Taking stock of the oil and gas sector as the transition to sustainable finance proceeds apace

Key Findings

The tumble in oil and gas prices after Russia’s invasion of Ukraine tells us the industry outlook is negative—the temporary rise in prices was due to a volatile political situation, not financial forces.

The brief period of March through June 2022 on which fossil fuel companies stake claims of a comeback is increasingly looking like an anomaly—and one which leaves the industry’s long-term weak financial fundamentals unchanged.

The upsurge in revenue caused by the war in Ukraine reinforces the fact that the industry does not have a transition-ready business plan backed by a sound investment thesis.

Investors should heed the signals of an unstable fossil fuel sector, and protect their assets from further erosion by investing in broader-based sustainable economic strategies.

Watching the oil and gas markets in the short term is the stuff of chaotic metaphor—rabbit holes, dervishes and goose chases. Longer-term analysis, while challenging, can be more fruitful—and is the basis for prudent portfolio management.

The first half of the year (1H) 2023 energy sector performance takes place against a backdrop of two economies. One, a fossil fuel sector that is getting smaller and growing increasingly reliant on political maneuverings as its financial fundamentals falter; and two, a sustainable energy sector getting larger and searching for political tools appropriate for its growing dominance.

If it were a horse race, my bet would be on sustainability.

Investor losses from fossil fuels

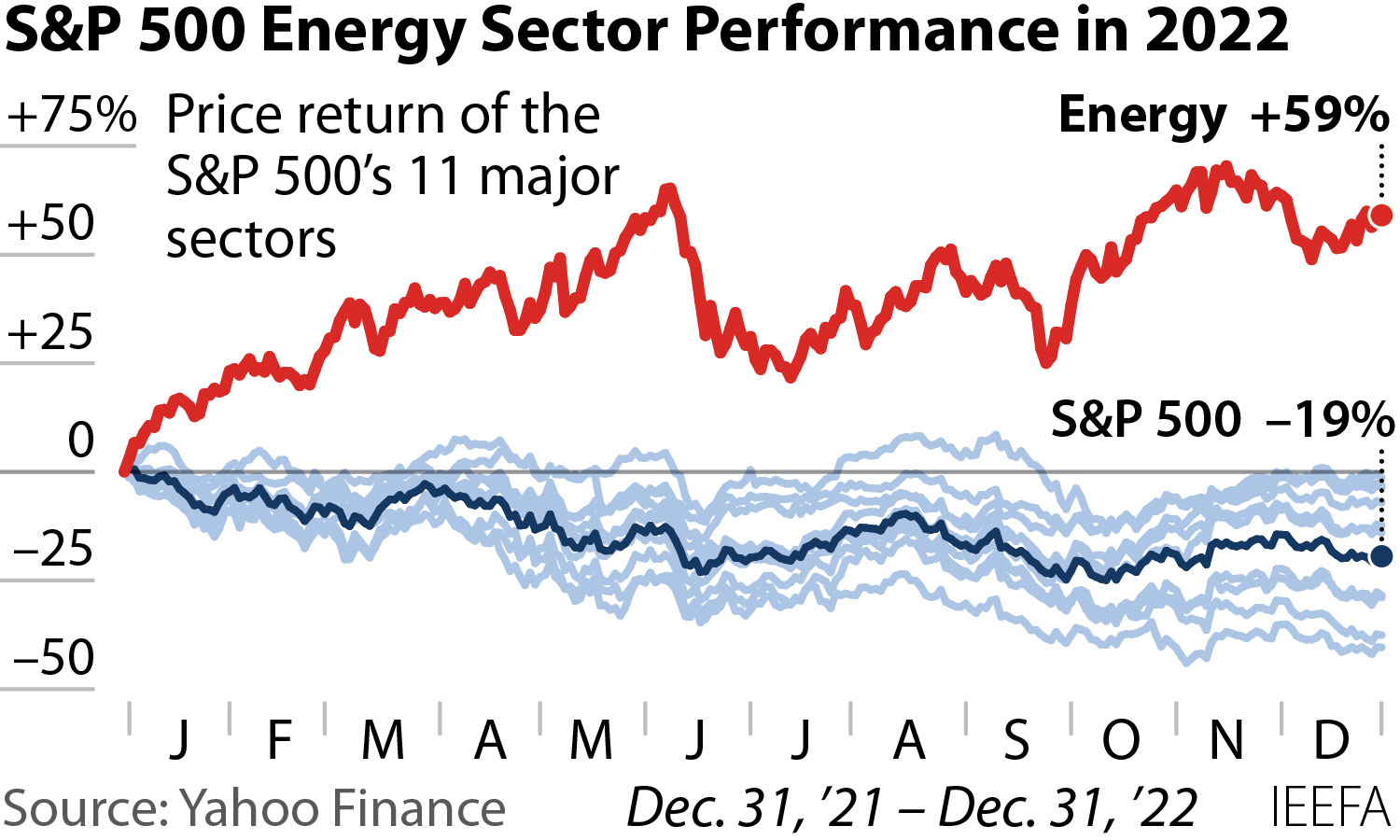

In 2022, the oil and gas sector ranked number one in the stock market. No other sector came close. In early 2023, when oil and gas companies announced their earnings for the prior year, it was high fives all around—as Reuters declared on Feb. 8, “Big Oil doubles profits in blockbuster 2022.”

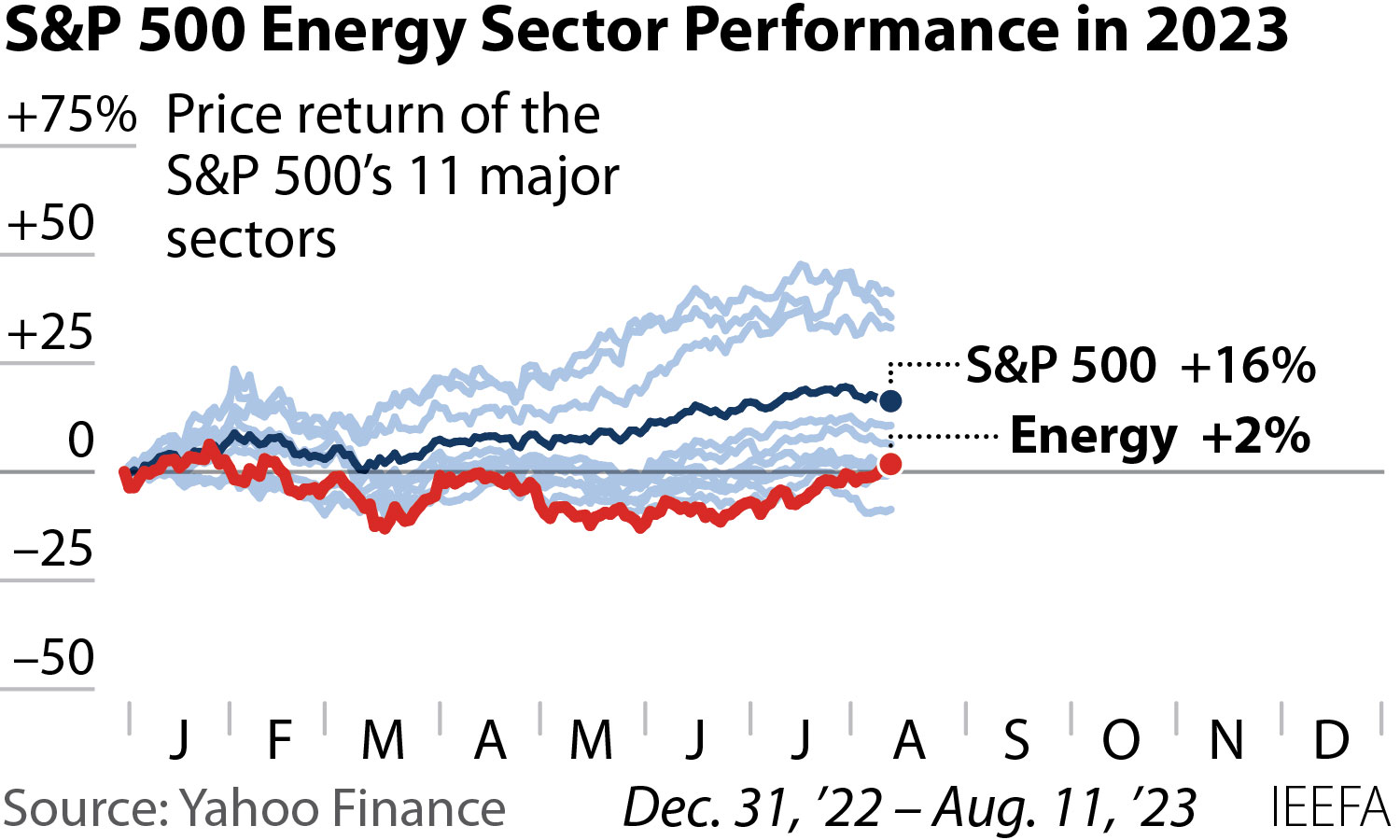

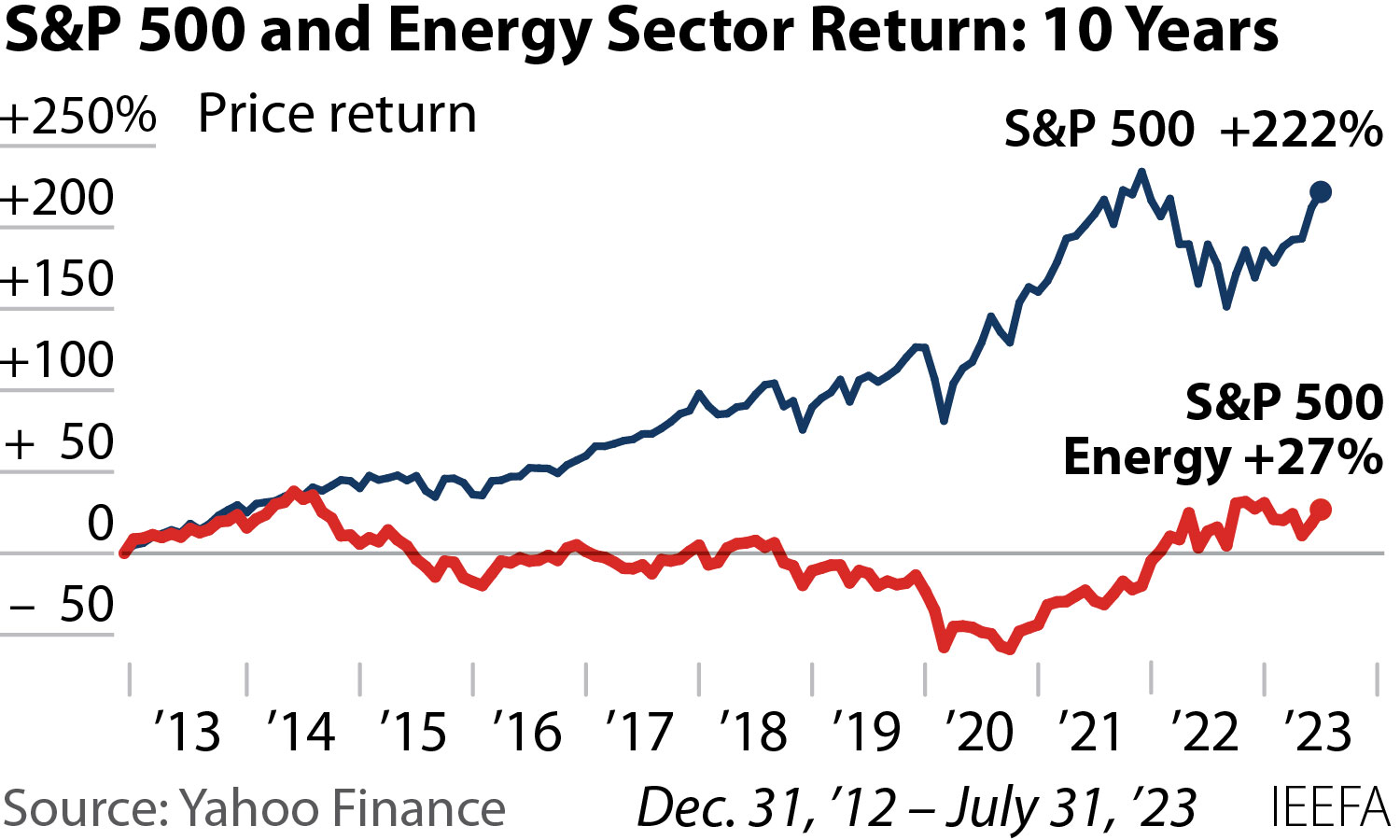

Yet as news of sky-high oil and gas profits blared across the airwaves, few noticed that the fossil fuel sector had already fallen back to last place in the stock market—a position it had held for much of the prior decade. And for the first half of 2023, oil and gas stocks have remained at or near last place.

The explanation for the oil and gas industry’s record-setting financial performance in 2022 comes down to one word: War. Global oil prices were already on a post-COVID economic rebound, with the Brent benchmark rising from $40/barrel in the first half of 2020 to $77/barrel by in the second half of 2021. But rising tensions between Russia and Ukraine in late 2021 and early 2022 caused prices to drift higher, and Russia’s full-scale invasion of Ukraine sent prices skyrocketing to $127 by March 7. Prices remained high for months, as sanctions on Russian oil created chaos in global markets. But as the market readjusted to new trade patterns, oil prices gradually eased, falling back to $81 by the end of the year.

The industry sits at or near the bottom of the stock market because with such low oil prices, it will fail to create robust revenues sufficient to increase profits, shareholder dividends, maintain significant cash reserves and reduce debt levels. And within the energy subsector, the integrated oil majors (ExxonMobil, BP, Total, Chevron et al.) now represent the poorest performing segment.

As oil and gas companies thrived in 2022, the rest of the economy foundered—weighed down, in part, by rampant inflation caused by the rising energy prices. In effect, high oil and gas prices became parasitic to the rest of the economy. Within the S&P, the energy sector represented just 2.0% of the market in October 2020. By autumn of 2022 that had reached 5.4%.

But with prices coming back down, the oil and gas sector has already given up much of those gains, and stands now at 4.3% on the market. ExxonMobil has again fallen out of the S&P 500 top ten. McKinsey is telling us the private markets have taken note of a clear downward trend in the energy space.

The brief period of March through June 2022 on which fossil fuel companies stake claims of a comeback is increasingly looking like an anomaly—and one which leaves the financial fundamentals unchanged. The impact of COVID-19, first slamming the market down in early 2020, fostered a turnaround through early 2022. And from March 2022 to June 2022, the fortunes of the oil and gas industry rose with the Russian invasion of Ukraine. The industry, however, snapped back from leader of the market in 2022 to last place in 2023 in a matter of months, based on the financially unsustainable military invasion.

Institutional investors are duty-bound to act with a long-term outlook. They should be particularly concerned by the fact that the industry’s purported new lease on life is based on the Russian invasion of Ukraine—an unsustainable geopolitical situation that is not caused by financial forces. From an analytical standpoint, the upsurge in revenue caused by the war reinforces the fact that the industry does not have a business plan with a sound investment thesis. The military action and resulting sanctions, market disruptions and oil spikes are geopolitical in nature and not part of the formerly powerful alignment with macroeconomics that characterized the energy sector for decades.

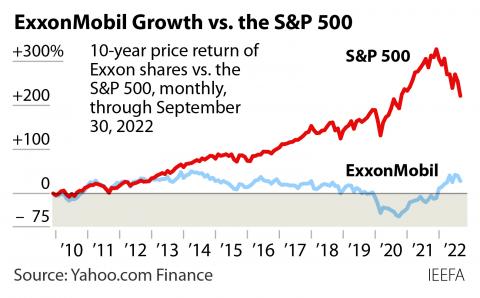

Looking back ten years before the invasion of Ukraine, the energy sector lagged the market generally. The industry led the market in only two of the ten years, while in 7 years the industry placed last or near last. With a major change in the geographical distribution of oil and gas production, along with growth of the oil and gas sector’s sustainable competitors in the power, transport and petrochemical markets, the oil and gas markets claimed a mere 2.0% of the stock market in October 2020.

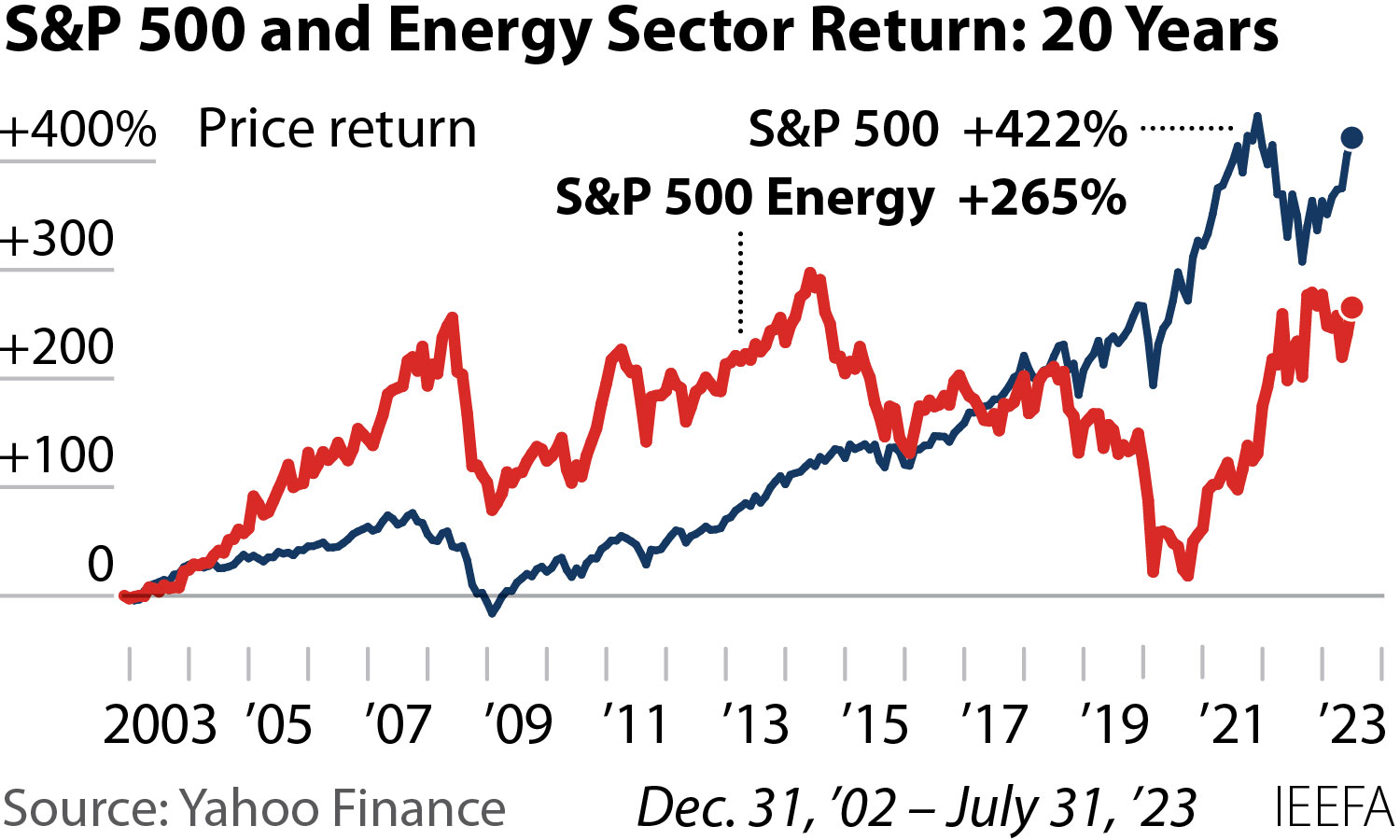

Looking back 20 years, the decade from 2004-2014 saw the oil and gas industry leading the market: The ups and downs of the energy sector and the economy as a whole mirrored one another, but the energy sector’s highs were higher. But from 2014 through 2020, the economy continued to grow even as the oil and gas sector struggled in the face of a broad set of economic changes. Today, as the war’s initial impact has been absorbed by the market, the longer-term performance of the energy sector continues to falter.

The marriage between economic growth and oil and gas sector growth is facing divorce

Despite their former alignment, a trend is emerging in which general economic growth and oil and gas sector growth are decoupling. The price spikes as a result of the invasion of Ukraine made a negative contribution to economic activity in the market as a whole. We now see in 2023 a relatively robust market and oil and gas are once again in last place.

The energy sector is challenged in the power, transport and petrochemical sectors by strong competitors, and fossil fuel interests have not developed meaningful solutions to the challenge. Nations with a clear commitment to combating climate change are finding it difficult to align fossil fuel extraction and climate solutions. Private companies in the oil and gas sector have been taking different paths with regard to emissions and climate change, and change is slow. State-owned (national) oil company information is hard to come by and evidence of change is sparse, although some are at least beginning to articulate programmatic objectives on climate change.

In contrast against these halting steps taken by oil and gas companies and producer nations, substantial long-term investments are being pursued to develop sustainable pathways. Electric vehicles, wind and solar power generation, as well as policy discourse on integrating sustainability and traditional growth models, are growing, stable and reliable forces for change. Institutional market forces are moving not only to reshape investment but also to prompt geopolitical realignments. Investments are in the hundreds of billions and continue to grow.

The ability of oil and gas companies to develop climate change solutions as part of their investment rationale is the subject of important questions. Can the companies successfully develop effective new technologies to reduce or eliminate emissions? Can they contribute to next-phase development in sustainable economic growth? Can they build companies that are responsive to an economy requiring far less fossil fuel use? As the sector devotes mere pennies on the dollar of capital expenditure towards low-carbon solutions, investors should be deeply concerned by the industry’s answer so far.

These future-oriented questions are critical, and bear heavily on the issue of whether oil and gas companies are viable investments amidst the collision of the two energy economies. Does the oil and gas sector’s increasingly weak financial performance show any signs that a reliable economic turnaround is possible? Their historical blue chip performance was demonstrated by financial and industrial leadership and a growth model tied to larger macroeconomic factors and stable returns. The energy sector no longer meets these fundamental components of the blue chip class.

Right now the financial rationale for oil and gas is at best elusive, and investment is risky. The industry is tied to the price of oil—a factor currently determined by increasingly volatile and unreliable forces, in a highly competitive market with strong sustainable competitors. The most potent revenue producer in a decade for the industry has been the unsustainable military invasion of Ukraine. Investors not heeding the signals are failing to protect their assets from further erosion.