Key Findings

The introduction of derivatives to India’s short-term power market will make it easier for renewable project developers to enter into offtake arrangements with state-owned distribution companies (discoms).

Power purchase agreements (PPAs) provide certainty of power offtake over a long duration and de-risk investors from price volatility.

Physical delivery of electricity will be separated from the financial settlement.

Executive Summary

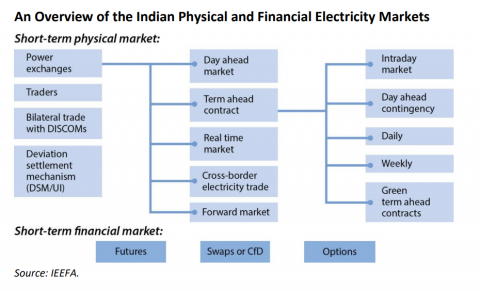

Long-term power contracts dominate the Indian electricity sector. Power purchase agreements (PPAs), with tenures of 25 years, comprise 88% of the overall traded volumes. While providing investors with certainty over a long duration and derisking from price volatility, the growing implications of these PPAs need to be addressed to aid the financial viability of state distribution companies (discoms).

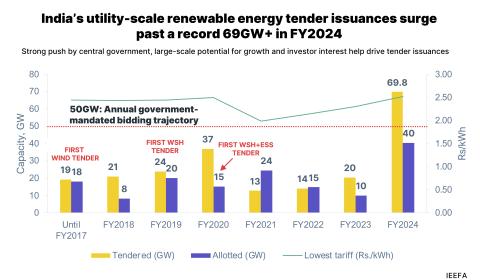

In the wholesale market, liquidity in the short-term market has increased over the years, although the overall volume is still low. Short-term bilateral contracts traded up to 3 months in advance of delivery comprise 3-4% of the volume; the day-ahead market comprises another 5-6%; and the balance of 1-2% is Unscheduled Interchange (UI).

June 2020 saw the introduction of the real-time market with price discovery through double-sided closed auctions which happen every half hour for two 15- minute time blocks, one-hour ahead on the power exchange. Further, in August 2020 the Green Term Ahead Market (GTAM) for trading renewable energy was launched. The introduction of green markets on the national exchange platform is a significant milestone that will enable consumers to make a sustainable choice, help the government to achieve its renewable energy goals and enable integration of renewable energy in the most flexible and efficient way.

In April 2021, the Indian Energy Exchange (IEX) commenced the Cross Border Electricity Trade (CBET) on its platform, with the aim of building an integrated South Asian regional power market in support of the One World One Sun One Grid ambition of the Government of India, developing a green electricity export market.

With the massive deflationary effect of renewable energy, discoms are becoming increasingly wary of signing long-term PPAs, thereby impacting development of new renewable projects in the absence of off-taker certainty. Long dated two-part PPAs for many coal power plants also undermine India’s ability to retire expensive, polluting end-of-life coal-fired power plants. Discoms are struggling with huge financial losses, with total debt projected to hit an all-time high of Rs4.5 lakh crore (US$61bn) in FY2020/21.

In order to ease their financial burden, the discoms need to be unshackled from expensive long-term PPAs with old, inefficient plants. The long-term PPAs are rigid contracts that underwrite the capital cost (financing and depreciation) of the old plants without providing value for customers. India now needs to transition towards development of financial products in the derivative (or financial) electricity market that developers could utilise to hedge risk without requiring the signing of long-term PPAs for the financial closure of projects.

Please view full report PDF for references and sources.