IEEFA/JMK: India’s first grid-scale standalone energy storage tenders to spur investments and domestic manufacturing

Policymakers view the tenders as pilot tests that will help streamline regulatory processes of the energy storage market.

Key Takeaways:

Successful execution of the two tenders will showcase the technological and financial viability of energy storage to investors and create a supply chain infrastructure for increased domestic manufacturing of batteries.

Energy storage systems will be vital for India’s renewable energy targets and need ample policy support, including a time-based target.

Future energy storage systems tenders will likely incorporate new business models, such as energy trading, focus on alternate technologies, and require using locally made batteries.

4 July (IEEFA & JMK India): Two standalone energy storage system (ESS) tenders by the Solar Energy Corporation of India (SECI) and NTPC will augment the country’s energy storage capacity by 1 gigawatt (GW)/4 gigawatt-hours (GWh) and create further opportunities in the Indian ESS market, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

“India is on the cusp of a potential energy storage revolution,” says co-author Vibhuti Garg, Energy Economist and Lead India, IEEFA. “Large-scale deployment of storage will be critical to firm increasing amounts of variable wind and solar as India scales up renewable energy capacity to meet its target of 500GW of non-fossil fuel energy by 2030.

“The recent power crisis showed there is a need to plan and invest now in storage as well as renewable energy capacity addition to help reduce reliance on increasingly uneconomic and unreliable coal-based power.”

The Central Electricity Authority predicts that India will need 27GW/108GWh of grid-scale battery energy storage system (BESS) and about 10.1GW of pumped hydro storage (PHS) to meet its target of 500GW of non-fossil fuel energy capacity by 2030.

“India has to rapidly deploy energy storage to meet its renewable energy goals, and a time-based target in the upcoming national energy storage policy would be a major driver of the ESS industry’s growth,” says Garg.

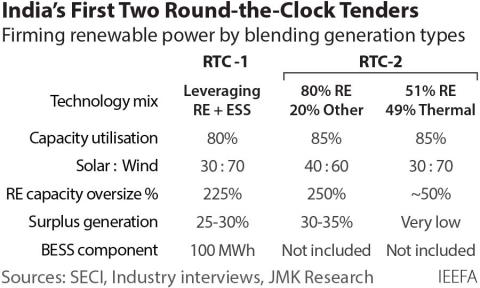

ESS tenders have evolved from round-the-clock and peak power to the current standalone tenders, the report notes.

“These are the first large-scale standalone tenders of their kind in the country, and they could be a catalyst for the entire Indian ESS market,” says co-author Jyoti Gulia, Founder, JMK Research.

“Successful and timely execution of these projects will boost investments into the ESS space and spur domestic manufacturing in this segment.

“SECI has deliberately declared its tender as a pilot project. Thus, the learnings from these tenders in bidding and execution will contribute to future ESS tender designs by central tendering authorities, such as NTPC and SECI.”

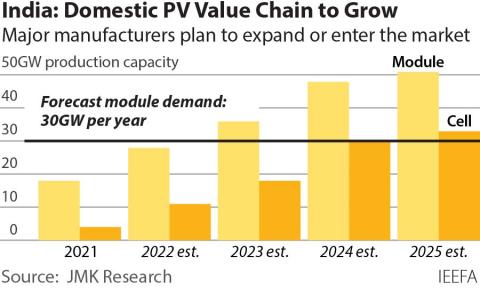

The report finds that NTPC and SECI tenders, if well executed, will offer opportunities to spur domestic manufacturing of batteries, boost investor confidence and create new business opportunities in the short-to-medium term.

The two tenders are a good indication of the scale expected in future ESS tenders. As a result, domestic manufacturing capacities of major components, such as batteries and battery inverters, and ancillary supply chain infrastructure, such as electrolytes, casings and separators, could rise.

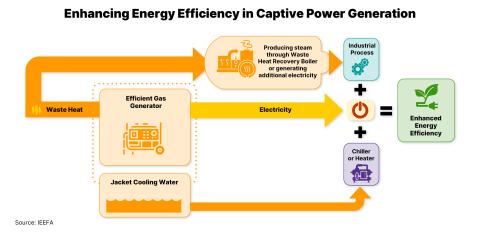

Similarly, the tenders will also help create new business models such as capacity markets, wherein capacity providers/developers supply power at a scheduled time.

Finally, while investors in India are unsure of standalone ESS, successful and timely execution of NTPC and SECI tender projects will help demonstrate the technological and financial viability of the new technology.

The report also notes that the two tenders from NTPC and SECI will likely face technical, procurement and regulatory challenges.

“For example, the NTPC tender requires a 6-hour ESS solution. While battery energy storage systems (BESS) are not a viable option beyond a 4-hour solution, pumped hydro storage (PHS) solutions have a significantly larger lead time than the project commissioning timeline,” says co-author Prabhakar Sharma, Senior Research Associate, JMK Research.

The authors also highlight the challenges these tenders will face to secure long-term supply and maintenance contracts as the technology is still nascent.

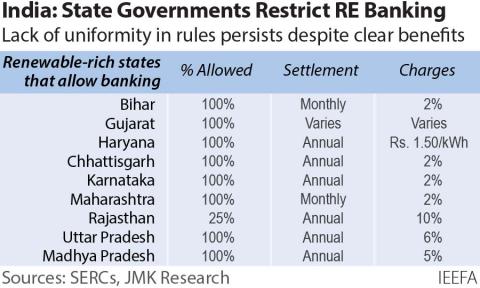

There are also regulatory issues that the tenders will need to overcome.

“The Indian Electricity Act 2003 does not consider energy storage as a standalone asset. Thus, taxation of such assets might create a few regulatory hurdles, especially until the formulation of a national ESS policy,” says co-author Akhil Thayillam, Senior Research Associate, JMK Research.

The report recommends policy support from the government and flexible tender designs by the authorities for the organic development of the domestic sector.

“ESS will be the next major technology influencing the power sector in the coming decade. A comprehensive national ESS policy will significantly address major impediments faced by the ESS industry in India,” says Gulia.

“It is the government’s responsibility to facilitate discussions/dialogues between various stakeholders in the ESS industry. This aids in formulating effective policy design and overcoming other challenges associated with an emerging technology like ESS.”

India, being a complex and diverse country, will need a combination of factors that have been the primary drivers of ESS deployment in the leading markets. Therefore, the report presents a case study of one of the largest operational BESS plants in the world installed in the UK. The facility provides certainty of revenue flow to the BESS owner, owing to its dynamic participation in multiple markets (Ancillary, Energy Shifting). This project demonstrates to Indian stakeholders (tendering authorities, developers etc.) ways to optimise the viability of ESS by utilising multiple revenue streams.

Read the report: Evolution of Grid-Scale Energy Storage System Tenders in India

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Author contacts: Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com