IEEFA report: Powder River Basin coal industry is in long-term decline

March 18, 2019 (IEEFA U.S.) — Coal producers in the Powder River Basin continue to lose customers as utilities across the U.S. embrace a shift toward cleaner and cheaper forms of power generation, according to a report published today by the Institute for Energy Economics and Financial Analysis (IEEFA).

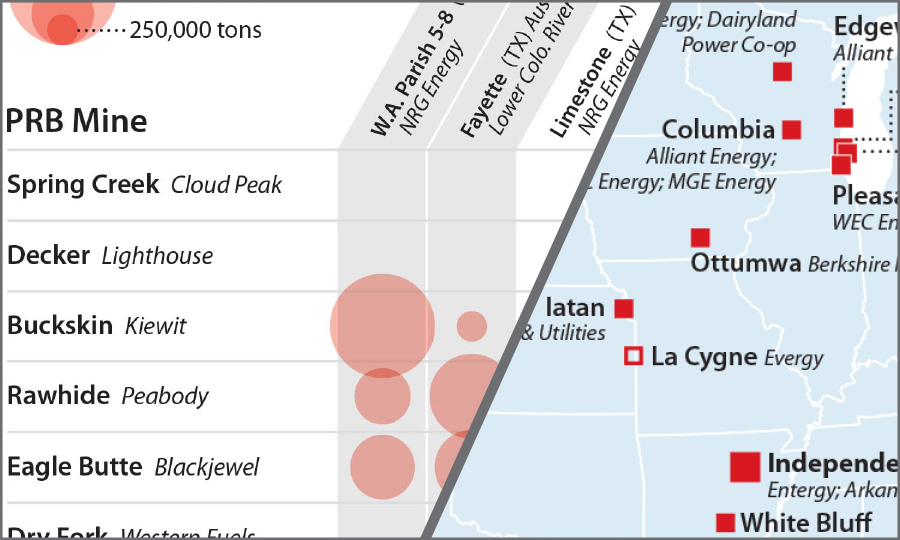

The report — Powder River Basin Coal Industry Is in Long‑Term Decline — details persistent declines in production, employment and the customer base across the basin, which has produced about 40% of the coal used in power generation nationally.

The electricity-generation sector is being reshaped by a wave of technology disruptions that have brought lower‑cost generation from natural gas and renewables, especially wind and solar, creating competition that is driving coal-fired power plants out of business.

“These disruptions have led to a sharp decline in coal consumption for power generation—the dominant market for PRB coal,” said Seth Feaster, an IEEFA data analyst and lead author of the report. “The trends are also expected to continue, pushing more coal plants into retirement.”

The report analyzes potential impacts on 16 Powder River Basin mines, and finds three emerging categories:

- The most vulnerable PRB mines, including Absaloka and Rosebud (both owned by Westmoreland Coal),

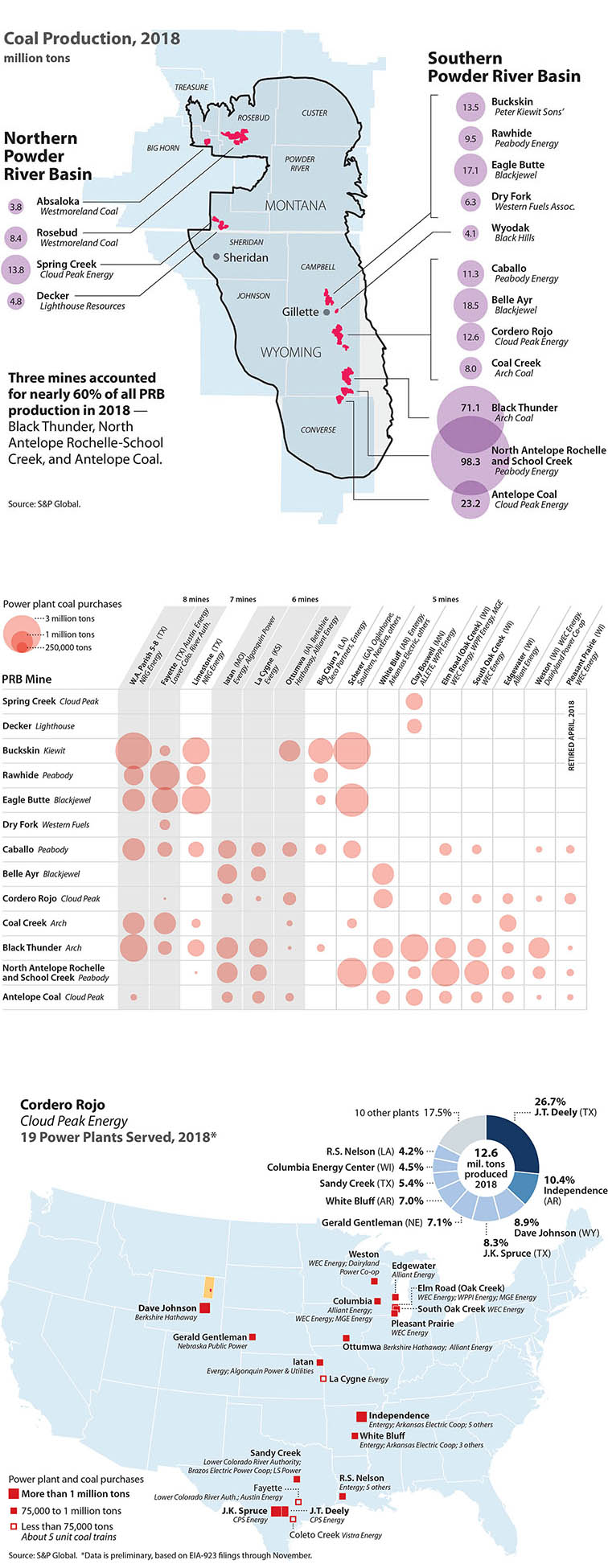

- Mines with lower-quality coal that have slightly broader customer bases, including Rawhide (Peabody Energy), Coal Creek (Arch Coal), Eagle Butte (Blackjewel), Belle Ayr (Blackjewel), Buckskin (Kiewit), and Cordero Rojo, (Cloud Peak Energy).

- Mines that are in a stronger position to survive for the longer term based on their customer profiles and (in some cases) large-company ownership, including North Antelope Rochelle‑School Creek (Peabody), Black Thunder (Arch Coal), and Antelope Coal (Cloud Peak).

Excerpts:

- No new coal plants are being built in the U.S., coal plant retirements are expected to continue, some coal-fired plants are being converted to use natural gas, and capacity factors are declining.

- Utilities are driving the shift from coal.

- Customer and corporate pressure for clean energy is also pushing the transition.

- Utilities increasingly see coal as an economically challenged proposition hobbled by aging assets further undermined by the high cost of pollution control and site clean-up.

- Coal is an increasingly shrinking part of utility companies’ generation portfolio and companies are changing their coal-purchasing behavior through short-term supply contracts and more spot purchases.

- At the macroeconomic level, a national recession would likely drive utilities to accelerate plans for coal-unit retirements, especially if power demand declines, as it did during the 2007-2009 recession and financial crisis, and in the 2001 recession.

Full report here: “Powder River Basin Coal Industry Is in Long-Term Decline: Fast-Changing Markets Indicate Deeper Downturns to Come in Montana and Wyoming”

Media Contact: Vivienne Heston, [email protected], +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.