Latest Oil Industry Research

See more >

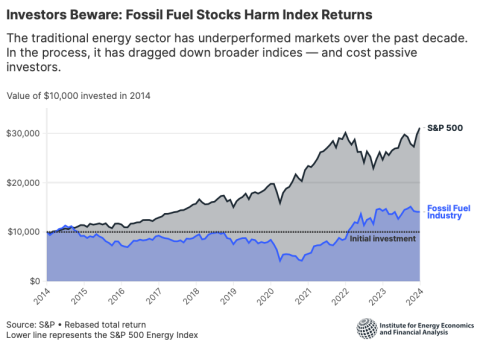

IEEFA highlights rise of low-carbon, passive indexes that compare favorably with traditional funds

February 26, 2024

Tom Sanzillo

Analysis

Chevron’s $53 billion acquisition of Hess is mostly about Guyana

October 27, 2023

Tom Sanzillo

Analysis

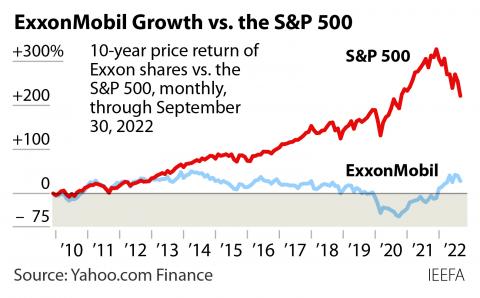

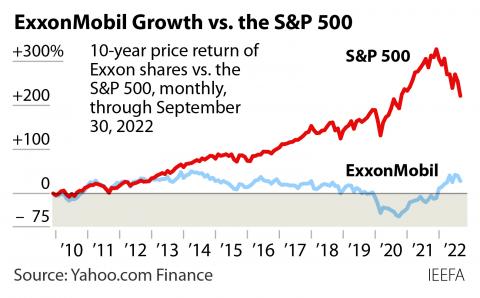

Pioneer deal: Another overpayment by ExxonMobil?

October 11, 2023

Clark Williams-Derry, Tom Sanzillo

Analysis

The Royal Bank of Canada’s climate policy has come under close scrutiny from its stakeholders

October 05, 2023

Mark Kalegha

Analysis

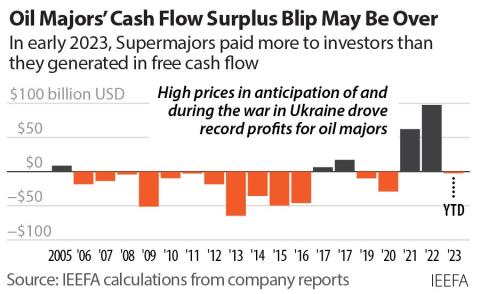

Declining supermajors profits reveal flaws in the oil and gas business model

August 09, 2023

Clark Williams-Derry

Analysis

Taking stock of the oil and gas sector as the transition to sustainable finance proceeds apace

August 01, 2023

Tom Sanzillo

Analysis

Recent decision leaves ExxonMobil responsible for only part of Guyana oil spill costs, leaving Guyanese people on the hook for the rest

June 14, 2023

Tom Sanzillo

Analysis

ExxonMobil loses key case in Guyana oil controversy over insurance

May 22, 2023

Tom Sanzillo

Analysis

Oil supermajors are meeting climate goals by selling assets—but still increasing emissions

May 10, 2023

Tom Sanzillo

Analysis

Financial case for pensions to dump fossil fuels in California is strong despite resistance

March 02, 2023

Tom Sanzillo

Analysis

New North Sea exploration licenses pose a threat to UK’s future energy security

February 08, 2023

Andrew Reid

Analysis

Latest TC Energy oil spill confirms the wisdom of denying a permit for the Keystone XL pipeline

December 19, 2022

Suzanne Mattei

Analysis

Latest Oil Industry Reports

See more >

Passive investing in a warming world

February 08, 2024

Connor Chung, Dan Cohn

Report

A strategic fossil fuel divestment policy would strengthen the British Columbia Teachers' Pension Plan

March 17, 2023

Mark Kalegha, Tom Sanzillo

Report

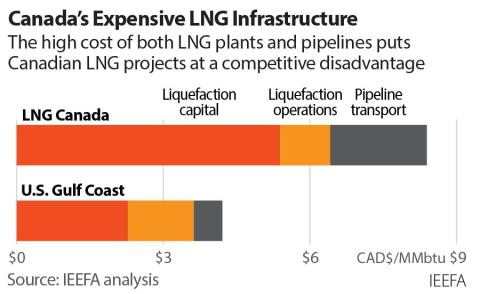

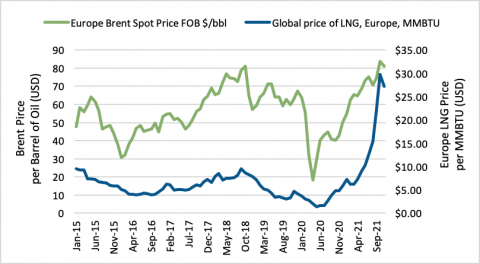

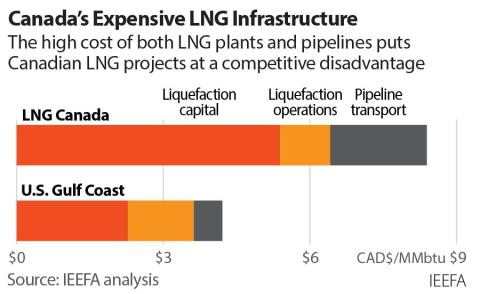

British Columbia LNG project costs rising again

February 01, 2023

Clark Williams-Derry

Report

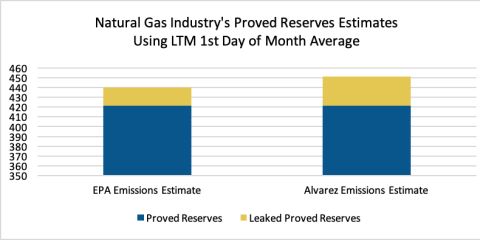

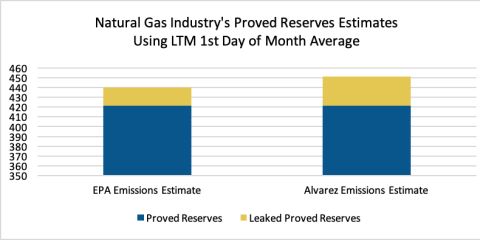

Why oil patch should be grateful for EPA methane rules

December 14, 2022

Trey Cowan

Report

The UK offshore supply-chain dilemma

December 14, 2022

Andrew Reid, Arjun Flora

Report

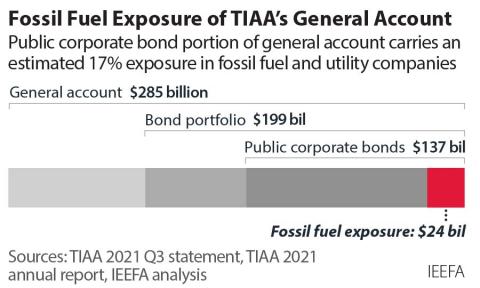

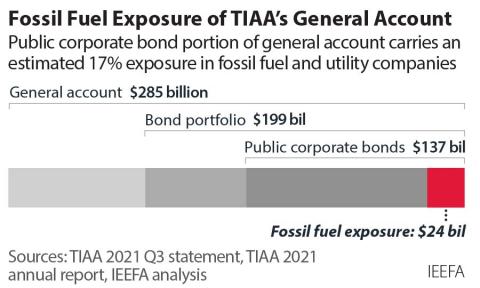

TIAA fails clients on climate

November 16, 2022

Tom Sanzillo

Report

Two economies collide: Competition, conflict, and the financial case for fossil fuel divestment

October 13, 2022

Tom Sanzillo, Dan Cohn, Connor Chung...

Report

Campaign to undermine ESG principles is about power—not good investment policy

September 28, 2022

Tom Sanzillo

Report

Why the now-abandoned Keystone XL Pipeline was troubled from the start and today would not serve its purpose

June 24, 2022

Omar Mawji, Suzanne Mattei

Report

Canada’s oil and gas decommissioning liability problem

May 25, 2022

Omar Mawji

Report

Clean-up costs for wells in Guyana, another loophole to benefit ExxonMobil and partners

May 24, 2022

Tom Sanzillo

Report

IEEFA report findings: 2016 petroleum agreement between Guyana, ExxonMobil, et al.

May 23, 2022

Tom Sanzillo

Report

Latest Oil Industry Press Releases

See more >

Financial rationale for investing in fossil fuel industry continues to unravel

February 08, 2024

Press Release

ExxonMobil project in Guyana in breach of insurance obligations, court finds

May 04, 2023

Press Release

Divesting is the correct path for the British Columbia Teachers’ Pension Plan

March 20, 2023

Press Release

IEEFA North America: British Columbia LNG project costs rising again

February 01, 2023

Press Release

IEEFA U.S.: Why the oil patch should be grateful for the EPA’s methane rules

December 14, 2022

Press Release

UK’s offshore wind targets at risk from renewed push for North Sea oil and gas extraction

December 14, 2022

Press Release

IEEFA U.S.: Financial services giant TIAA has a long way to go to become a climate leader

November 16, 2022

Press Release

IEEFA U.S.: Two economies collide: Competition, conflict, cooperation and the financial case for fossil fuel divestment

October 13, 2022

Press Release

IEEFA U.S.: Campaign to undermine ESG principles is about power—not good investment policy

September 28, 2022

Press Release

ExxonMobil benefits from loophole requiring Guyana to pay for costs of decommissioning wells

May 26, 2022

Press Release

Canada’s major banks continue funding oil and gas companies despite growing concerns over decommissioning liabilities

May 25, 2022

Press Release

Guyana is paying for oil costs 20 years in the future, with no guarantees that money will be there when needed

May 24, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.