IEEFA Report: China Set to Dominate U.S. in Global Renewables Boom; $32 Billion in Overseas Investments in 2016 Alone

Jan 6, 2017 (IEEFA.org) – China will likely expand its dominance of the booming global renewable- and clean-energy industries as new American energy policies come into play, concludes a report published today by the Institute for Energy Economics and Financial Analysis (IEEFA).

“The change in leadership in the U.S. is likely to widen China’s global leadership in industries of the future, building China’s dominance in these sectors in terms of technology, investment, manufacturing and employment,” states the report, “China’s Global Renewable Energy Expansion: How the World’s Second-Biggest Economy Is Positioned to Lead the World in Clean-Power Investment.”

Tim Buckley, lead author of the report and IEEFA’s director of energy finance studies, said the U.S. will very likely become less competitive economically if the Trump administration is able to deliver on its intentions to slow a global energy transition that is gaining momentum.

“The U.S. is already slipping well behind China in the race to secure a larger share of the booming clean energy market. With the incoming administration talking up coal and gas, prospective domestic policy changes don’t bode well,” Buckley said. “If the U.S. is serious about stimulating manufacturing-based growth, clean energy isn’t a sector to turn away from.”

The report details how China made a record $32 billion in overseas investment deals in 2016 alone, marking a 60 percent year-on-year rise in spending.

The report also includes 30 case studies of Chinese companies that are expanding their renewable and clean energy footprints domestically and internationally. It notes the country’s ambitious “pan-Asia” approach across the sector and its growing presence in Africa, Europe, the Middle East, North America and South America. The report puts Chinese global investment in clean energy annually at more than $100 billion, more than twice what the U.S. is investing.

“China understands that renewables present a huge business opportunity,” Buckley said. “Building on the staggering scale of its domestic growth in low-emissions energy, China is accelerating its commercial expansion overseas. As the U.S. owned the advent of the gas age, so China is shaping up to be unrivaled in clean power leadership today. In years to come, the U.S. may look back in regret.”

Excerpts from the report:

- “China’s impressive drive into renewable energy (RE) has made it the world’s largest investor in clean energy with US$102.9bn invested in renewables (excluding large hydro) in 2015, up 17% over 2014. This represents well over one third of global investment, with the U.S. in second place, but well behind, at US$44.1bn.1 Most of this Chinese investment has been domestic, but Chinese companies and institutions are increasingly looking overseas for opportunities in renewable energy development.”

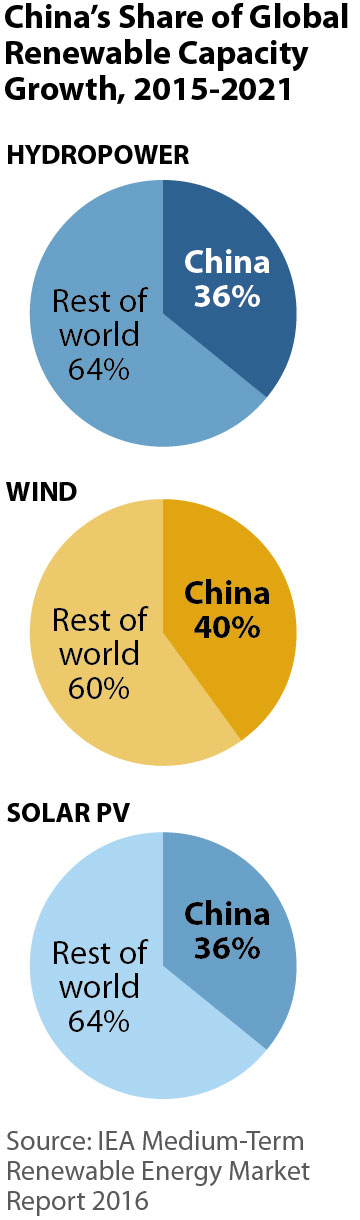

- “China will install 36% of all global hydro electricity generation capacity from 2015-2021. Similarly, China will install 40% of all worldwide wind energy and 36% of all solar in this same period.”

- “Five of the world’s six largest solar-module manufacturing firms in 2016 are in China.”

- “On the wind front, Goldwind, a Chinese company, overtook Vestas in 2015 to become the largest wind-turbine manufacturer globally. Counting its more domestic-focussed companies, which included United Power, Ming Yang, Envision and CSIC, China owns five of the ten top wind-turbine manufacturing firms.”

- “China’s Tianqi Lithium is the largest lithium ion manufacturer globally following its acquisition of Talison Lithium in 2012 and Galaxy’s Jiangsu processing facility in 2015.”

- “Chinese leadership and control of the global lithium sector is developing along the lines of the rare-element mining and processing sector, which is now 90% and 72% controlled respectively by Chinese enterprises.”

- “State Grid Corp of China (SGCC) is the world’s largest electricity utility, employing over 1.9 million staff and generating annual sales of US$330bn.”

- “In a series of government development policies for ‘Going Global’ that include ‘One Belt, One Road,’ the ‘Silk Road Fund,’ the ‘China-Pakistan Economic Corridor,’ and the ‘Bangladesh-China-India-Myanmar (BCIM) Economic Corridor,’ international renewable energy investment has become a key focus for China.”

- “China holds 3.5 million of the 8.1 million renewable energy jobs globally. This compares to 769,000 jobs dependent on renewables in the U.S.”

Media contacts:

U.S.— Karl Cates, [email protected], 917.439.8225

Australia — James Lorenz [email protected] +61 400.376.021

About IEEFA: The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.