Latest Powder River Basin Coal Research

See more >IEEFA: Institutional investors have a major role to play in carbon emissions reduction

June 15, 2021

Tom Sanzillo

Analysis

IEEFA U.S.: Decline in coal exports adds to Navajo-owned company’s problems

November 24, 2020

Clark Williams-Derry

Analysis

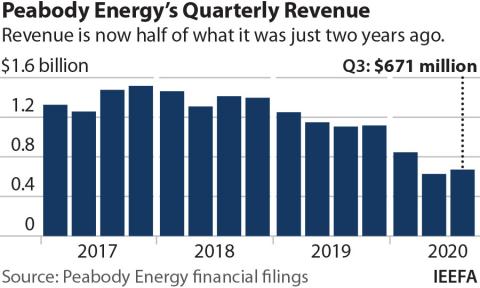

IEEFA update: Peabody Energy flirts with bankruptcy—again

November 12, 2020

Clark Williams-Derry, Seth Feaster

Analysis

IEEFA U.S.: Bankruptcy of Oakland project marks a bellwether moment for U.S. coal export ambitions

November 11, 2020

Brent Israelsen, Karl Cates

Analysis

IEEFA U.S.: Idaho Power IRP should be required reading for Wyoming regulators, politicians

November 04, 2020

Dennis Wamsted

Analysis

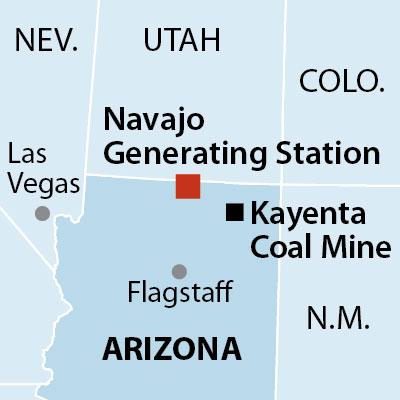

IEEFA U.S.: As utility company exits Four Corners Power Plant, NTEC seeks to keep it open

October 22, 2020

Seth Feaster, Karl Cates

Analysis

IEEFA op-ed: Glenrock’s CO2 capture facility hopes are based on wishful thinking

August 26, 2020

Dennis Wamsted, David Schlissel

Analysis

IEEFA U.S.: PNM stance on Four Corners spells danger for NTEC

April 03, 2020

Seth Feaster

Analysis

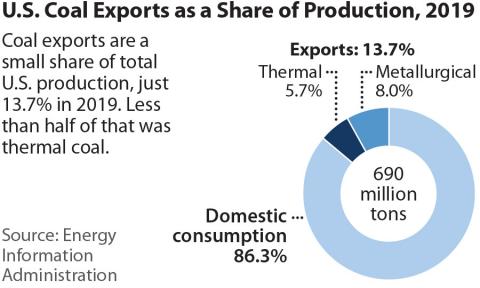

IEEFA U.S.: Why exports won’t save American coal

February 28, 2020

Seth Feaster, Karl Cates

Analysis

IEEFA U.S.: Navajo-owned energy company is in trouble

January 31, 2020

Karl Cates, Seth Feaster

Analysis

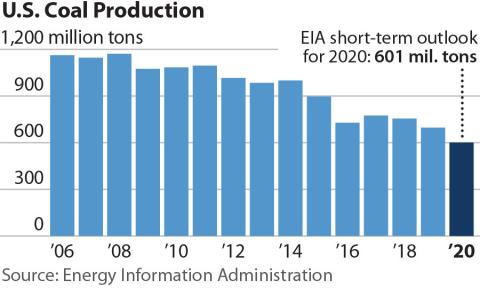

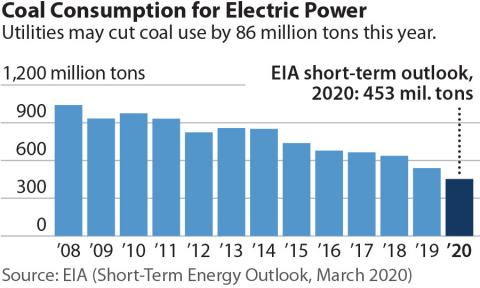

IEEFA U.S.: The coal rebound that didn’t happen

January 07, 2020

Seth Feaster, Clark Williams-Derry

Analysis

IEEFA update: Navajo Nation’s refusal to support NTEC is an act of sovereign responsibility

November 13, 2019

Karl Cates, Seth Feaster, Clark Williams-Derry...

Analysis

Latest Powder River Basin Coal Reports

See more >

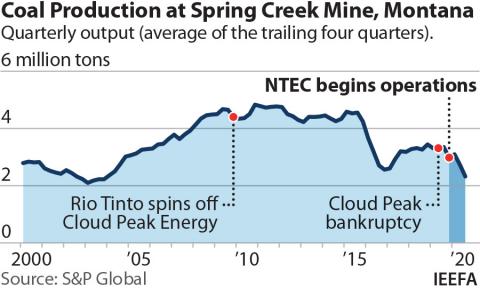

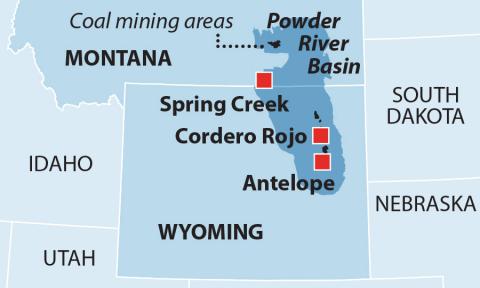

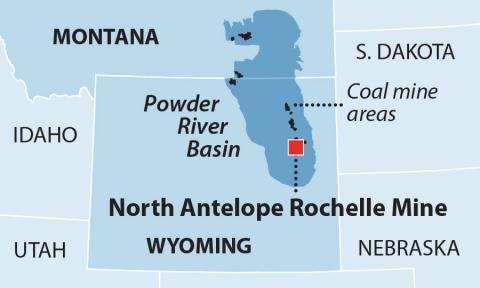

In Powder River Basin debut, NTEC stumbles

October 01, 2019

Karl Cates, Clark Williams-Derry, Seth Feaster...

Report

NTEC Move to Buy Cloud Peak Mines Is an Increasingly Questionable Wager

September 01, 2019

Seth Feaster, Karl Cates

Report

Bill to spark federal post-coal reinvestment in Arizona tribal communities is a good beginning

September 01, 2019

Karl Cates, Tony Skrelunas

Report

13 questions on NTEC's bid to buy Powder River Basin coal mines from bankrupt Cloud Peak

August 01, 2019

Karl Cates, Seth Feaster, David Schlissel...

Report

Proposed Navajo acquisition of bankrupt U.S. Coal company is an ill-timed gamble

August 01, 2019

Karl Cates, Seth Feaster, Dennis Wamsted...

Report

Powder River Basin coal industry is in long-term decline

March 01, 2019

Seth Feaster, Karl Cates

Report

A blow-by-blow of the U.S. coal phase-out

April 01, 2017

Seth Feaster

Report

2017 U.S. coal outlook

January 01, 2017

Tom Sanzillo, David Schlissel

Report

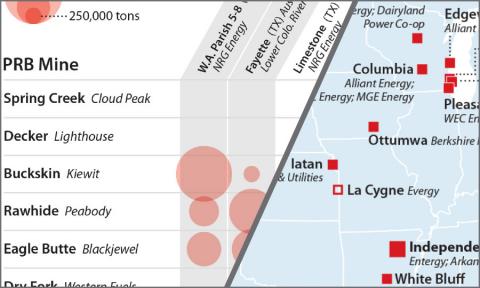

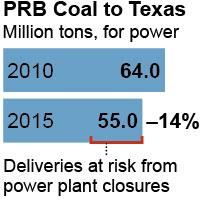

Texas' outsize role in the decline of the Powder River Basin coal industry

August 01, 2016

Tom Sanzillo

Report

Peabody's Strategies for Survival Ignore Market Realities and Risk Backfiring

February 01, 2016

Tom Sanzillo, Tim Buckley, Clark Williams-Derry...

Report

A bleak future for Colstrip Units 1 and 2

June 01, 2015

David Schlissel, Cathy Kunkel

Report

20 fourth-quarter questions for Powder River Basin coal producers

November 01, 2014

Tom Sanzillo

Report

Latest Powder River Basin Coal Press Releases

See more >

IEEFA U.S.: Peabody’s $1.42 billion write-down concedes coal mines have little value and dim future

August 06, 2020

Press Release

IEEFA Coal Outlook 2020: Market trends are pushing U.S. industry to a reckoning

March 30, 2020

Press Release

IEEFA report: Navajo company’s foray into Powder River Basin coal is off to a troubled start

October 25, 2019

Press Release

IEEFA U.S.: Bill to incentivize federal reinvestment in tribal regions of Arizona suggests a model for coalfield communities nationally

September 19, 2019

Press Release

IEEFA update: Business case weakens for Navajo Transitional Energy Company (NTEC) bid to purchase Montana-Wyoming coal mines

September 05, 2019

Press Release

IEEFA U.S.: 13 questions on Navajo Transitional Energy Company’s proposed acquisition of bankrupt Cloud Peak’s Montana and Wyoming mines

August 30, 2019

Press Release

IEEFA: Proposed Navajo acquisition of bankrupt U.S. coal company is an ill-timed gamble

August 23, 2019

Press Release

IEEFA report: Powder River Basin coal industry is in long-term decline

March 18, 2019

Press Release

As Texas Coal-Fired Power Plants Close, Powder River Basin Mines Are Losing Their Largest Customers

August 02, 2016

Press Release

IEEFA Analysis of Colstrip 1 and 2 Finds Outlook for Two Coal-Fired Electricity Plants in Montana Worse Than Previously Known

March 04, 2016

Press Release

Divestiture Movement, Deepening Distress of Coal Industry, Emerging Battles Over Solar, Overbuilding of Shale Gas Pipelines Highlight IEEFA Energy Finance 2016 Conference in New York City

February 29, 2016

Press Release

Coal-Lease Reform: ‘Obama Is Doing for the Coal Industry What It Cannot Do for Itself’

January 14, 2016

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.