Key Findings

Local leaders are using new authority under 2016 reforms to Louisiana’s Industrial Tax Exemption Program to balance business and community interests.

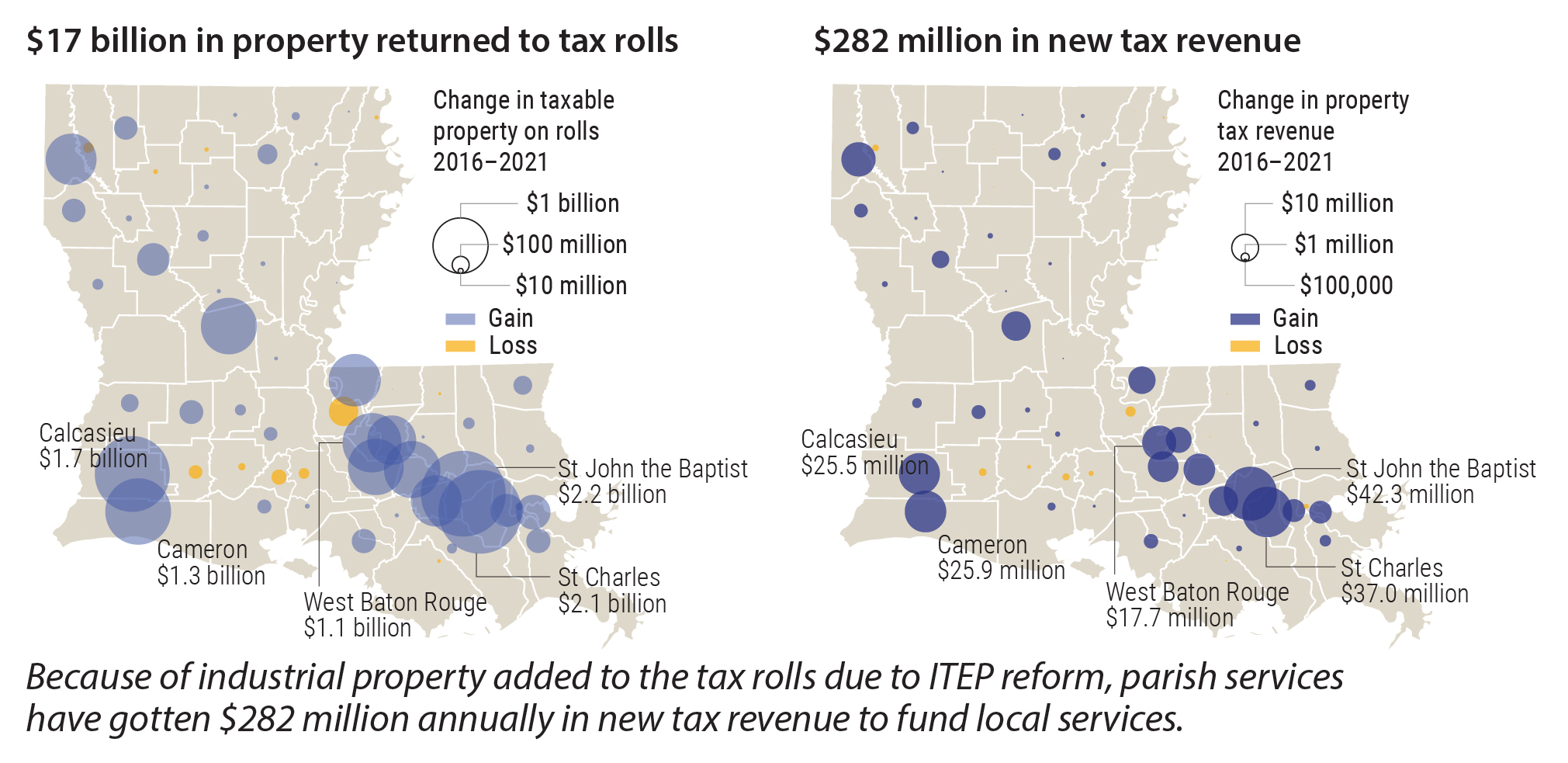

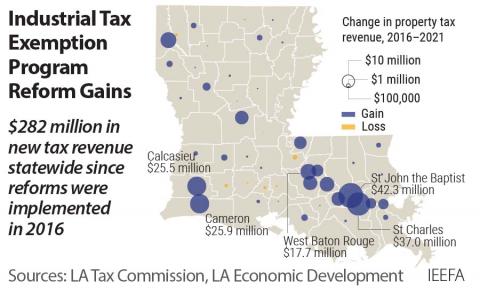

Reforms increased annual industry property tax revenue by more than $280 million between 2016 and 2021.

Annual revenues of $113 million for schools, $55 million for law enforcement, and $115 million for other parish services have been generated by the reforms.

Executive Summary

Louisiana’s Industrial Tax Exemption Program (ITEP) was long recognized as one of the most generous industrial subsidy programs of any state in the country. Before the program was reformed, applications for tax exemptions were made by a state board—with no input from the local jurisdictions whose tax revenues would be directly affected.

In 2016, Louisiana Gov. John Bel Edwards issued two executive orders to reform ITEP, based on the recognition that the program was costing local governments substantial revenue without helping the state to attract industry. The reforms reduced the total value of the possible tax exemption, introduced a job creation provision and—critically—required that applications be approved by the local government bodies whose tax revenues were affected.

IEEFA analyzed the impact of the 2016 reforms and found:

- The percentage of industrial property that was actually taxed, as opposed to exempted, increased from 37% in 2016 to 50% in 2021, averaged across parishes.

- Annual industrial property tax revenue increased by more than $280 million between 2016 and 2021. The increase was due almost entirely to the ITEP reforms.

- More than 90% of the increased revenue was concentrated in the 15 parishes with the largest manufacturing bases.

- The reforms have generated additional annual revenues of $113 million for schools, $55 million for law enforcement and $115 million for other parish services.

- The most important revenue-related aspect of the 2016 reforms has been the requirement that companies justify their applications before the local governing bodies. The reform has dramatically changed the behavior of corporations by significantly reducing the number of applications and shifting applications towards investment in new facilities, instead of additions or renovations.

- In almost every case where an ITEP application was partially or completely rejected by local governing bodies, the project still proceeded—showing that the pre-reform ITEP program was not a major factor in the location of industrial projects.

Introduction

This report analyzes the impact of reforms made to Louisiana’s Industrial Tax Exemption Program (ITEP) in 2016.

Louisiana’s ITEP has been extraordinarily generous to industry compared to other states.

From its inception in 1936 until 2016, ITEP was one of the largest state industrial subsidy programs in the nation, offering a 100% property tax exemption for as long as 10 years on capital investments by industrial manufacturers. It has been called a “perverse incentive, the nation’s most notorious property tax abatement system,” and a “$2 billion welfare plan that raises taxes and kills jobs.” In practice, ITEP resulted in a significant loss of public revenue in a manner that was not targeted either to attract new investment or create jobs:

- The Board of Commerce and Industry, which has the authority to approve the exemptions, received about 12,000 applications for exemptions from 1998-2016. It approved 99.95% of them.6

- Between 2000 and 2016, 97% of the projects that sought property tax exemptions had already been completed when their requests were filed.

- From 2000 to 2016, only 4% of the exemptions went to new projects; only 3% were given to facility expansions.

- There was no requirement that the companies receiving exemptions create jobs.

ITEP was excessively generous, in part because decisions on applications were made by a state-appointed board with the authority to grant tax breaks that resulted in lower revenues for local governments. For the most part, no evidentiary threshold was required for approval. The Board of Commerce and Industry frequently granted applications in globo, meaning that it would vote for or against (in practice, only for) all ITEP applications under consideration at a given meeting. In 2015, the board granted more than 600 ITEP exemptions during four meetings, without considering a single application individually.

The consequences of the bifurcation between decision-making authority over tax exemptions and local budgetary and political responsibility have been significant. In 2016, according to IEEFA analysis (see Appendix B):

- 63% of all industrial property across the state was tax-exempt.

- $45 billion of industrial property was off the tax rolls.

- School districts lost $327 million in tax revenues; local law enforcement lost $145 million.

Louisiana’s ITEP has been extraordinarily generous to industry compared to other states. In Texas—Louisiana’s main competitor for attracting oil and petrochemical-based manufacturing— the tax exemption program is locally controlled, includes job creation and capital expenditure thresholds for eligibility, and does not allow maintenance capital to be eligible for exemption. Louisiana Economic Development concluded in a July 2016 report that, as a result of this structure, Texas counties “remain competitive with Louisiana but forego less in local revenue.”

Louisiana Economic Development acknowledged that the ITEP program was costlier than industrial property tax exemption programs in other states before being reformed: “Louisiana’s competitor states have often been able to forego less in local revenue while remaining just as competitive.”

The 2016 ITEP reforms were a response to policy proposals developed by Together Louisiana, a statewide network of community organizations and non-profits. The changes included a reduction of the maximum exemption from 100% to 80%; creation of a weak jobs requirement; discouraged exemptions for routine capital expenditures; and most significantly, established a requirement that local entities with taxing authority approve any new exemptions.

This report assesses the impact and effectiveness of these reforms by analyzing property tax and ITEP data pre- and post-reform. It asks: To what extent have the reforms changed the percentage and amount of industrial property exempted under ITEP? To what extent have they changed property tax collections? What aspects of the reforms seem to have made the biggest difference? Have the reforms dampened potential economic investment?

The methodology for answering these questions is to identify a sample group of approximately 200 of the largest industrial manufacturers (aggregated by parish) statewide. Then, we compare a pre-reform, 2016 baseline assessment of taxable and exempt property with the figures from a post-reform, 2021 assessment.