New risk factors emerge as GE shutters California power plant – 20 years early

Download Full Report

Key Findings

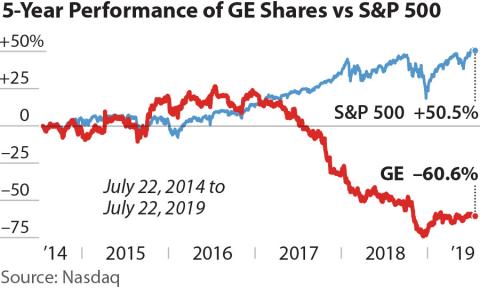

GE's plan of scrapping down its Inland Empire power plant came when the H-class sales were disappointing even after all the hype.

The declining coal usage and low natural gas prices helped GE to reach its decision on gas turbine sales.

The company has already faced a series of losses in terms of fossil fuel investments, and the California plant is the latest one on the list.

Executive Summary

GE will close its $1 billion natural gas power plant in southern California, only 10 years into its planned 30-year life cycle. Why? GE’s once state-of-the-art efficient gas plant that promised baseload usage and steady revenues now features obsolete technology, declining usage and unsustainably low revenues.

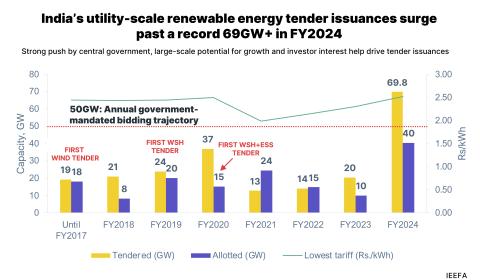

The energy system includes growing amounts of lower-cost solar and wind generation. With renewable energy already cost competitive and with the clear prospect of continuing technological improvements leading to increased efficiencies in renewables, California’s regulatory design is moving away from fossil fuels. Gas plants now serve as back-up generation. This requires different gas plant operating systems if the plants are to stay competitive.

The end result: this huge California plant, which cannot operate under these new market conditions, is uneconomic and being closed. This latest problem comes on the heels of the collapse of GE’s power unit. The bet the company made on natural gas plants and turbine development proved to be value destroying. GE’s current and continued wager on natural gas is also showing signs of coming up short.

Press release: IEEFA report: Risk factors multiply for GE as California power plant shutters – 20 years early

Please view full report PDF for references and sources.