Search

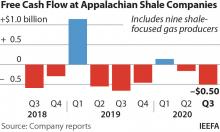

Appalachian frackers spill red ink in third quarter - again

Nine shale-focused producers in Appalachia report cumulative $504m negative free cash flow. They slashed their capital expenditures (capex) in the third quarter by more than one-third compared to the prior year. Despite the cuts, the nine…

Report

Carbon capture and storage is about reputation, not economics

Even though supermajors have emphasized the role of CCS in meeting net-zero objectives, there is no financial justification for investing in CCS.

Report

Is the oil industry really keeping inflation in check? Huge profits suggest not

Oil industry executives complain about rising drilling costs but their responses to breakeven profitability questions downplay the cyclical impacts of their industry

Analysis

In Q1, Four of Five Oil Majors Paid More Cash than They Made from Operations

Four of the world’s five largest oil and gas companies spent more cash on dividends and share buybacks during Q1 than they generated from their core business operations.

Report

New Mexico’s risky reliance on oil revenue must change

After years of benefitting from record oil and gas revenues, global markets are signaling the beginning of the end of New Mexico’s financial reliance on fossil fuels.

Report

ExxonMobil’s prodigal reserves return: Company rebooks 3.2 billion barrels of previously de-booked Canadian oil sands reserves

ExxonMobil’s recent 10K filing for 2018 shows it has rebooked 3.2 billion barrels of Canadian oil sands reserves, increasing its worldwide reserves from 21.2 billion barrels in 2017 to 24.3 billion barrels in 2018, a 13% increase.

Report

IEEFA Energy Finance Conference 2020 roundup: Local leadership, global change

The transition to renewable energy is frequently advocated on environmental grounds, but the financial case for moving away from fossil fuels is becoming undeniably clear, according to experts speaking during the final week of IEEFA’s 2020…

Analysis

Vaca Muerta update: Faltering development plans for Argentina’s shale reserves will accelerate without foreign investment

Faltering development plans for Argentina's shale reserves will accelerate without foreign investment

Report

Despite hype, Tellurian's LNG plans face an uphill battle

… that the company had secured LNG purchase

agreements with Shell but a closer look at the finances reveal a different …

Report