Kathy Hipple

Former IEEFA Financial Analyst Kathy Hipple is a founding partner of Noosphere Marketing and the finance professor at Bard’s MBA for Sustainability. She worked for 10 years with international institutional clients at Merrill Lynch and then served as CEO of Ambassador Media.

Research from Kathy Hipple

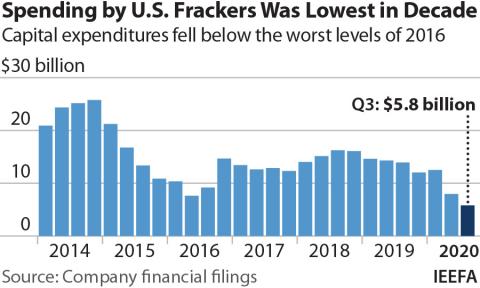

See all Research from Kathy Hipple >U.S. frackers slash capital investment to lowest level in over a decade

December 01, 2020

Kathy Hipple, Clark Williams-Derry, Tom Sanzillo...

Report

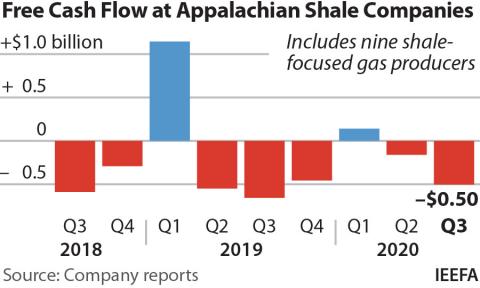

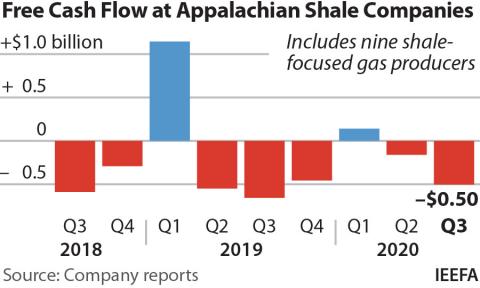

Appalachian frackers spill red ink in third quarter - again

December 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

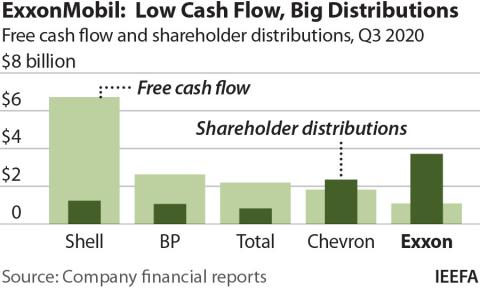

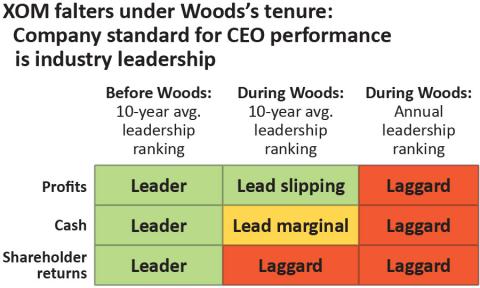

IEEFA update: ExxonMobil’s dismal third quarter

October 30, 2020

Kathy Hipple, Clark Williams-Derry, Tom Sanzillo...

Insights

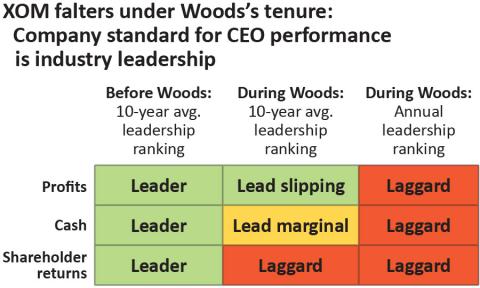

ExxonMobil's industry leadership deteriorates under CEO Darren Woods

October 28, 2020

Tom Sanzillo, Kathy Hipple

Report

IEEFA update: ExxonMobil says the long-term fundamentals have not changed. Really?

October 20, 2020

Tom Sanzillo, Kathy Hipple

Insights

Leader To Laggard ExxonMobil's Financial Troubles Intensify

October 01, 2020

Tom Sanzillo, Kathy Hipple

Report

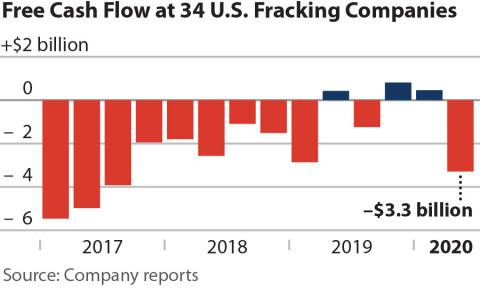

Pandemic accelerates dismal financial performance of U.S. fracking companies

September 16, 2020

Clark Williams-Derry, Kathy Hipple, Tom Sanzillo...

Report

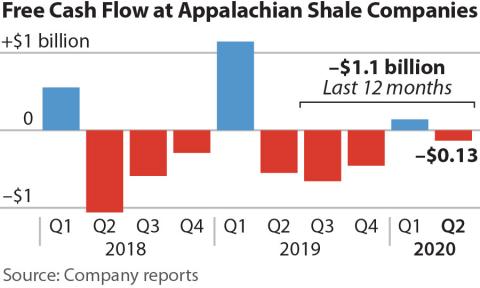

Despite Capex Cuts, Appalachian Frackers Report Negative Free Cash Flow in Second Quarter 2020

September 01, 2020

Kathy Hipple, Clark Williams-Derry, Tom Sanzillo...

Report

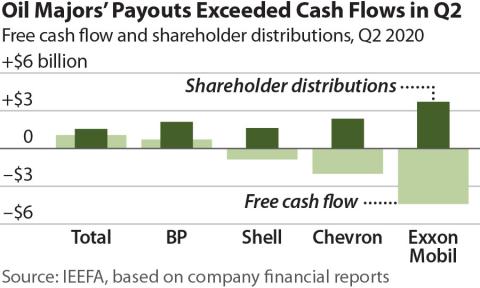

Q2 results show shareholder dividends pushed oil supermajors deep into red

August 25, 2020

Kathy Hipple, Tom Sanzillo, Clark Williams-Derry...

Insights

Major oil companies’ ongoing struggle to pay shareholders out of cash flows from operations accelerates in dismal second quarter

August 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

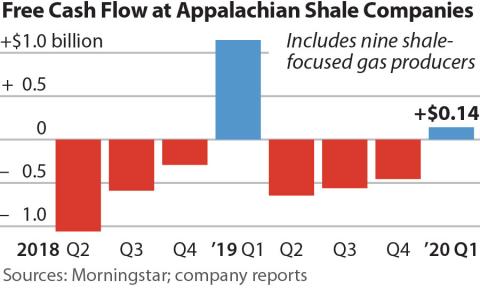

Cuts in capex and cash from hedging give Appalachian frackers positive free cash flow in first quarter

June 25, 2020

Kathy Hipple, Clark Williams-Derry, Tom Sanzillo...

Report

Vaca Muerta update: Faltering development plans for Argentina’s shale reserves will accelerate without foreign investment

June 25, 2020

Kathy Hipple, Tom Sanzillo

Report

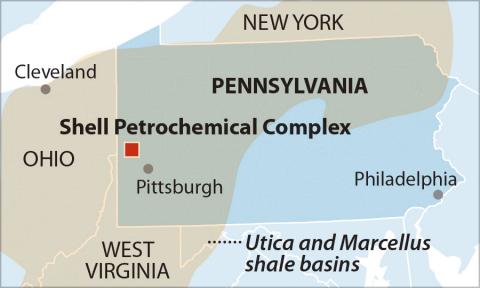

Shell's Pennsylvania petrochemical complex: Financial risks and a weak outlook

June 04, 2020

Tom Sanzillo, Kathy Hipple

Report

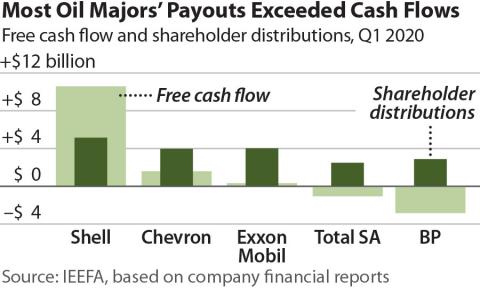

In Q1, Four of Five Oil Majors Paid More Cash than They Made from Operations

May 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

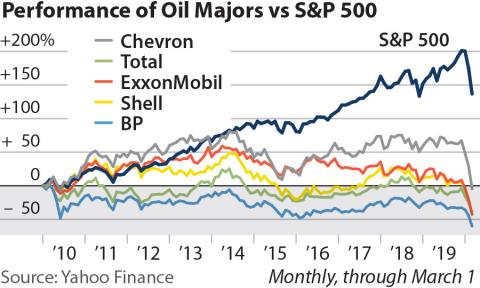

Beyond Their Means: Oil Majors Pay More to Shareholders Than They Earn by Selling Oil and Gas

April 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

Posts from Kathy Hipple

See all Posts from Kathy Hipple >

IEEFA U.S.: Frackers cut capex to $5.8 billion during third quarter, lowest level in a decade

December 08, 2020

Press Release

Appalachian Frackers Spill Red Ink

December 04, 2020

Press Release

IEEFA update: ExxonMobil’s financials indicate slide under CEO Darren Woods’s leadership

October 28, 2020

Press Release

IEEFA U.S.: Weakness of fracking accentuated by plunging cash flows during pandemic quarter

September 15, 2020

Press Release

Capex cuts fail to stem gusher of red ink for Appalachian frackers

September 10, 2020

Press Release

IEEFA update: Frackers record positive free cash flow during Q1, no thanks to economics of gas industry

June 25, 2020

Press Release

IEEFA report: Pandemic, price collapse may be final straw that sends Argentina’s ailing “Dead Cow” to slaughter

June 24, 2020

Press Release

Informe de IEEFA: El colapso de los precios provocado por la pandemia podría ser la gota que rebalse el vaso y termine definitivamente con la debilitada «gallina de los huevos de oro» de Argentina

June 24, 2020

Press Release

IEEFA report: Financial risks loom for Shell’s Pennsylvania petrochemicals complex

June 04, 2020

Press Release

IEEFA U.S.: Four of five oil supermajors pay investor dividends even as operations losses mount

May 26, 2020

Press Release

IEEFA update: Oil majors paid $216 billion more to shareholders than they earned directly from business over the past decade

April 06, 2020

Press Release

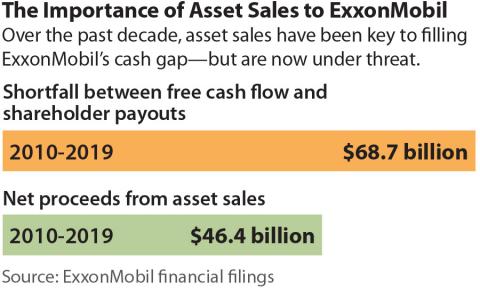

IEEFA: ExxonMobil Planned Asset Sales

April 03, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.