Key Findings

PLN's renewable energy plans lag its regional and global peers.

PLN's management team must prepare itself for a much higher level of scrutiny than it previously faced from the fixed income market.

Abandoning coal projects in the pipeline would demonstrate PLN's seriousness.

Executive Summary

In November 2020, state-owned electricity company PT Perusahaan Listrik Negara (PLN) announced its commitment to provide clean and sustainable energy for Indonesia in line with government policy, and published its Statement of Intent on Sustainable Financing Framework.

The release of the framework is the first public acknowledgement that PLN is preparing to issue a debut “green and/or sustainable financing” instrument as early as January 2021.

This is a step in the right direction for PLN. However, the company will need to work hard to build credibility given its track record as a major carbon emitter that continues to add coal-fired power capacity at a determined pace.

The company’s renewable energy plans lag its regional and global peers and therefore, to build a bridge to high quality ESG (environmental, social, and corporate governance) investors, PLN’s management team must prepare itself for a much higher level of scrutiny than it previously faced from the fixed income market.

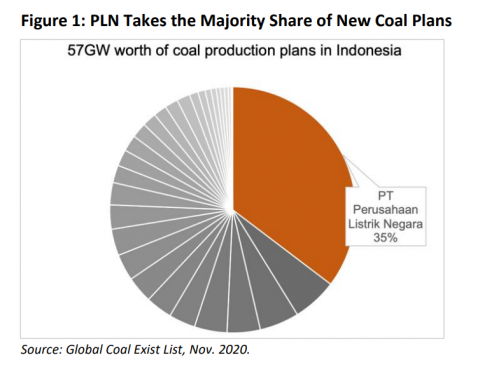

Based on IEEFA research, ESG investors are reluctant to fund issuers that lack transparency and that continue to be fossil fuel focused. This will be an obvious challenge for PLN in light of the fact that the company still has at least 20 gigawatts (GW) of coal projects in the pipeline.

PLN also has no meaningful experience of disclosing or reporting to investors on ESG-linked performance metrics. This has the potential to create risk for those who invest in good faith but find that PLN does not yet have the capacity to meet expectations in the sustainable finance market.

Please view full report PDF for references and sources.