In China’s Turmoil, Further Declines for Coal

The latest demand-side statistics out of China show a continuation of coal-industry pain:

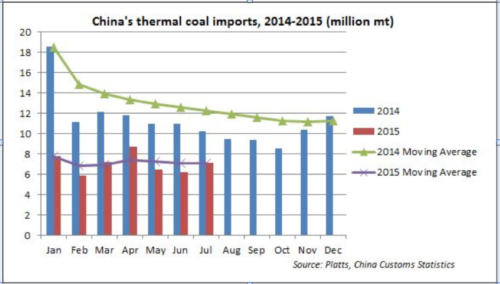

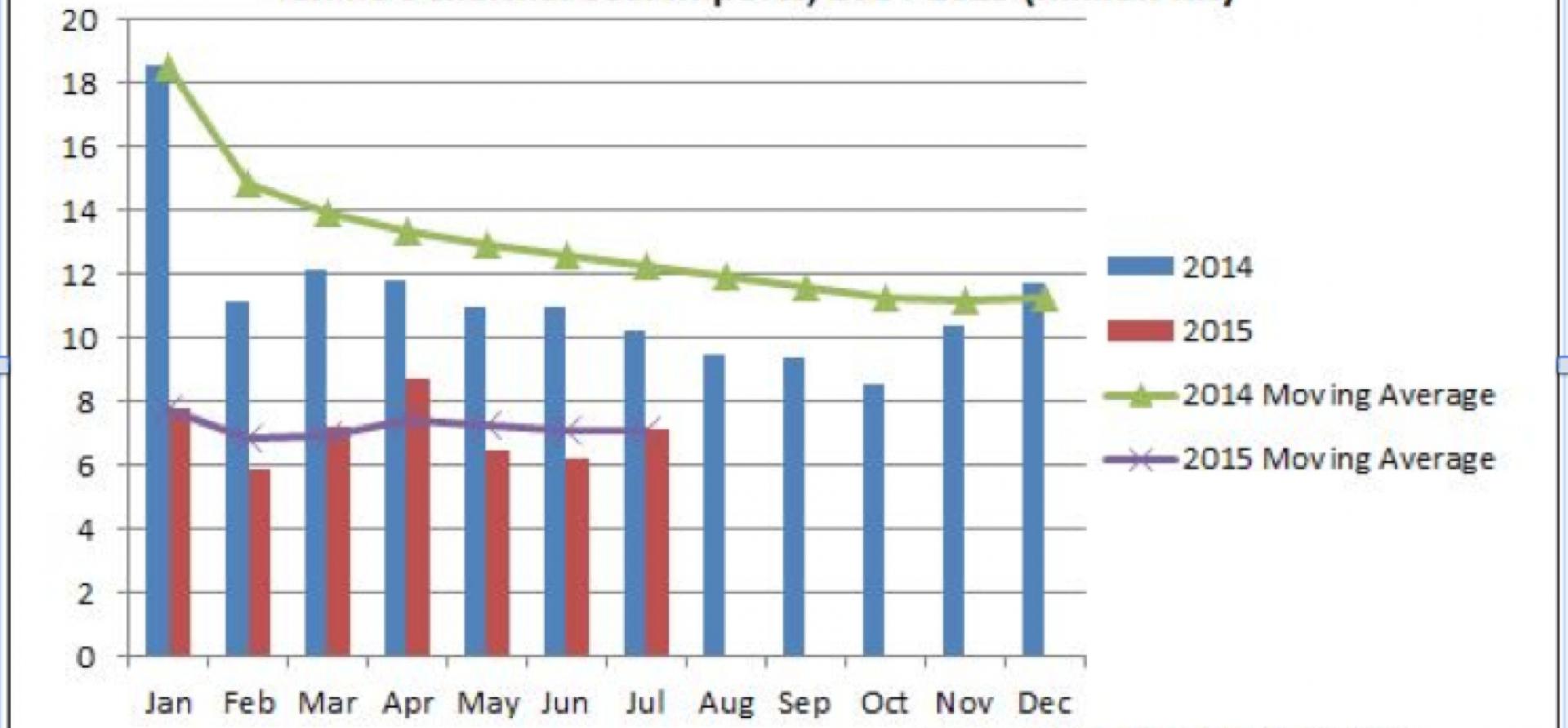

- Coal imports into China were down 34.4 percent year-on-year through July.

- Total China coal sales were 305Mt in July, down 4.9 percent on the year, and declining 7.7 percent to 1.945 billion tonnes in the first seven months of the year.

- China’s manufacturing demand continues at well below average in a trend that is consistent with the near-term equity market collapse and currency devaluation, both suggesting continued weak commodity demand ahead.

Expanding on China’s coal import trends, it’s noteworthy that coal imports fell 9 percent year-on-year in July, a significant slowing in the rate of decline relative to the total 38 percent year-on-year drop over the first six months of the year. Reuters reports a significant lift in Australian coal exports to China in July after a horrific first half of the year. While still down 22 percent year-on-year since Jan. 1, Australian exports to China actually rose 0.6 percent year-on-year in July, according to the Reuters data.

On the coal-consumption side of the equation, year-to-date numbers are extremely weak, down 7.7 percent year on year (weaker than the 5.8 percent decline in domestic coal production, consistent with the loss of market share by imports). The last reported electricity numbers for China shows demand marginally up (by 1.3 percent year-on-year for the first six months of 2015), so this collapse in coal demand suggests a massive market share loss to other sources of electricity generation. So there’s a three-pronged loss of momentum: Electricity demand is decoupling from economic growth, coal is losing market share, and imports are losing share of coal’s shrinking segment of that market (International Energy Agency projections have yet to acknowledge this triple whammy).

Consistent with the market share loss by coal, China Longyuan Wind Power reported its first half of 2015 interim results this past weekend, with wind generation up 22 percent year on year. China Longyuan is the largest wind farm owner in China, and added 1.03 gigawatts of new wind-farm generation over just the last six months, with an additional of 10.6 gigawatts in the pipeline. Bloomberg New Energy Finance sees 2015 shaping up to be a global record for Chinese wind installs to about 23 gigawatts in total,. Solar in China is likewise forecast to be a record 17-18 gigawatts in 2015. Chinese nuclear and hydro capacity expansions continue apace as well.

CONSISTENT, TOO, WITH THE SIGNIFICANT DECLINE IN CHINA’S DOMESTIC COAL CONSUMPTION, are results reported this week by China Shenhua Energy. Coal production in the first half of 2015 was down 10.1 percent year-on-year. Shenhua’s coal-fired power generation was down 5.8 percent, revenue was down 31 percent, and net profit was down 43 percent.

Shenhua reports July coal production down 9.7 percent year on year and electricity production down 7.9 percent—another clear signal of no let-up in the momentum. Shenhua’s total coal sales in terms of volume, (including third-party trading) were down 15 percent.

Reuters reports that China will probably see some 96-170 gigawatts of coal-fired power capacity idled this year, as slowing demand for electricity will make it impossible for the industry to absorb growing capacity, which may exceed 960 gigawatts in total by the end of the year. Yet China continues to rapidly expand its coal-fired power-generation capacity even as demand shrinks for the second year running, creating a huge stranded-asset problem that will have to be addressed if the coal-fired power sector is to stabilize toward profitability.

China’s coal-fired power plant utilization rates declined to a national average of only 49.4 percent in the first half of 2015, a decade low.

AND IT’S QUITE A BEARISH COMMENT ON THE PRICE OUTLOOK FOR THERMAL SEABORNE COAL that appears this week in a Platts research note. The note makes mention of the very competitive cost structures in Columbia and Russia under current conditions.

Here’s an excerpt:

“The elusive ‘floor’ has been a subject of debate as the market consistently broke almost every estimate on the street, as prices grinded lower. What we do know is that from current levels, there is a declining marginal impact of every unit of weakening in exchange rates on the cost of production. Operating margins can be cushioned only so much by declines in the currency value and in oil prices, as we move towards the intrinsic value of the commodity and plus its most ‘basic’ extraction and freight costs.”

“The Colombian producers can push their marginal cost of production to the low $30s/mt on an FOB basis, adding freight to which can set the delivered price into Europe at close to the low $40s/mt.”

The report has a good chart that’s shows the monthly comparison of Chinese coal imports in 2015 versus 2014. The rate of decline has slowed as the year has progressed, but China is on track still to see an overall more than 30 percent coal import volume decline in 2015.

Meantime in India, an article in Business Standard yesterday details the government’s restated commitment to encouraging outside investment in clean energy and energy efficiency and to its “substantially enhanced target for renewable energy of up to 300 gigawatts by 2030.”

In the same piece: A rejection by the high-ranking union environment minister, Prakash Javadekar, of a policy suggestion that India ally with Poland and Australia to lobby for more coal production.

IEEFA expects that India’s INDC will positively surprise on commitments for aggressive renewable energy, grid and energy efficiency targets out to 2030, subject to a global commitment to deliver the necessary infrastructure investment capital. This could give significant momentum to “Road to Paris” policy initiatives to accelerate the transition to a lower emissions-intensive global economy.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia.