Key Findings

STEAG’s strategy for phasing out coal is so far non-existent, raising the concern that the current 4.1 GW of coal-fired generation will keep running until 2038—the new proposed coal exit date according to the German Energiewende.

It is assumed that STEAG does not have any strategy for phasing out coal yet, and it remains uncertain whether a robust one will be released in spring 2023 as planned by company management.

The announced sale of the company confirms that the management decarbonisation strategy (yet to be stated) will be short-lived. The new buyer is expected to maximize the existing coal fleet lifetime.

Executive Summary

This paper presents the case of a German municipalities owned power utility, Steinkohlen Elektrizität AG (STEAG), whose generation is almost entirely coal-fired.

Since the 1930s, STEAG has been a coal-fired power producer from the industrial heartlands in Germany spread across the Nord Rhein Westphalia, Saarland, and Baden Württemberg regions.

In the recent years STEAG has partially divested one thermal power plant in the Philippines. It still owns and operates coal generation assets in Turkey and Colombia. Despite being awarded decommissioning auction for three plants, only one German coal plant has been decommissioned so far. As of today, STEAG is still operating 4.1 gigawatts (GW) of coal-fired capacity, with no decommissioning dates planned.

The company has recently split into two entities: ICONY GmbH, a branch dedicated to renewables and grid investments, and STEAG Power GmbH, which hosts all the legacy coal generation assets.

The company is preparing a coal phase-out plan which has not yet been published. The phase-out strategy was initiated only in late 2022 and does not seem so far driven by specific decarbonisation targets.

The company has been losing money for most of the past decade. The six municipalities owning STEAG put the company up for sale in late 2022, hoping to take advantage of a high-power price environment that could make it more attractive to buyers. The sale process is expected to start in May 2023.

It is of great concern that the new buyer will not follow a coal phase-out strategy and will maximize the coal fleet lifetime until being compulsorily decommissioned by the Federal Network Agency.

The goal of this paper is to call for a reassessment of the company’s sale or raise awareness for a responsible sale that implies a public commitment to implement STEAG's coal exit strategy.

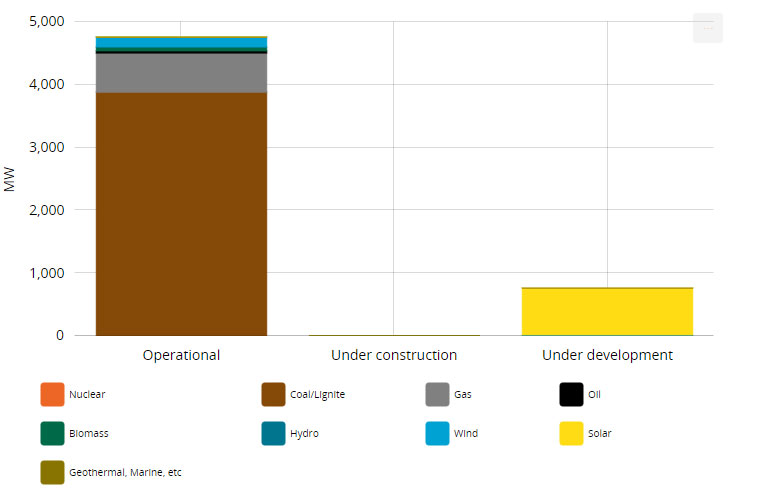

Figure 1: STEAG Fleet by Technology (megawatts), Including ICONY Assets

Source: Enerdata.

The data above shows the large majority of STEAG fleet is coal-fired (4 GW). The solar development capacity falls under the ICONY portfolio (a separate entity from STEAG Power).

Read the full report: STEAG’s Uncertain and Slow Decarbonisation Strategy

Read the German version of the report: Ungewisse und zögerliche Dekarbonisierungsstrategie der STEAG