Repurposing India’s coal power plants: Sustainability-linked green bonds as a financing solution

Key Findings

India’s journey to meet climate-related goals risks being hampered by its growing energy needs and socio-political sensitivities around the early retirement of coal power plants.

Capital market-based solutions could help India repurpose technically feasible coal power plants into renewable energy plants while ensuring a just transition.

Sustainability-linked green bonds (SLGBs) could be a possible option. A lower cost of borrowing would be crucial to motivate utility companies to repurpose coal plants early.

India faces a dilemma – balancing its growing energy needs with its pledge to reduce greenhouse gas (GHG) emissions as part of its revised Nationally Determined Contributions (NDC) goals (45% lower GHG emissions compared to 2005 levels by 2030).

The early retirement of coal power plants is necessary to meet this target; however, the timing of these retirements is a point of contention amongst policymakers, plant owners, financiers and other stakeholders.

India has pushed back on the U.S. and Germany – leading the Just Energy Transition Partnership (JETP) negotiations – regarding including an early coal phase-out in the discussions. Instead, India has demanded that the JETP financing deal include renewable energy, technology transfer, and green jobs without discussing early coal retirement due to its increasing energy demands and socio-political sensitivity.

This impasse on receiving global public finance for early coal retirement and just transition leads to the question of how India can meet its emission reduction targets while meeting its rising energy demand.

A case for capital market-based solutions

In light of this, private utility players (accounting for 35% of India’s total coal capacity, around 73 gigawatts (GW)) committed to decarbonising could consider capital market-based solutions to repurpose technically feasible coal power plants into renewables while ensuring a just transition.

A study by Climate Risk Horizon estimated that the financial benefits of repurposing coal plants in Maharashtra would outweigh the cost of early retirement by 2-4 times. Furthermore, it will help the Maharashtra State Electricity Distribution Co save Rs750 billion (US$9.08 billion) over 10 years due to lower renewable energy power costs.

The cost savings will also cover 30-170% of the new capital expenditure required to repurpose the coal plants into renewable energy plants. This would be a mutually beneficial outcome for coal power producers and off-takers.

Sustainability-linked green bonds

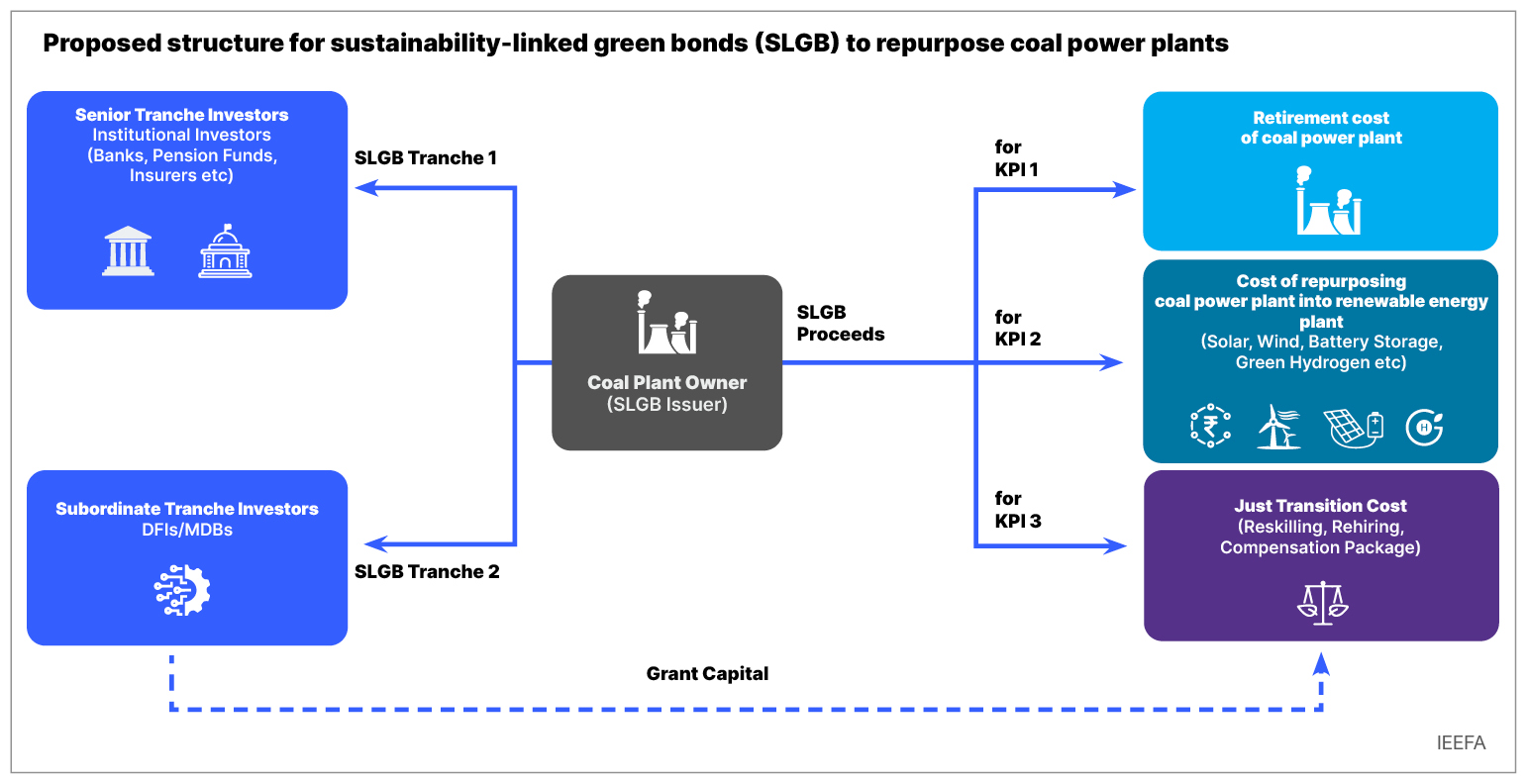

Using sustainability-linked green bonds (SLGBs) could be a possible option to finance the repurposing and just transition of coal power plants into renewable energy plants.

The proposed structure would suit private-sector coal power utilities. These companies, like Tata Power, have more latitude to retire coal plants earlier, have committed to decarbonising and have a strong balance sheet and ability to access debt capital markets. Although state-owned companies can also use this structure, they may be hesitant due to the government's plan to avoid retiring any coal plants before 2030.

SLGB structure with potential to deliver on decarbonisation and just transition

A vanilla sustainability-linked bond (SLB) is structured around key performance indicators (KPIs). These KPIs relate to the issuer's environmental, social and governance targets. Failure to meet these KPI targets usually results in monetary penalties, while reaching them can lead to lower subsequent coupon payments. The SLB market has grown globally to US$244 billion, as of 27 February 2023, since the first issuance in 2019.

However, proceeds of vanilla SLBs can end up funding non-green projects, thus raising concerns about greenwashing. Hence, we propose an SLGB structure where the KPIs and the proceeds are tied to specified projects.

Under this proposal, a coal power producer would issue an SLGB with three KPIs:

- Decommissioning coal generation capacity by an ambitious date.

- Adding renewable energy generation capacity prior to or in tandem with coal decommissioning.

- Reskilling, rehiring and compensation package ensuring a just transition from a coal to renewable energy power plant.

The issuer must also ring-fence proceeds of the SLGB to specified projects that would fulfil each KPI to ensure the transparency of the issuance and prevent the misuse of funds.

Blending SLGBs with public capital for cost-effective debt

A lower cost of borrowing would be crucial to motivate utility companies to repurpose coal plants early. The companies could achieve this through dual-tranche issuances. The senior tranche could target institutional investors, while the subordinate tranche targets Multilateral Development Banks (MDBs) and Development Finance Institutions (DFIs). The subordinate bondholders would provide capital at a concessional rate to incentivise early coal plant repurposing.

Alternatively, credit guarantees by MDBs/DFIs can lower the cost of SLGBs. Furthermore, MDBs/DFIs could offer grants to fund the re-skilling of the workforce, issuance transaction costs, and the ongoing monitoring and verification costs required for a credible SLGB.

Conclusion

The proposed SLGB structure offers a pathway for public and private debt providers to participate in India's early retirement of coal plants. The mechanism would ensure issuers utilise the funds for their intended purpose. It enhances the credibility of the transaction, incentivises coal power producers to take action sooner than later, and supports a just transition. Most importantly, this could be a way to support India in achieving its emissions reduction goals.

This commentary was first published by the World Economic Forum.