Research hub

IEEFA produces objective, evidence-based research on financial markets and the acceleration of the global energy transition.

Toggle Filters

Filters

Integrated System Plan needs greater ambition on DER to be a true whole-of-system plan

Briefing Note

African LNG projects threatened by a global wave of new capacity

Analysis

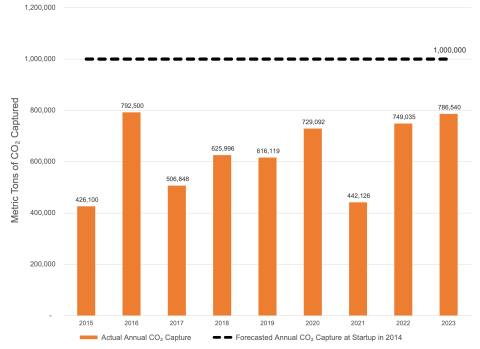

Carbon Capture at Boundary Dam 3 still an underperforming failure

Analysis

Japanese corporates and government policies prioritize global LNG influence over Asia’s energy transition

Analysis

Italy’s excessive gas-fired power reliance slows renewables buildout

Analysis

South Korea needs to address its vicious cycle of power trilemma

Analysis

BHP: As the steel technology transition accelerates, met coal’s biggest exporter wants to get even bigger

Analysis

European banks’ prudential transition plans must support climate neutrality goals

Testimony | Submission

Global LNG Outlook 2024-2028

Report

Why Victoria’s ban on networks offering gas appliance rebates is a win for energy consumers

Insights

Appliance standards are key to driving the transition to efficient electric homes

Briefing Note

Indian States' Electricity Transition (SET): 2024

Report

Revised tariffs make clean energy compelling for Bangladesh

Insights

Carbon Capture for Steel Fact Sheet

Fact Sheet

No shortage of solutions to gas supply gap

Report