Energy Department should only spend public funds on hydrogen hub projects that are practicable

Key Findings

The U.S. Department of Energy must decide if proposed production methods and uses for H2Hub proposals are practicable. They will not be practicable unless they are safe, protect the environment, and are economically competitive.

The Energy Department does not appear to be skeptical of investing federal funds in H2Hub projects that use methane, a powerful greenhouse gas.

The department should develop a policy against funding hydrogen projects, especially methane-based projects, with end uses that can be met more cost-effectively with renewable energy.

A DOE failure to exercise its ability to determine which hydrogen production methods are practicable could result in a substantial waste of tax dollars.

The U.S. Department of Energy (DOE) faces challenges regarding its decision to allocate federal subsidies for regional clean hydrogen hubs (H2Hubs). Applicants had until April 7 to submit their full proposals for as much as $7 billion in federal funds. Although some projects may be reasonably sound investments, others are likely to be questionable. Sinking massive amounts of government money into unwise and even risky H2Hub projects would be a poor use of taxpayer dollars. The department must examine whether the proposed production methods and uses for H2Hub proposals are safe, protect the environment and are economically competitive.

The H2Hubs defined by the Infrastructure Investment and Jobs Act are not meant to be temporary experiments. They are supposed to be jobs-generating, economy-building industrial centers that link the production of clean hydrogen with end users. But will they be? It depends on whether the DOE vigorously analyzes the risks, costs, and likelihood of project success.

The law instructs the DOE to promote feedstock diversity when selecting proposals for funding. The agency is expected to fund at least one H2Hub project that produces hydrogen from fossil fuels (natural gas or coal); one from renewable energy and water; and one from nuclear energy and water. The law also sets a goal of end use diversity, with at least one H2Hub demonstrating the use of hydrogen in the electric power generation sector; one in the industrial sector; one in the residential and commercial heating sector; and one in the transportation sector.

But the DOE’s mandate is to achieve this diversity “to the maximum extent practicable.” The agency is not required to mindlessly sink public money into projects likely to fail. The statute’s language gives the department room to take a pragmatic look at the projects seeking public funding. The agency should do so.

Hydrogen hubs will not be rational, practical investments of taxpayer money if they:

- Prolong or expand the use of fuels that cause greenhouse gas pollution;

- Create significant public safety risks; or

- Result in higher energy costs for the public and industry in comparison with renewable energy or fail to compete successfully in the energy market.

DOE appears to assume 50% to 80% of new hydrogen will be methane-based. It must consider the greenhouse gases released by such hydrogen production.

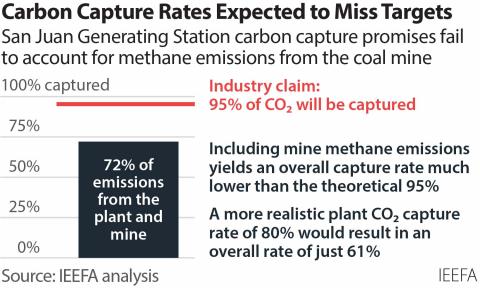

Hydrogen typically is derived in one of two ways. The first, often called “green hydrogen,” involves splitting water molecules to produce hydrogen and oxygen through electrolysis. The second, often called “gray hydrogen,” is achieved by reforming methane (the main component of natural gas) through a chemical reaction process that produces hydrogen but also releases carbon. Methane-derived hydrogen, if coupled with some level of carbon capture and storage (CCS) equipment, is often called “blue hydrogen.”

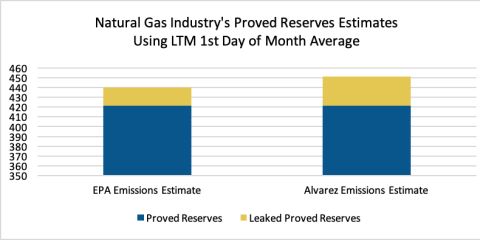

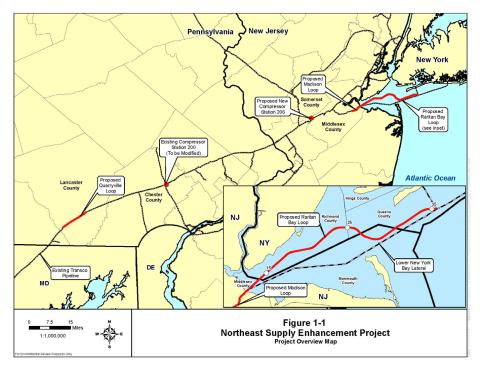

IEEFA is concerned that sinking federal dollars into large hubs to produce hydrogen from methane would be putting the cart before the horse. CCS technology has not met its claimed capture goals consistently at commercial scale. Also, fugitive emissions of methane from wells, pipelines and other points in the system and leakage of carbon dioxide from pipelines and storage facilities during the life of a project must be considered. Methane is at least 84 times more powerful as a greenhouse gas than carbon dioxide over a 20-year period.

Given the greenhouse gas effects of methane, the DOE should be skeptical of investing federal funds in H2Hub projects using methane. The agency’s plan for boosting hydrogen, however, appears to do the opposite.

A recent DOE publication, Pathways to Commercial Liftoff, reports that if various challenges to green hydrogen expansion are not met, it expects methane-based hydrogen with CCS will dominate hydrogen production. This means methane-based hydrogen would be likely to make “up to 80% of hydrogen produced in 2050 versus 50% in a high-renewables scenario.” Whether methane-based hydrogen makes up 50% or 80% of the future hydrogen market, boosting such technology guarantees continued drilling and transport of natural gas, with all the risks of methane and carbon dioxide leakage.

The DOE should disclose the percentage of federal funds it plans to invest in methane-based hydrogen, as opposed to green hydrogen.

DOE must evaluate the public safety risks of hydrogen transport and end uses

In setting forth the criteria for selection of regional clean hydrogen hub projects for funding, the infrastructure law states at 42 USC § 16161a(c)(3)(F):

“ADDITIONAL CRITERIA.—The Secretary may take into consideration other criteria that, in the judgment of the Secretary, are necessary or appropriate to carry out this title.”

One of those additional criteria should be public safety.

Hydrogen can present significant issues when transported to power plants, or to homes and buildings for heating and cooking. A 2022 General Electric report on hydrogen use in power generation raised safety issues that also apply to home settings. GE noted that hydrogen has a flame speed that is an order of magnitude faster than methane and higher than most common hydrocarbon fuels. It also noted that hydrogen’s upper explosion limit is 75% compared to methane at 15%. The GE report cautioned that “hydrogen leaks could create increased safety risks requiring changes to plant procedures, safety/exclusions zones, etc.”

The GE report warned that hydrogen can cause steel alloys to become brittle. It also noted that hydrogen molecules are so small they can leak from seals that are presumed to be airtight against other gases. A 2021 Congressional Research Service review of scientific literature found that hydrogen also can leak through polymer materials typically used in natural gas pipeline infrastructure four to five times faster than methane.

Transport of hydrogen presents safety considerations, as well. The DOE’s Pathway report acknowledges that when hydrogen production and hydrogen end use are not located in the same place, liquid or gas hydrogen will have to be distributed by trucks, likely raising community concerns.

DOE should reject propping up end uses for non-competitive hydrogen

The DOE should not artificially boost uses for hydrogen that are not practical. Funding a project that cannot compete in the marketplace after the initial subsidized capital investment and expiration of tax credits authorized under the Inflation Reduction Act will be a waste of public money. Ample evidence exists that using hydrogen in home heating, for example, will not be cost-competitive. Four of the encouraged applications include direct use of hydrogen in residential and commercial heating—a use that also raises safety issues.

Infrastructure challenges can weaken project competitiveness. In the concept stage of the application process now underway, the DOE reviewed preliminary project descriptions and selected projects to encourage or discourage. A recent review by Resources for the Future found most of the DOE-encouraged applicants included some transportation end uses. The DOE’s Pathway report observes that heavy-duty truck use of fuel cell technology “will be highly depending on the build-out of refueling infrastructure, advancements in fuel cell vehicle technology, certainty of hydrogen supply, and the cost of alternatives.” It observes: “On the financing side, perceived credit risk will be high for hydrogen projects while these challenges remain unresolved, delaying timelines for low-cost capital providers to enter the market.” Hard questions need to be asked before public dollars are sunk into such projects.

Of the encouraged applications, 15 would use hydrogen in power generation, which raises a variety of practical questions. The 2022 General Electric report, although expressing support for hydrogen blending, nevertheless warned about infrastructure renovations that would be needed for such use, including increased gas compression, protection of pipes so they don’t become brittle, and other measures that would affect costs.

The DOE should develop a prudent policy against funding hydrogen projects—especially methane-based projects—for end uses that can be met more cost-effectively by renewable energy.

Conclusion

The DOE must base its investment decisions regarding regional clean hydrogen hubs on whether the production methods and end uses for the hydrogen are safe, protect the environment, and are economically competitive. Despite its instructions about diversity of production methods and end uses, the infrastructure law gives the DOE discretion to determine whether any method or use is practicable, and to adopt additional criteria for its decisions. Failure to exercise this discretion diligently could result in a substantial waste of taxpayer dollars.