive accelerates

December 08, 2020

Press Release

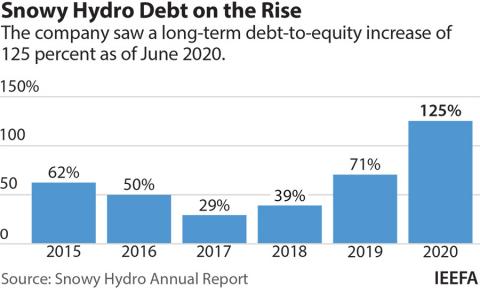

IEEFA: Snowy Hydro gas plant expansions likely to be fuelled with taxpayer funds

November 18, 2020

Press Release

IEEFA: As owner of India’s most valuable energy company, the Adani Group should lead the country’s energy strategy

November 10, 2020

Press Release

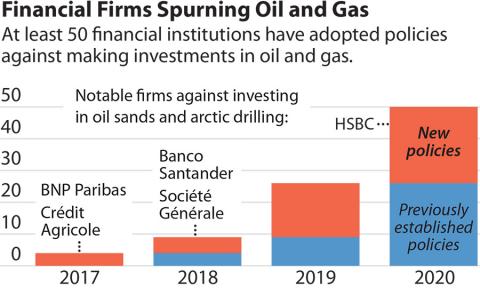

From zero to fifty, global financial corporations get cracking on major oil/gas lending exits

October 19, 2020

Press Release

IEEFA India: How state governments can manage mounting power distribution sector debts

September 10, 2020

Press Release

BHP coal assets worth a billion less than just two years ago

August 10, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.