Kentucky

Latest Kentucky Research

See more >

Kentucky bankers sue state over right to classify climate risk as financial risk

December 02, 2022

Tom Sanzillo

Analysis

IEEFA U.S.: ‘New Promise Act’ would help communities transition from coal-based economy

April 02, 2021

Tom Sanzillo, Cathy Kunkel

Analysis

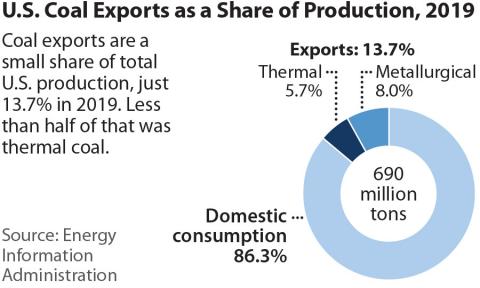

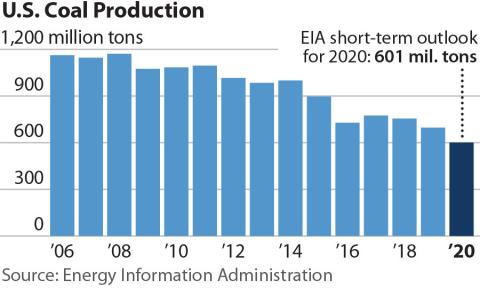

IEEFA U.S.: Why exports won’t save American coal

February 28, 2020

Seth Feaster, Karl Cates

Analysis

IEEFA U.S.: The coal rebound that didn’t happen

January 07, 2020

Seth Feaster, Clark Williams-Derry

Analysis

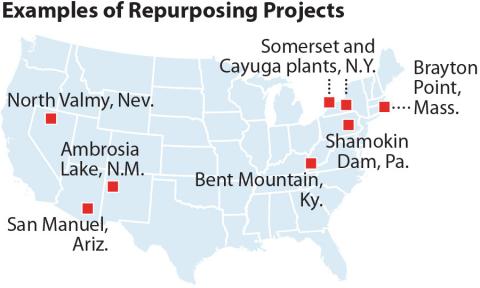

IEEFA update: Out-to-pasture coal plants are being repurposed into new economic endeavors

June 07, 2019

Karl Cates, Seth Feaster

Analysis

IEEFA U.S.: Seeds of a just coal transition policy in Colorado

May 09, 2019

Pam Eaton, Karl Cates

Analysis

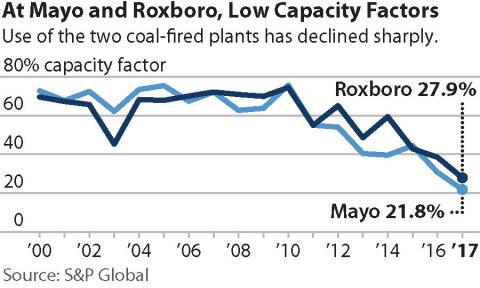

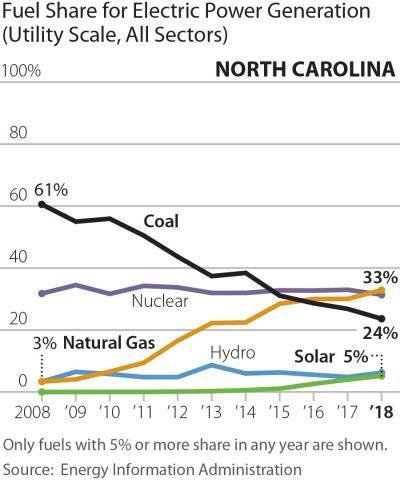

IEEFA U.S.: Two of Duke Energy’s plants in North Carolina reflect national trend in baseload slippage for coal

October 29, 2018

Dennis Wamsted

Analysis

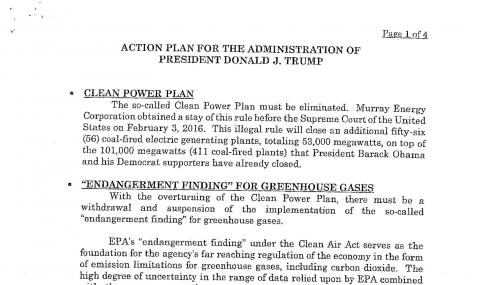

Wishing Won’t Make it So: Industry ‘Action Plan’ for Federal Policy Changes Can’t Revive Coal Mining in U.S.

January 22, 2018

Eric Schaeffer

Analysis

IEEFA Research Brief: Coal in Decline, Blow by Blow

April 21, 2017

Seth Feaster

Analysis

IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals

January 20, 2017

Tom Sanzillo, David Schlissel

Analysis

IEEFA Update: Many Hurdles Facing U.S. Coal-Fired Power Fleet

October 11, 2016

David Schlissel

Analysis

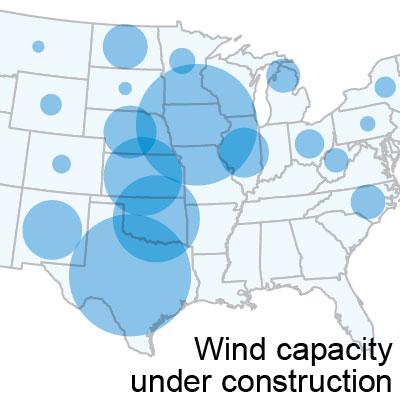

Wind in the Wires, and More on the Way

September 16, 2016

Seth Feaster

Analysis

Latest Kentucky Reports

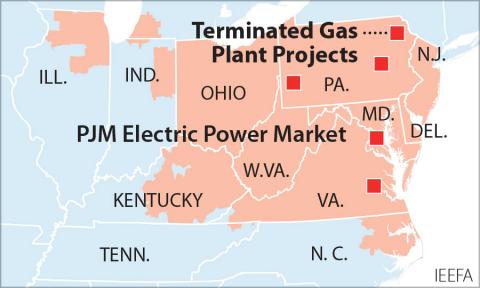

See more >Rapidly Changing Investment Climate Challenges Planned PJM Gas Plants

November 01, 2021

Dennis Wamsted

Report

Long-term power plant contracts saddle AMP communities with high electricity prices

September 21, 2020

David Schlissel

Report

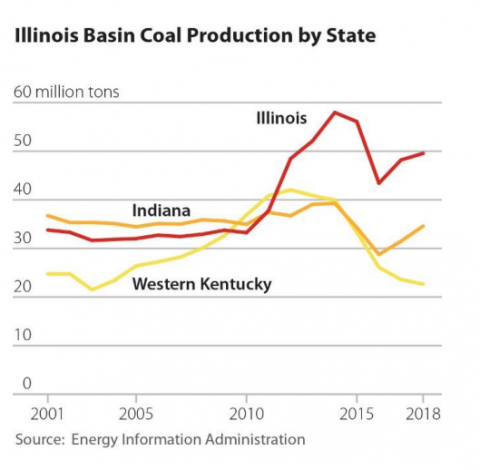

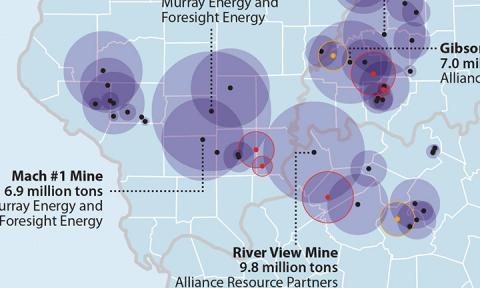

Dim future for Illinois Basin coal

December 01, 2019

Seth Feaster, Karl Cates

Report

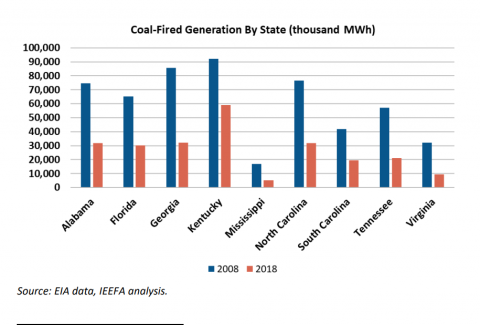

Coal-fired power generation in freefall across southeast U.S.

October 01, 2019

Dennis Wamsted, Seth Feaster

Report

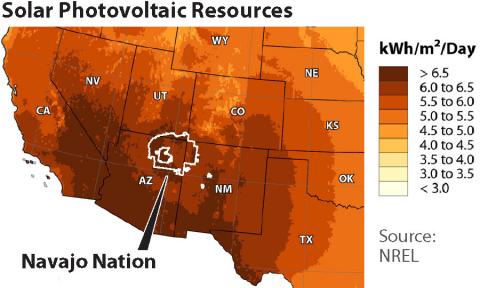

Bill to spark federal post-coal reinvestment in Arizona tribal communities is a good beginning

September 01, 2019

Karl Cates, Tony Skrelunas

Report

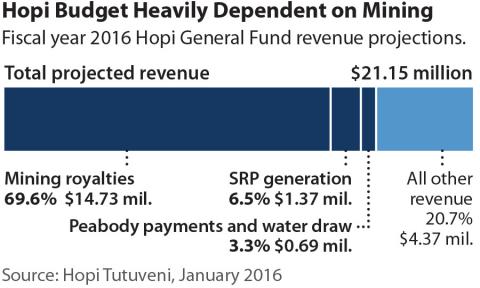

As coal economy collapses, imminent public budget crisis confronts Hopi-Navajo tribes

May 01, 2019

Karl Cates, Pam Eaton

Report

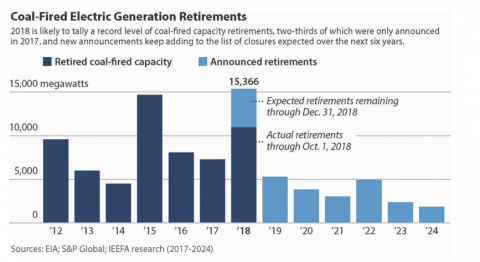

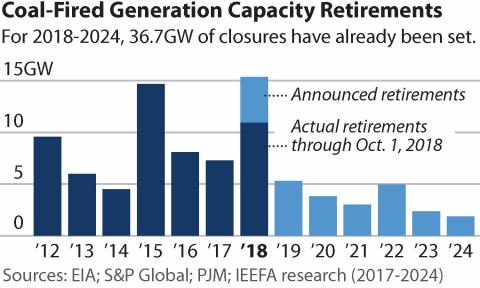

Record drop in U.S. Coal capacity likely in 2018

October 01, 2018

Seth Feaster

Report

A blow-by-blow of the U.S. coal phase-out

April 01, 2017

Seth Feaster

Report

2017 U.S. coal outlook

January 01, 2017

Tom Sanzillo, David Schlissel

Report

The economics of continued operation of Owensboro Municipal Utilities’ Elmer Smith Station coal-fired power plant

July 01, 2016

David Schlissel

Report

Cost of coal from 'mine-mouth' Prairie State plant isn’t the bargain that was promised

April 01, 2015

Tom Sanzillo

Report

2014 - another year of unmet promises for the Prairie State Energy Campus

February 01, 2015

David Schlissel

Report

Latest Kentucky Press Releases

See more >

IEEFA U.S.: Gas-fired power plant cancellations and delays signal investor anxiety, changing economics

November 18, 2021

Press Release

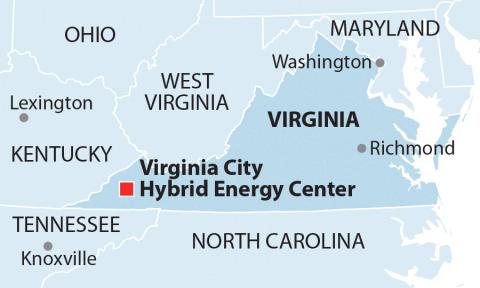

IEEFA U.S.: Virginia coal plant’s future isn’t bright: preparation for transition should commence now

December 16, 2020

Press Release

IEEFA U.S.: Long-term contracts with American Municipal Power (AMP) saddle local communities with high prices

September 21, 2020

Press Release

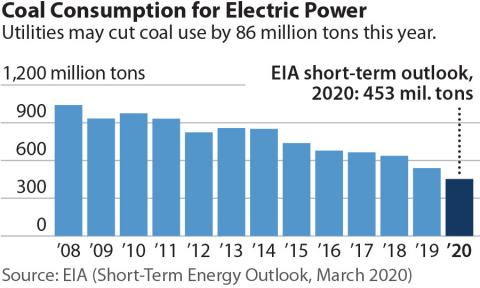

IEEFA Coal Outlook 2020: Market trends are pushing U.S. industry to a reckoning

March 30, 2020

Press Release

IEEFA report: Dim future for Illinois Basin coal

December 10, 2019

Press Release

IEEFA report: Coal-fired power generation collapsing across Southeast U.S., longtime bastion of the industry

October 01, 2019

Press Release

IEEFA U.S.: Bill to incentivize federal reinvestment in tribal regions of Arizona suggests a model for coalfield communities nationally

September 19, 2019

Press Release

IEEFA brief: Paradise 3 coal plant merits retirement

June 11, 2019

Press Release

IEEFA U.S.: Imminent Hopi-Navajo budget crisis as coal industry collapses

May 30, 2019

Press Release

IEEFA U.S.: Solar tax credit extension through 2024 critical for coalfield communities

May 01, 2019

Press Release

IEEFA report: U.S. likely to end 2018 with record decline in coal-fired capacity

October 25, 2018

Press Release

IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals

January 19, 2017

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.