Russian oil volumes down, but revenues soar sky-high due to prices

The Centre for Research on Energy and Clean Air has released a 100-day update on Russian exports of fossil fuels, charting the flow of Russian exports since the beginning of the Ukrainian invasion.

A financial insight: Volumes of oil exported from Russia are down, but revenues are up—way up, due to high prices.

Besides the various countries still tethered to the Russian fossil fuel spigot, many major oil companies, utilities and industrial companies are still making industrial purchases from Russia. They include ExxonMobil, Shell, TotalEnergies, Repsol, Lukoil, Neste, Orlen, Taipower, Chubu Electric Power, Triest Thermal, Nippon Steel, Formosa Petrochemical, JFE Steel and Malaysia’s national electric company, TNG.

Volumes of oil exported from Russia are down, but revenues are up

First-quarter earnings for the oil and gas industry were splattered with news of high oil prices, revenue celebrations, volume uncertainty, buybacks, rich dividends and maybe even a hint of future exploration and drilling. Even in the face of oil industry write-offs from interrupted oil ventures in Russia, the black ink flowed.

The rainmaker for the oil and gas industry is Vladimir Putin. The rainmaker is not only generating benefits for himself, but is making it rain for everyone within his orbit, including major fossil fuel companies. The Russian president has used the newfound surplus to finance a war that disrupted markets, and drove oil prices skyward in the chaos.

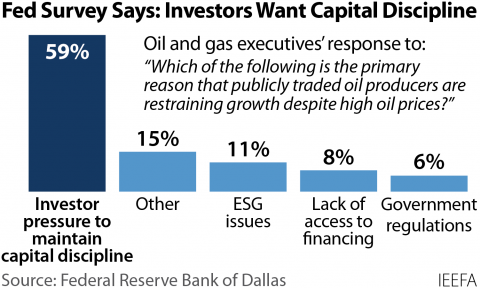

Energy sector stocks are up by 59% since January, and the S&P 500-stock index is down 18.7 percent. The conflagration in Ukraine has turned around a 10-year losing streak for the oil and gas industry.

The price of oil, already on its way up prior to the invasion due to the de-bottlenecking from the pandemic, took on juggernaut proportions when Russia invaded Ukraine.

While it would be the height of impropriety for oil and gas companies to rain praise on the Russian leader for his audacious play, the cash from continued purchases is thanks enough. From the oil companies, on the way to the bank, one hears a sigh of relief.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis