IEEFA: Who benefits from MIGA’s sustainable loan guarantee for PLN?

Sometimes bankers can be too clever for their own good. This is especially true when the market is distracted by misleading statements about sustainable development impact and investors fail to read the fine print.

PLN has serious financial pressures to address

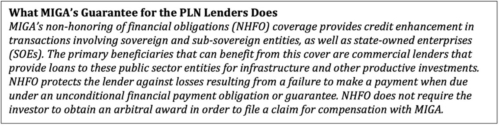

Indonesia’s state-owned power company, PT Perusahaan Listrik Negara (PLN), started 2021 by proudly announcing that it had finalized a USD 500 million sustainable loan from a consortium of leading global banks including Citibank, DBS, JP Morgan, Standard Chartered, and SMBC—all of which count debt-laden PLN as a valued customer. It even had the imprimatur of the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA), which provided a guarantee to the lenders to cover the risk if the state-owned PLN could not meet its repayment obligations. On the face of it, this was a tailored loan that looked like a welcome solution to PLN’s urgent cash needs.

Source: MIGA

The loan was also pitched as a good way for PLN to begin establishing its credentials with the green and sustainable finance market. With this in mind, PLN’s finance director, Sinthya Roesly was quoted by Environmental Finance as saying that “This step is a follow-up to PLN in realizing the Sustainable Financing Framework…and is a real agenda for the transformation of PLN.”

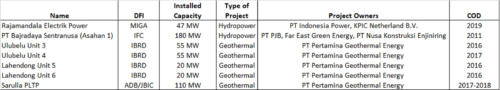

PERHAPS PLN’S ROESLY CAN BE FORGIVEN FOR INDULGING IN SOME MARKETING SPIN. PLN has serious financial pressures to address and affordable funding from any source has to be at the top of her agenda in 2021. What’s more puzzling is MIGA’s cynicism. An analysis of this green loan makes it hard to shake the impression that this was an opportunistic green box ticking exercise. That’s because the indirect beneficiaries of the proceeds are the six sponsors of operating renewable projects that have already been funded, in part, by the World Bank and two fellow development finance institutions, the Asian Development Bank (ADB) and the Japan Bank for International Cooperation (JBIC).

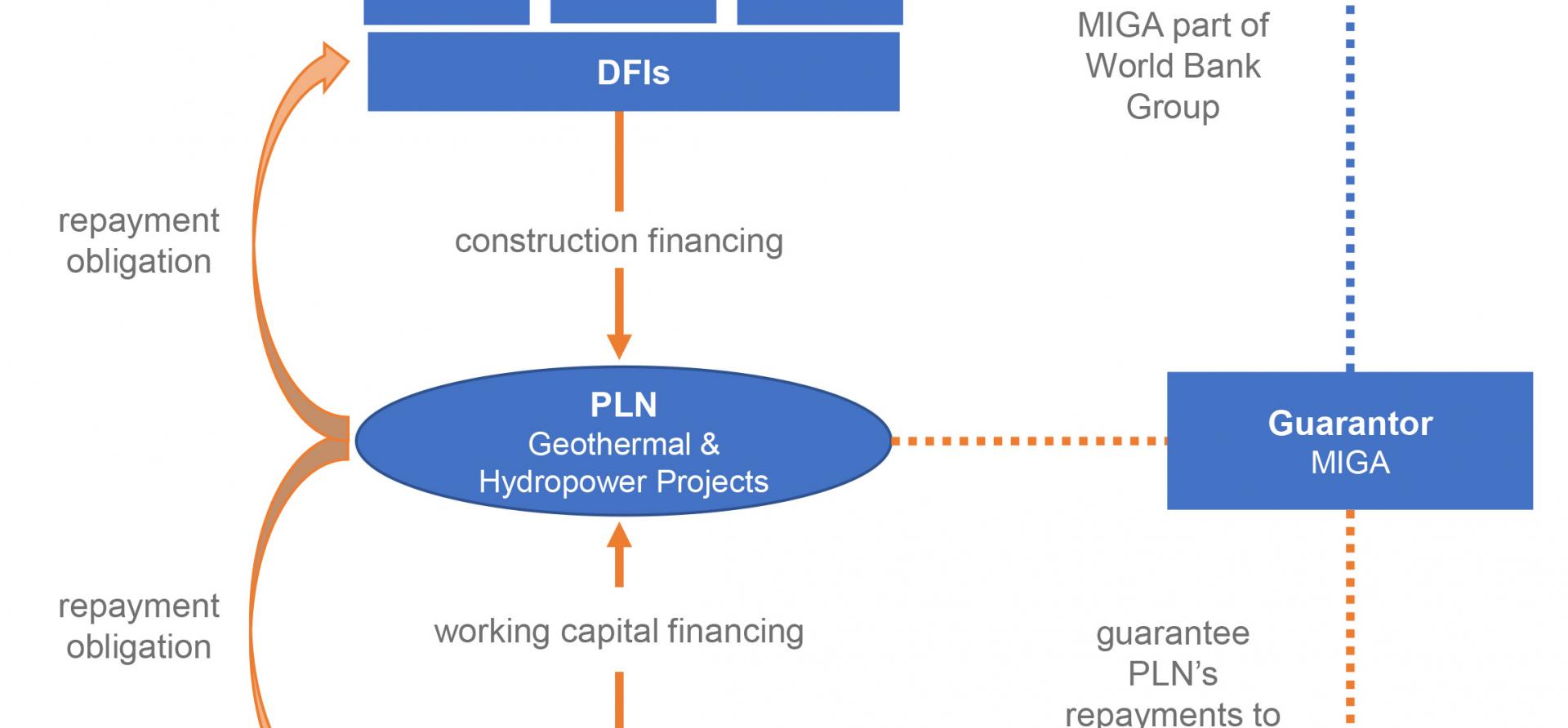

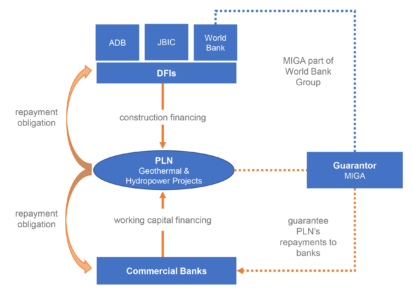

MIGA’s documentation for the PLN loan describes a process in which they were approached by eight “potential lenders” to provide a guarantee covering up to USD 617.5 million of loan principal and future interest for a term of up to five years. The purpose of the loan is to finance “short-term working capital expenses” for renewable power projects that supply PLN. MIGA’s documentation for their board states that this guarantee is “consistent with MIGA’s US$ 6 billion COVID-19 response package” which is intended to “assist member countries in addressing the global pandemic and its impacts.” The loan is also intended to support “sustainable energy and universal access in Indonesia.”

Source: IEEFA

FIRST, THE FINANCE REALITIES. This is nothing more or less than a credit-enhanced working capital facility designed to cover PLN’s “operational expenses” related to six projects that have already been fully funded. In other words, the funding will cover tariff and power purchase agreements for renewables projects that have already been completed and are presumably already part of PLN’s operating budget. That means that the loan fails the test of additionality. The funding does nothing to provide new incentives to PLN to accelerate energy transition—or to address any of its existing operational challenges. It merely means that PLN will benefit from an injection of cheap working capital to stay current with its IPP payments—the clean and the dirty. It does nothing to change PLN’s current or future generation mix. It merely plugs a cash hole.

SECOND, IT APPEARS THAT MIGA HAS CHOSEN TO SUBSIDIZE A LOAN TO PLN THAT COULD BE VIEWED AS PROVIDING A BENEFIT TO THE WORLD BANK GROUP. Like a green bond where the proceeds are meant to flow to a specific project, the MIGA backed green loan has been specifically designed to provide working capital to fund payments to projects that have been funded in part by the World Bank (MIGA’s parent) and other development finance institutions (DFIs). Optically, this comes uncomfortably close to a type of self-dealing that undermines the lofty goals cited in the project documentation. In this instance, PLN’s leading offshore lenders, backed by MIGA’s guarantee, have done little more than provide working capital financing to PLN that will now, in part, be used to meet PLN’s financial commitments to projects that presumably need to meet debt repayment obligations to the World Bank, JBIC, and ADB.

The loan fails the test of additionality

The DFIs’ interest in ensuring that their projects stay current—and realize their expected return—is easy to understand. By providing credit enhancement to the lenders, MIGA has lowered PLN’s funding costs and mitigated the risk that PLN might miss tariff payments to their projects. This will permit the DFIs to recycle capital, but it fails to address PLN’s fundamental strategic challenges stemming from a decade of over-reliance on coal-fired independent power projects (IPPs) with fixed capacity payment obligations. At a time when the DFIs should be working with PLN to address fundamental operating problems and energy transition, it appears that they have instead opted to put a low-cost band-aid on PLN’s financial problems.

Source: MIGA, IEEFA research

THIRD, THIS DEAL DOES LITTLE TO PUT PLN ON THE RUNWAY FOR SUCCESS IN THE SUSTAINABLE FINANCE MARKET. Green bonds and sustainability-linked loans are designed to channel funding to new sustainable projects and investments that will help companies achieve tangible sustainability outcomes. Governance—in the form of transparency and disclosure—is crucial to building credibility for issuers like PLN. MIGA should be well aware of the importance of these principles as a World Bank Group entity. Instead, the available documentation does little to indicate that MIGA has appreciated the challenges that PLN faces in building a sustainability track record.

PLN’s lenders were smart enough to know that a greenish label would please the market

Leading asset owners and asset managers have already expressed clear preferences for projects that provide additionality in the form of funding for low carbon projects that would not otherwise have been funded. In addition, any form of project funding for a traditional green bond gains credibility in the marketplace only when the issuer has demonstrated that project commitments support a coherent energy transition plan and a credible sustainable finance framework. In the absence of a current power sector planning document (RUPTL) or an updated Nationally Determined Contribution (NDC), it is impossible for investors to assess what role the six renewables projects play in PLN’s generation mix or whether these projects are having the desired positive environmental impacts.

PLN’s lenders were smart enough to know that a greenish label would please the market. But given the importance of credit enhancement to PLN’s lenders, it’s hard to imagine that MIGA couldn’t have come up with a more credible set of incentives for PLN that would deliver a positive impact. This is a time for innovation and high impact sustainable finance solutions, not a clever wrapper for a guaranteed working capital loan that destroys market credibility.

This article first appeared in Responsible Investor.

Related articles:

PLN still refusing to adapt, a move which will hurt investors, consumers, and the government purse

PLN has ‘Green Ambition’ but is short on renewable energy credibility