Cathy Kunkel

IEEFA Energy Consultant

Cathy Kunkel is an Energy Consultant at IEEFA.

Cathy also served as an IEEFA Energy Finance Analyst for 7 years, researching Appalachian natural gas pipelines and drilling; electric utility mergers, rates and resource planning; energy efficiency; and Puerto Rico’s electrical system. She has degrees in physics from Princeton and Cambridge.

Research from Cathy Kunkel

See all Research from Cathy Kunkel >

Risk of AI-driven, overbuilt infrastructure is real

June 03, 2025

Cathy Kunkel, Dennis Wamsted

Insights

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Report

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Fact Sheet

A pesar del daño a los abonados, la junta de supervisión fiscal de Puerto Rico abre la puerta para aumentos en la tarifa de la energía eléctrica

April 29, 2025

Cathy Kunkel

Insights

Despite harm to ratepayers, Puerto Rico oversight board opens door to increases

April 29, 2025

Cathy Kunkel

Insights

Puerto Rico Electric Power Authority bondholders insist on being paid $3.7 billion that doesn’t exist

April 24, 2025

Cathy Kunkel

Insights

Los bonistas de la Autoridad de Energía Eléctrica de Puerto Rico insisten en el pago de $3.7 mil millones de dólares que no existen

April 24, 2025

Cathy Kunkel

Insights

IEEFA submits testimony to Louisiana Public Service Commission

April 15, 2025

Cathy Kunkel

Testimony | Submission

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Cathy Kunkel

Report

Southeast utilities are betting big on gas power plants and pipelines

January 29, 2025

Cathy Kunkel

Fact Sheet

El Negociado de Energía de Puerto Rico se burla de su propio proceso de planificación al autorizar la construcción de una nueva planta de gas natural en cuartos oscuros

January 22, 2025

Cathy Kunkel

Insights

Puerto Rico Energy Bureau makes a mockery of its own planning process to secretly approve new natural gas plant

January 22, 2025

Cathy Kunkel

Insights

New Fortress Energy: Increasing indebtedness, but still paying big dividends to shareholders

December 04, 2024

Tom Sanzillo, Cathy Kunkel

Insights

New Fortress Energy misleads investors in its push for natural gas in Puerto Rico

December 03, 2024

Tom Sanzillo, Cathy Kunkel

Insights

New Fortress Energy, leader of LNG growth bubble, facing bankruptcy

November 22, 2024

Tom Sanzillo, Cathy Kunkel

Insights

Posts from Cathy Kunkel

See all Posts from Cathy Kunkel >

Data center-driven electricity transmission buildout in PJM region puts West Virginia ratepayers on the hook

May 29, 2025

Press Release

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Press Release

Oversight board, power plant operator threaten renewable energy transformation

June 12, 2024

Press Release

La Junta de Supervisión Fiscal y el operador de las plantas de energía amenazan la transformación de las energías renovables

June 12, 2024

Press Release

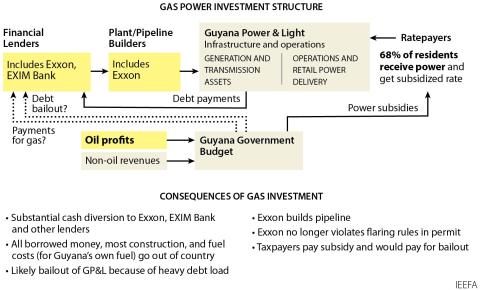

Guyana Gas to Energy project is unnecessary and financially unsustainable

October 04, 2023

Press Release

Delays, damages and poor service: LUMA Energy’s first two months highlight privatization flaws

August 16, 2021

Press Release

Retrasos, daños y mal servicio: los dos primeros meses de LUMA Energy ponen de relieve los defectos de la privatización

August 16, 2021

Press Release

IEEFA: Consultants poised to make more than $1 billion from bankrupt Puerto Rico utility

April 29, 2021

Press Release

IEEFA: Consultores listos para ganar más de $1,000 millones de la corporación de servicios públicos de Puerto Rico en bancarrota

April 29, 2021

Press Release

IEEFA: Puerto Rico can provide resiliency to 100% of homes through solar expansion

March 10, 2021

Press Release

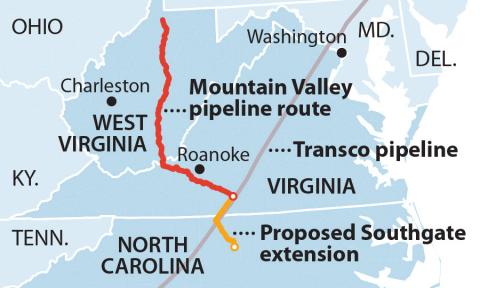

IEEFA U.S.: Financial rationale for Mountain Valley Pipeline has evaporated in changing market

March 08, 2021

Press Release

IEEFA U.S.: Biden administration has historic opportunity to rebuild Puerto Rico electricity grid

January 27, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.