Study: FirstEnergy’s Ohio Plan Would Cost Ratepayers $4 Billion; Proposal Aims to Protect Company Shareholders and Outdated Plants

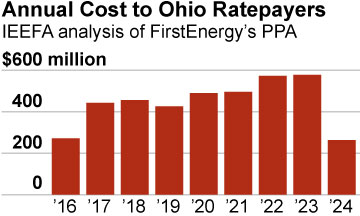

Feb. 8, 2016, CLEVELAND — A proposal by Akron-based FirstEnergy Corp. to keep four aging electricity generation plants alive will cost ratepayers in Ohio almost $4 billion through 2024, a new study by the Institute for Energy Economics and Financial Analysis concludes.

Feb. 8, 2016, CLEVELAND — A proposal by Akron-based FirstEnergy Corp. to keep four aging electricity generation plants alive will cost ratepayers in Ohio almost $4 billion through 2024, a new study by the Institute for Energy Economics and Financial Analysis concludes.

The report, ”A $4 Billion Bailout in the Buckeye State,” is an independent analysis of FirstEnergy’s proposal, which is being considered by the Public Utilities Commission of Ohio (PUCO).

The study details energy market trends that put coal-fired and nuclear-powered electricity generation plants at a growing disadvantage to other energy sources. It also shows how FirstEnergy is pursuing approval of the plan as part of a larger corporate strategy to shift risk to ratepayers and how the proposal before the PUCO would guarantee shareholders a 10.38 percent return on the plants regardless of their performance.

“The goal of FirstEnergy in putting forth this ratepayer-subsidized plan is to prolong the life of outdated plants in Ohio, put customers on the hook for the escalating costs of these plants and ensure future profits for FirstEnergy shareholders,” said Sandy Buchanan, IEEFA’s executive director. “The PUCO should reject it.”

The report, by David Schlissel, IEEFA’s director of resource planning, and Cathy Kunkel, an IEEFA energy analyst, details financial and market risks attached to the coal-fired W.H. Sammis, Clifty Creek, Kyger Creek plants and the nuclear-powered Davis-Besse plant.

Among well-established market trends that present obstacles to the competitiveness of the plants, according to the report:

- The precipitous recent decline in natural gas prices and the decline in the cost of generating power at natural gas-fired power plants.

- The rise of wind- and solar-powered generation as renewable-energy installation costs drop as and as federal and state incentives for renewable power continue.

- Flat growth in electricity demand in PJM, the regional electricity-transmission organization, driven by the deployment of energy-efficiency programs, demand response, and distributed, on-site renewable resources.

The report notes that all four of the plants in question are currently unprofitable and describes how they will likely remain so for years to come. It includes market analysis that undermines FirstEnergy’s forecasts for future natural gas prices and PJM electricity market prices.

“Our findings conflict sharply with what FirstEnergy asserts,” Buchanan said. “The arrangement FirstEnergy seeks would turn ratepayers into de facto merchant generators vulnerable to the same difficult economic trends and market conditions that have plagued other merchant power generators in recent years. Rather than drag Ohio’s economy down with an additional $4 billion in unnecessary expenses, the state should recognize that markets are changing, support the development of cleaner, modern and more efficient resources, and support a transition plan for communities and workers where these aging plants are located.”

The full report is posted here.

Media contact: Karl Cates 917-439-8225 [email protected]

________________

About IEEFA: IEEFA conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.