IEEFA highlights rise of low-carbon, passive indexes that compare favorably with traditional funds

Key Findings

The temporary boost from the pandemic recovery and the Russian invasion of Ukraine reversed the oil and gas sector’s fortunes—temporarily.

As the energy sector has declined, low-carbon exposure index funds have outperformed the traditional market benchmarks.

Large and small institutional funds can now invest in a plethora of solidly performing low-carbon indexes.

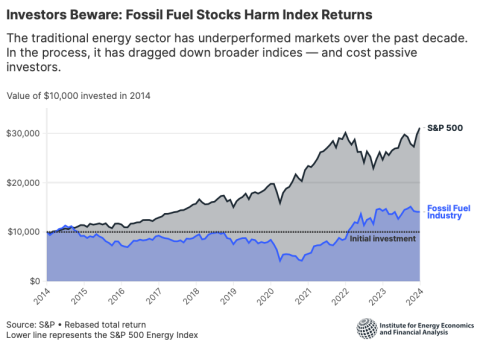

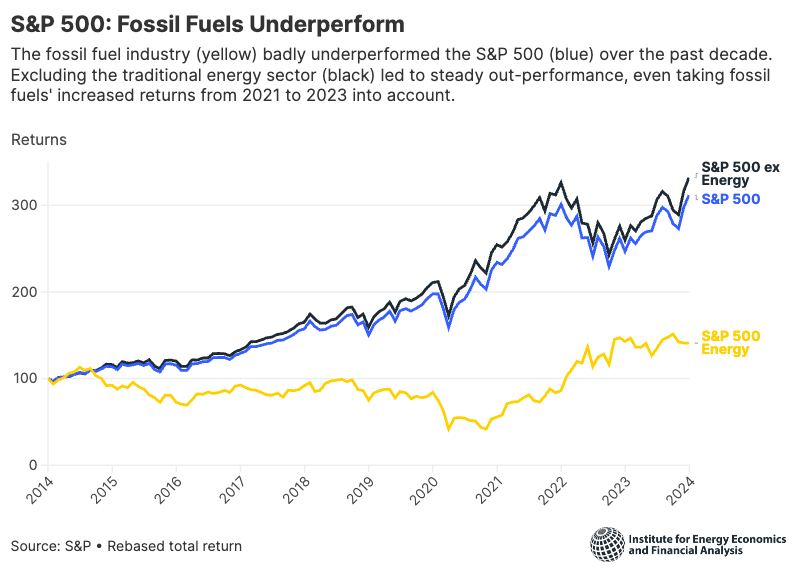

A recent IEEFA report, Passive Investing in a Warming World, makes it clear that the energy sector (composed solely of oil and gas stocks) has declined for a decade—lagging the S&P 500-stock index for the most part and comparing unfavorably to broad, global index funds with sustainable mandates.

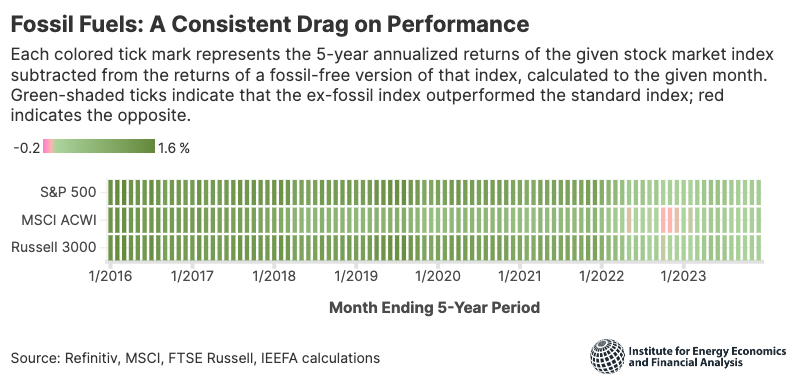

Among 3 named, passively managed index funds (Russell, Standard and Poor’s, MSCI) that reported 10 years of data, IEEFA found that all turned in superior performances to the marquee, mainstay indexes. The differences were modest but consistent: The S&P 500-excluding fossil fuels averaged a 12.74% annualized total return; the marquee S&P 500, 12.03%. The performance results were the same for emerging market, small- and medium-cap indexes.

The numbers were only reversed on the three-year metric between 2021 and 2023, when the average price of oil rose to $84 per barrel (for the 10-year period, the average was $68 per barrel). The three-year superior stock price includes the price bump from the COVID-19 recovery and the early days of the war in Ukraine.

In 2023, however, prices fell, and so did the fortunes of the energy sector. It placed next to last in the stock market, and the marquee fund performance was once again dragged lower than indexes without fossil fuels.

Given this performance, the less-than-stellar returns for 2023 and a largely negative outlook, the question remains: Why are institutional investors staying with oil and gas stocks?

Investors often cite a few record quarters of recent years. But the only factors that supported oil and gas stock performance were a pandemic and a war. The historical link between fossil fuel growth and economic growth is decoupling. Nothing shows the destabilizing role of oil and gas in the economy more clearly than the 2022 oil price spike caused largely by the invasion of Ukraine. The price spike hitting $125 per barrel catapulted energy stocks to No. 1 in the stock market, while the rest of the economy lost ground. (Also, essential context: Fossil fuels have dragged down indices on five- and 10-year bases, even when considering record profits caused by global crises.)

That was the upside for oil prices. But geopolitical destabilization isn’t always a recipe for profits: In 2020, another conflagration had the opposite effect when Saudi Arabia and Russia’s dispute drove oil prices to record lows and an average of $41 per barrel for the year.

The days of growth based on sound business fundamentals are over. Instead, the fossil fuel sector now relies on exogenous forces. These geopolitical drivers of oil prices and profits only serve to underscore the longer-term inability of the industry to serve as a constructive input to economic performance.

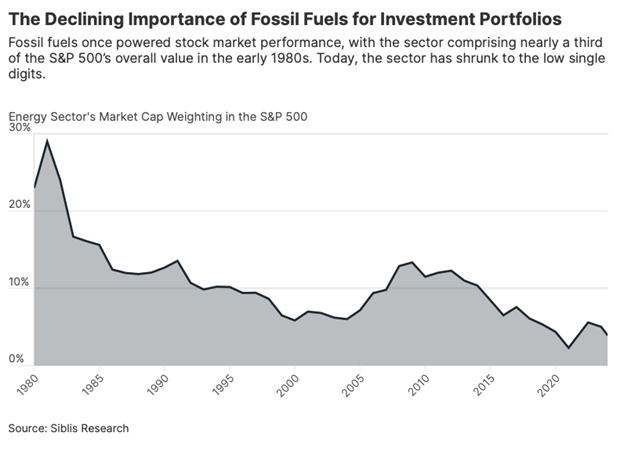

During the last decade, the oil and gas sector also has posted mostly single-digit market share percentages in the composition of the S&P 500. The industry’s share plunged to 2% in October 2020 before rebounding to a little more than 5% in the wake of the Ukraine invasion—but still a major slide from its high of almost 30% in the 1980s.

The IEEFA report sets out facts that present a choice. Institutional funds can meet their financial targets with or without fossil fuels. With war and pandemic as the driving source of profits and the energy transition proceeding, what is the institutional rationale for the continued investment in fossil fuel stocks? If they are speculative stocks, then they should be treated as such by institutional funds. Justifying the maintenance of holdings of fossil fuel stocks in a passive index because the stock is yielding short-term, speculative profits based on geopolitical manipulation and negative outlook is contrary to the logic and design of passive investing.

The negative outlook facing the oil and gas sector is based on several dynamics. First, the industry faces competition in each of the major sectors where it has traditionally dominated. ExxonMobil CEO Darren Woods has made it clear that electric vehicles will dominate the market by 2040, cutting into the company’s gasoline refining business. Second, while natural gas continues to grow, robust growth is a thing of the past. European economic policy is moving away from fossil fuels in the petrochemical and home heating industries. Third, while natural gas took much of coal’s market share in the United States, wind and solar now compete with natural gas for market share.

Oil and gas stocks can serve a speculative function in the market but the evidence from this report is that investors are looking for longer-term, more stable alternatives, and the market is responding with a variety of new sustainable funds.

IEEFA researchers compared 33 examples of sustainably mandated funds and compared them to the market performance of traditional, marquee funds that serve as the markets leading benchmarks. The performance for these ex-fossil fuel indexes were solid, providing an ample supply of passive index fund designs that could be used by institutional investors seeking to reduce or eliminate their fossil fuel holdings across market geographies and capitalizations. Due diligence and care should continue to be exercised, since returns and carbon exposure metrics vary for the mandated indexes.

The report gives many examples of indexes that have adopted various divest-invest options. IEEFA researchers point to the weakening financial performance of traditional oil and gas stocks to explain the growth in sustainably mandated funds. A convergence exists that is long in the making but nevertheless clear: The mainstay, marquee investment funds are increasingly resembling sustainably mandated funds, and vice versa. The last decade has de-risked decarbonization strategies.