Japan’s declining gas demand will leave utilities with persistent LNG oversupply through 2030

Japan’s LNG buyers are cultivating demand in emerging Asia to offload surplus LNG volumes

Once the largest global importer of liquefied natural gas (LNG), Japan’s demand for the fuel has fallen rapidly in recent years. As a result, the country’s gas and power utilities face a surplus of LNG purchase commitments and are increasingly focused on marketing and selling the fuel abroad, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

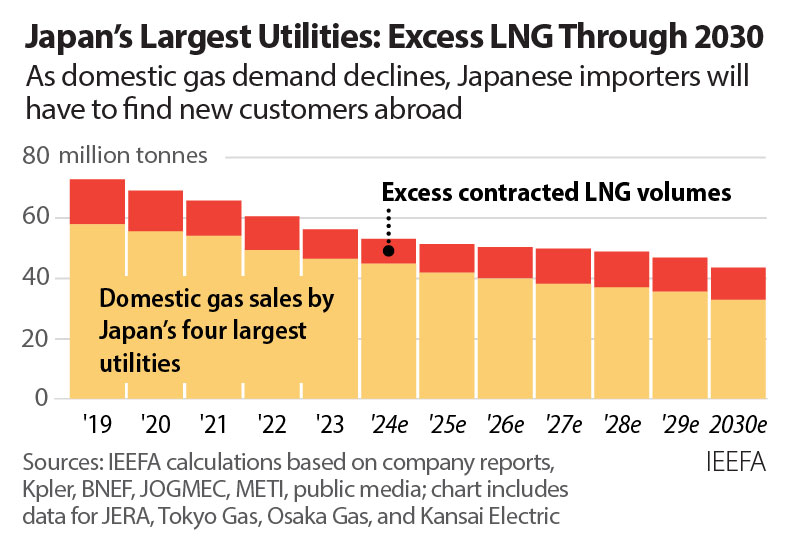

The report finds that Japan’s largest utilities — including JERA, Tokyo Gas, Osaka Gas, and Kansai Electric — are likely to face an over-contracted position of roughly 11 million tonnes per annum (mtpa) for the remainder of the decade.

Due to limited growth opportunities in Japan’s domestic gas market, these utilities are cultivating LNG demand abroad by investing in midstream and downstream gas infrastructure, such as regasification terminals and LNG-fired power plants, particularly in South and Southeast Asia. Government policies have also encouraged Japanese companies to transact higher LNG volumes with emerging markets.

“The importance of Japan’s shift into LNG resales and marketing should not be underestimated,” says Sam Reynolds, the report’s co-author and LNG research lead at IEEFA. “Rather than absorbing more volumes from the global market, Japanese companies may increasingly find themselves in direct competition with global suppliers for potential customers in emerging markets.”

Based on figures from the Japan Oil, Gas and Metals National Corporation (JOGMEC), LNG sales by Japanese companies to third countries surged from 14.97 million tonnes (mt) in FY2018 to over 38 mt in FY2021. Although domestic sales have declined, the total volume of LNG transacted by Japanese companies increased over the same timeframe.

Japan’s domestic LNG demand is falling due to rising generation from nuclear and renewables, long-term energy and climate targets, and demographic shifts. Meanwhile, the country’s incumbent utilities have lost significant market share since 2017 due to the introduction of retail competition in gas and power sectors.

Government climate and energy plans expect LNG-fired power generation to more than halve by 2030. As a result, IEEFA estimates that Japan’s LNG demand could fall between 25.7 and 31.6 mtpa — or roughly one-third of 2019 levels — if electricity generation targets are achieved. LNG imports have already fallen 22 mtpa since 2014.

“As domestic demand falls faster than LNG purchase commitments, Japanese utilities will face an important choice,” says report co-author Christopher Doleman, an IEEFA LNG specialist. “Either they can resell flexible cargoes abroad or exercise contractual volume flexibilities and cancellation rights, which may incur additional costs.”

Japan’s Ministry of Economy, Trade and Industry (METI) has set a target for companies to transact 100 mtpa of LNG by 2030. This is well above the 79 mtpa that buyers have currently contracted, but in line with recent transaction volumes. Meanwhile, Japan’s Asia Zero Emission Community (AZEC) initiative aims to replicate its energy mix across Asia.

These policies, as well as the corporate strategies of major utilities, suggest Japanese companies will continue to play a major role in LNG transactions, despite declining domestic demand. For example, JERA executives have expressed a desire to turn the company into a major global LNG portfolio player. At the same time, Tokyo Gas has said that the ultimate target is to form a Southeast Asia LNG value chain.

“This has major implications for global LNG exporters and the industry,” says Reynolds. “LNG exporters continue to justify new liquefaction investments under the false impression that Japan will continue to buy more volumes. The opposite is true: Japanese buyers may increasingly compete for potential customers in prospective markets.”

“An increase in LNG sales by Japanese utilities is likely to coincide with a flood of new supply capacity entering the market in the middle of the decade,” says Doleman. “As demand from Japan and other key markets falls, prices are widely expected to fall. LNG marketers, including Japanese utilities, could see margins on LNG resales collapse.”

Moreover, Japanese LNG marketers could face a unique set of challenges amidst a looming global glut. Most of Japan’s purchase commitments contain pricing formulas indexed to oil benchmarks, often at relatively steep rates that may be out of the money compared to falling spot prices. During past periods of global LNG oversupply, some Japanese utilities have lost money on reselling LNG abroad, demonstrating the financial risk involved with LNG trading.

“Ultimately, Japan’s shift into LNG trading could exacerbate a looming global glut of LNG,” says Doleman.

Read the report: Japan’s largest LNG buyers have a surplus problem

The fact sheet of this report is available here.

Author contacts:

Sam Reynolds ([email protected])

Christopher Doleman ([email protected])

Media contact:

Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)