Press Releases

Toggle Filters

Filters

AEMO needs greater ambition on DER for a true whole-of-system ISP

Press Release

IEEFA: Tidal wave of new LNG supply to flood market amid demand uncertainty

Press Release

Karnataka, Gujarat continue to exhibit strong progress towards clean electricity transition

Press Release

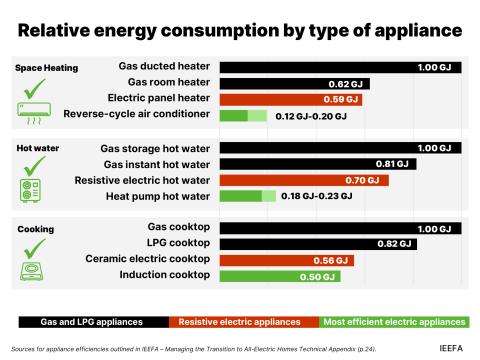

Appliance standards delays costing Australians $3.4bn a year

Press Release

Solutions to energy security issues lie much closer to home than costly gas imports

Press Release

Victoria’s ban on networks offering gas appliance rebates is a win for customers

Press Release

CCUS will not play a major role in steel decarbonisation

Press Release

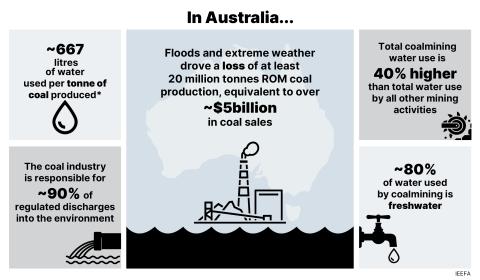

Coal industry’s thirst raises water risks for investors, communities and environment

Press Release

Early action needed to enable a just transition in Indian coal-producing states

Press Release

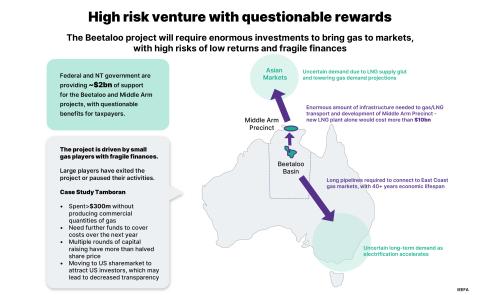

Beetaloo a $10bn pipe dream for minor gas producers as big players desert Basin

Press Release

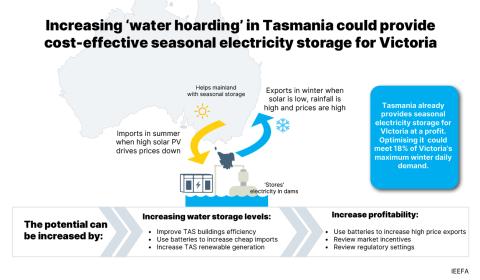

Optimising Tasmania’s ‘Battery of the Nation’ plan

Press Release

South Korea’s misplaced faith in a fossil fuel-oriented power mix cost an additional $17bn in a year

Press Release

Credit rating agency evolution on climate change risk and fossil fuel financial viability

Press Release

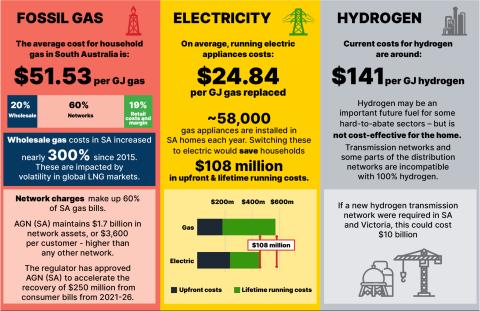

Getting off gas and going all electric could slash rising energy bills for SA homes

Press Release

IEEFA depone en vista sobre el Plan de Ajuste de la Deuda AEE

Press Release

IEEFA testifies at Puerto Rico PREPA debt restructuring hearing

Press Release

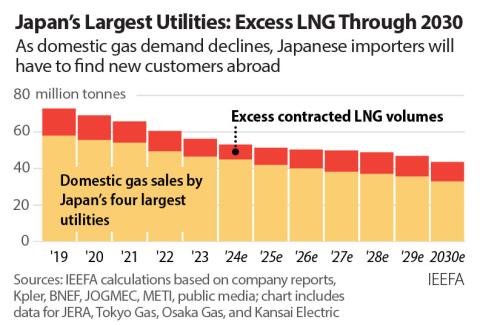

Japan’s declining gas demand will leave utilities with persistent LNG oversupply through 2030

Press Release

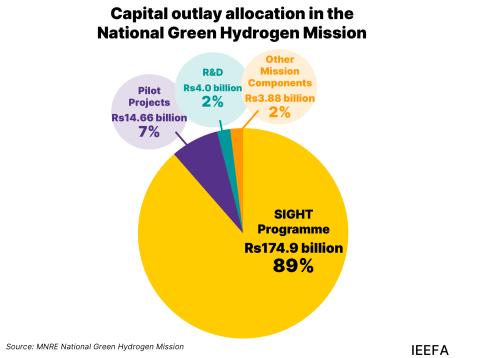

India’s $2.1bn push for local electrolyser manufacturing and green hydrogen production sees strong interest from large companies

Press Release