IEEFA Report: Winners and Losers Among Big Utilities as Renewables Disrupt Markets Across Asia, Europe, the U.S., and Africa

Oct. 4, 2017 (IEEFA) — The Institute for Energy Economics and Financial Analysis (IEEFA) published a report today that describes how the rise of renewable energy is disrupting electricity markets worldwide.

The report, “Global Electricity Utilities in Transition: Leaders and Laggards: 11 Case Studies,” documents a pace of change in Asia, Europe, the Americas and Africa that has surprised almost everyone, driven by technological advances and declining costs in wind- and solar-power generation.

The combined loss in market capitalization of the underperforming utilities covered in the report from 2007-2016 totaled US$185 billion.

“From Europe to Asia to the Americas and Africa, wholesale electricity prices are being pushed down by the rise of renewable generation,” said Tim Buckley, lead author of the report and IEEFA’s director of energy finance studies, Australasia.

“From Europe to Asia to the Americas and Africa, wholesale electricity prices are being pushed down by the rise of renewable generation,” said Tim Buckley, lead author of the report and IEEFA’s director of energy finance studies, Australasia.

“Developers of renewables can now consistently outbid fossil fuel-based generation, in no small part because renewable generation has no fuel costs.

“Crucially, renewables need only capture a relatively small market share for market disruption to occur, and for it to continue.

While it may take decades yet for renewables to become the dominant form of generation globally, their presence today is permanent and their advance inevitable,” Buckley said.

“Electricity utilities still considering how and when to embrace the global shift toward renewables would do well to accelerate their transition if they are to avoid the financial damage typically incurred in stranded-asset write-downs of late movers,” the report concludes.

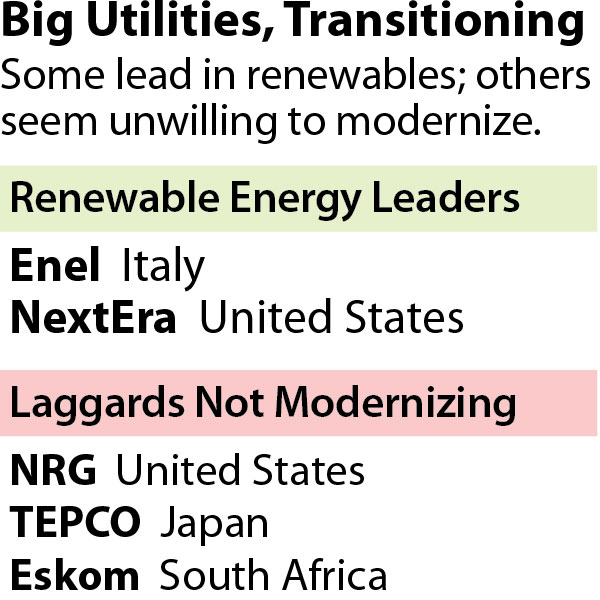

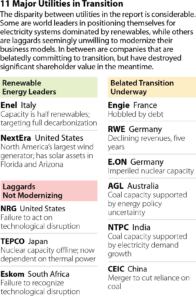

The report divides the 11 major utilities into three groups: breakaway renewable energy leaders; middle-of-the pack utilities with belated renewable energy transitions underway; laggards that are failing to adequately modernize.

Additional highlights from the report:

- Across Europe, lower wholesale electricity prices have created significant disruption and have shown how late-arriving major utilities are at risk of ongoing financial loss by not seizing the renewable-energy mantle quickly enough.

- In the United States, the renewable-energy leader NextEra sees renewables as a means to create sustained shareholder value add while keeping providing power at low prices.

- In China, CEIC – the merged China Shenhua and China Guodian – stands to create the world’s largest power company by installed capacity (225 gigawatts, or GW).

- In South Africa, where electricity prices have quadrupled since 2007 and an expensive coal-fired power build-out threatens to drive prices even higher, renewables appear ever more appealing, but also disruptive.

- In India, which passed a milestone in 2017 when solar tariffs came in lower than the cost of power generated from existing coal-fired capacity of the main national utility, NTPC.

- In Australia, sky-high electricity prices have become a major political issue driven by uncertainty on energy policy and a resulting delay in renewable-energy rollout.

Read the full report here: “Global Electricity Utilities in Transition: Leaders and Laggards: 11 Case Studies”

Media contacts:

Australia/Asia: Brami Jegan – [email protected] +61 448 276 945

Europe: Joseph Zacune [email protected] +47 93077925

U.S: Karl Cates, [email protected] +1 917-439-8225

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment.

###