From intent to action: India well poised to become a global leader in green hydrogen

Key Findings

The Indian government recently announced an initial capital outlay of Rs19,774 crore (almost US$2.5 billion) under the green hydrogen mission. This is a step towards establishing India as a global hub for the production, utilisation and export of green hydrogen and its derivatives.

Green hydrogen is capital-intensive, and the private sector has been wary of investing in risky technologies. The government pump-priming the green hydrogen sector will boost investor confidence.

Reducing the costs of electrolysers and round-the-clock renewable energy is key to making green hydrogen commercially viable.

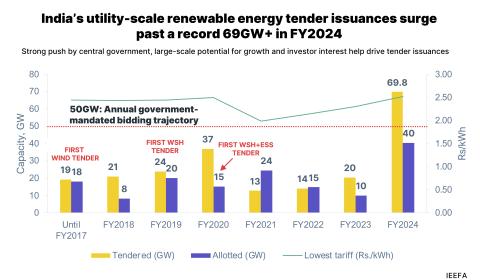

While geopolitics drove many countries in 2022 to shift back to burning fossil fuels, 2023 offers a big reason to rejoice as India looks set to lead the world in energy transition.

The government's recent announcement of an initial capital outlay of Rs19,774 crore (US$2.43 billion) under the green hydrogen mission is a step in establishing India as a global hub for the production, utilisation and export of green hydrogen and its derivatives. The hydrogen mission is expected to help develop 5 million tonnes of green hydrogen per year, garner investment of Rs8 lakh crore (US$100 billion), create jobs, reduce import and subsidy burden, and abate greenhouse gas emissions.

The hydrogen mission is expected to help develop 5 million tonnes of green hydrogen per year, garner investment of Rs8 lakh crore (US$100 billion), create jobs, reduce import and subsidy burden, and abate greenhouse gas emissions.

Given the high costs so far, few pilots have been carried out. For this technology to become commercially viable, bringing down the costs of electrolysers and round-the-clock renewable energy is key. Allocation of money for strategic interventions and research and development (R&D) will improve the feasibility of such projects and help garner more investment from the private sector.

Green hydrogen is capital-intensive, and the private sector has been wary of investing in risky technologies. The government pump-priming the green hydrogen sector will boost investor confidence and attract large investments from domestic and international capital. Further, the government’s announcement of the sovereign green bonds framework and the Reserve Bank of India (RBI) discussion paper on climate risk and sustainable finance will help attract capital for green hydrogen and its derivatives.

It is likely that in the upcoming budget, the Indian government will allocate more capital under the Production Linked Incentive (PLI) scheme for the domestic manufacturing of electrolysers. Also, until the domestic manufacturing of electrolysers increases, there will be concessional duties and taxes for imports in the next few years.

For India to achieve its net zero goal by 2070, it is imperative to decarbonise not only the electricity sector but others like steel, cement, transport, refining.

For India to achieve its net zero goal by 2070, it is imperative to decarbonise not only the electricity sector but others like steel, cement, transport, refining etc. Green hydrogen can help companies decarbonise their operations.

As mentioned earlier, developing a green hydrogen ecosystem is highly capital-intensive. Conventional debt will not be available to fund these forays. A large part of the capital will need to come from promoters’ balance sheets. Thus, a company faces many risks and requires huge capital to diversify across the green hydrogen value chain. Hence, collaborations are necessary to develop green hydrogen and its derivatives in India successfully.

Collaborations can help companies to continue with their primary business but at the same time decarbonise and shift towards clean energy.

One such example is Indian Oil Corporation (IOC) and NTPC signing an agreement in July 2022 to form a joint venture (JV) company. The JV will meet the power requirements of upcoming IOC refineries with round-the-clock renewable energy of up to 650 megawatts (MW) by December 2024.

IOC is going big on green hydrogen. Larsen & Toubro (L&T) and ReNew Power have also signed a tripartite agreement with IOC to supply green hydrogen at an industrial scale. The tripartite venture brings together the strong credentials of L&T in designing, executing, and delivering engineering, procurement and construction (EPC) projects, IOC’s expertise in petroleum refining along with its presence across the energy spectrum, and ReNew Power’s prowess in offering and developing utility-scale renewable energy solutions.

If we look at the global trends, green hydrogen development is a part of industrial clusters. Several entities will operate in industrial clusters, each with diverse expertise, including green hydrogen producers, logistics providers and end-users. Thus, collaboration is important among all these entities within a cluster. India is also following this template. Mangalore is becoming the hotspot for green hydrogen projects in the country.

Indian companies are playing to their strengths and joining hands with each other. They have already started collaborations. If such partnerships are successful, many more players will likely follow, given that the government is setting out individual net zero targets or consumption targets for certain sectors.

Green hydrogen is a nascent technology, and all companies are going through their learning curve. Government support through the right policies and framework, capital outlay and, more importantly, strategic collaboration between players in the value chain can help strengthen India’s positioning to become a global leader.

This article first appeared in Money Control