Key Takeaways:

With a Budget geared towards renewable energy, why is the Federal Government pushing new gas developments?

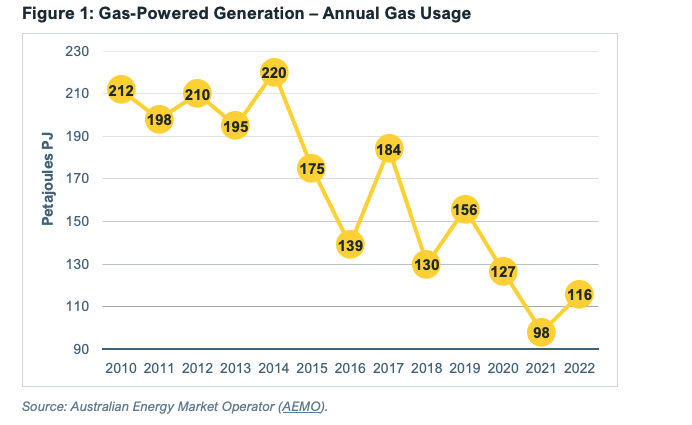

Gas usage for electricity generation has almost halved in recent years dropping 47% from 2012 – 2022 and is expected to drop a further 34% to 2030.

The amount of gas we will need for electricity generation by 2030 is very small, at just 4% of forecast production on the east coast of Australia.

Gas usage in the power industry has collapsed and further drops are expected.

11 May 2023 (IEEFA Australia): A new report by the Institute of Economics and Energy Financial Analysis (IEEFA) shows that Australia has been transitioning away from gas for power generation since 2014. Gas usage for power generation has fallen 47% from 2014-2022.

The amount of gas we will need for electricity generation by 2030 is very small, at just 4% of forecast production on the east coast of Australia.

In stark contrast, renewables are up from 14% in 2014 to 35% in 2022, and the government has clear ambitions to increase renewables to 82% by 2030.

Bruce Robertson, IEEFA’s lead gas analyst, says, “The fact is the renewables’ share of generation has gone up two-and-a-half times while gas usage for gas-fired generation in the National Electricity Market has nearly halved. We have a renewables-rich grid, and our study has demonstrated that the amount of gas needed in the energy transition is small and continues to shrink.

“Just because the gas industry continues to say we need more gas to transition, and just because the Prime Minister repeats it, doesn’t make it true. APPEA is intentionally conflating an increase in gas-peaking capacity with an increase in gas demand from electricity generation.”

Mr Robertson says gas demand for electricity generation has and will continue to fall for two basic reasons:

- Gas baseload plants are closing. The fuel is too expensive in Australia to use for baseload generation. Because they are in operation most of the time, they use a lot of gas.

- Gas-peaking plants simply don’t operate very often. Typically, gas-peaking plants will operate for 4-14% of the year.

High gas-consuming gas baseload plants are shutting, and some heavily government subsidised gas-peaking plants are opening that will not consume much gas. We might need some gas-peaking capacity, but it will not operate very often leading to low gas consumption.

Grid-scale batteries pose a major threat to gas-peaking plants. They are increasing in number and size.. AGL has completed a big battery project at Torrens Island in South Australia, and has even bigger batteries planned. Origin Energy plans a 700MW battery for its Eraring site, where it intends to close its coal-fired power plant in 2025.

Batteries have totally different economics to gas plants. They have high up-front capital costs but very low operating costs. Because of this, they will operate every day, filling at the cheap prices of the day and typically selling into the evening peak periods. Their economics rely on the difference between the price they buy electricity and the price they sell electricity.

“This is unlike a gas peaking plant that can only operate at very high electricity prices as they struggle to compete in Australia with the very high domestic gas prices,” Mr Robertson says. “The current investment in increasing scale and number of grid-scale batteries will crimp demand for gas. Technological advances in batteries could spell the demise of gas much faster than any current forecasts for the industry.

“The gas industry does not have a supply problem. It has a demand problem and gas is a fuel transitioning out of the energy system.”

Read the report: Gas' Role in the Transition

Media contact: Amy Leiper [email protected] 0414 643 446

Author contacts: Bruce Robertson [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)