Making the case for Norwegian Sovereign Wealth Fund investment in renewable energy infrastructure

Download Full Report

Key Findings

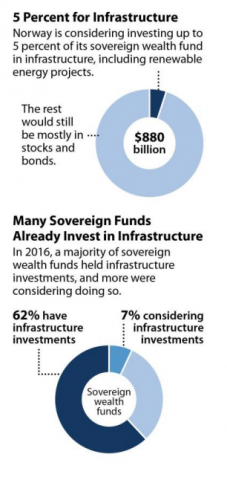

A growing proportion of sovereign wealth funds are investing in unlisted infrastructure, and participation has increased from 57 percent of such funds in 2014 to 62 percent in 2016.

As Funds look to broaden their investments universes and balance risk and reward with traditional investment allocations to equities and bonds, real estate and infrastructure have become the most commonly sought-after sectors. Roughly 7% of sovereign wealth funds that have not done so yet are considering investing in infrastructure, suggesting that this asset class is likely to see further growth.

Executive Summary

Global investment markets in renewable energy infrastructure are growing rapidly, returns are reliable, and the sector benefits from a positive outlook.

These are the essential findings of this report, which describes how assets bought and sold across this space—in wind farms and solar plants—yield returns and retain value.

In June, lawmakers will consider granting a mandate for the US$880 billion Government Pension Fund Global (GPFG) to invest in infrastructure including renewable energy, which has become by far the most significant sub-sector in this asset class.

The manager of the Fund, Norges Bank, recommends up to 5 percent of the Fund be invested in global infrastructure. Norway’s Finance Ministry has been reluctant to approve such a move, however, citing concerns over assorted risks, but Parliament has the authority to advance the mandate. This report is meant to inform the dialogue.

Infrastructure is an established asset class embraced by many of the world’s leading investment funds. In 2016, 62 percent of sovereign wealth funds held infrastructure investments, and an additional 7 percent were considering doing so.

This report focuses on unlisted infrastructure, a sector that is dominated by renewable energy but also includes public roads, ports, railways, and water and sanitation facilities. Renewable energy infrastructure accounts for roughly 42 percent of all unlisted infrastructure transactions, and is becoming a separate investment vehicle.

Well-managed infrastructure investments bring returns of 12 to 15 percent annually, with investments in renewable infrastructure producing steady, stable returns that exceed expectations. Brookfield Asset Management, among the examples mentioned in this study, operates exemplary funds that return 10 to 20 percent annually.

The renewables sector is no longer the experimental space it was, having entered a longterm growth cycle with a strong outlook driven by low costs, competitive prices, policy advances and rapid uptake. The sector is also diversifying by adding wind and solar investments to long-held hydropower portfolios.

Unlisted infrastructure investments do come with risks. These include financial risk related to liquidity, complexity and transaction costs, and regulatory and political risks that vary by location. That said, well-managed funds have developed robust methods to mitigate such risks.

Five Recommendations for How to Proceed:

- Establish an investment mandate that requires managers of the Government Pension Fund Global to invest 5 percent of the fund’s assets in unlisted infrastructure, including unlisted renewable energy investments.

- Guide the Fund’s investments in unlisted infrastructure by expanding in-house professional staff resources, with a focus on developing a long-term team comparable in quality to those at other top institutional investors.

- Create partnerships with established investment funds that have a track record in the unlisted infrastructure field, and co-invest with those funds under mutually beneficial arrangements.

- Reserve a portion of the Fund’s infrastructure funds for investments in listed utility companies that have significant and promising portfolios in renewable energy.

- Develop a firm and prudent commitment to investing in infrastructure projects in emerging markets.

The opportunity in infrastructure investment is enormous. The risk is manageable.

Press release: IEEFA Report: Norway Sovereign Wealth Fund Stands to Gain by Investing Now in Renewable Energy Infrastructure

Please view full report PDF for references and sources.