IEEFA: India’s new record-low solar power tariff demonstrates investor confidence despite the pandemic

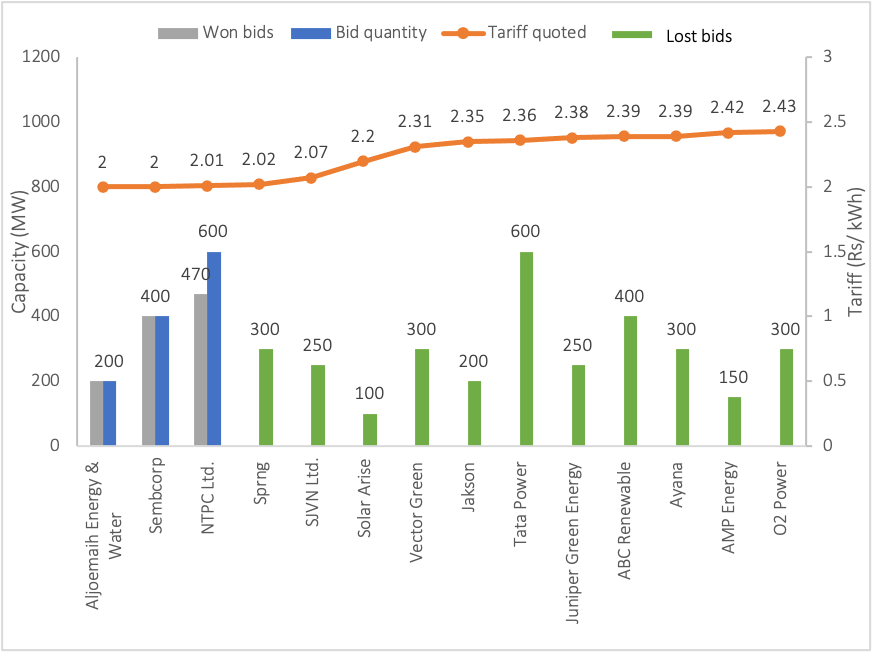

India set a new record low tariff of Rs2/kWh ($0.027/kWh) in the recent Solar Energy Corporation of India (SECI) auction on 23 November 2020. The tariff based bidding was conducted for selection of solar power developers to set up 1,070 megawatts (MW) of grid-connected solar PV projects on a “build-own-operate” (BOO) basis in Rajasthan (Tranche-III). With 14 developers participating, the tender was oversubscribed by 3,280MW, attracting a total of 4,350MW of bids.

SECI 1,070MW Solar (Tranche-III) Tender Results

Source: SECI, JMK Research

Saudi Arabia-based Aljomaih Energy and Water Co. and Sembcorp Energy’s India arm Green Infra Wind Energy Ltd. were the lowest (L1) bidders with a tariff of Rs2/kWh for 200MW and 400MW capacities respectively. State-owned NTPC Ltd. won the contract for the remaining 470MW with the second lowest (L2) bid of Rs2.01/kWh.

The commissioning timeline for these projects is 18 months from the date of signing power purchase agreements (PPA). This is the first SECI tender where the majority of capacity (600MW) has been won by foreign developers.

In our new briefing note we discuss the key factors behind the Rs2/kWh ($0.027/kWh) tariff. These include access to low-cost financing at 7-7.5% for government entities like NTPC and for international developers able to arbitrage multi-decade, record-low OECD interest rates (even adjusting for a significant combined currency and country risk premium for India). And expectation that mono PERC module prices will fall 10-15% to reach USc19-20/Wp (watt peak) by 2022 (excluding duties and taxes).

In addition to low-cost financing and module price deflation, there is another factor facilitating the tariff of Rs2/kWh. The adoption of bifacial modules with single axis trackers increases the capacity utilisation factor (CUF) by 4% to 23%, which leads to higher generation. However, lenders in India are reluctant to fund this technology without a project history or previous track record, despite its rapid adoption and use in various other countries including the UAE.

Power purchase assurance – with the Power Sale Agreement (PSA) between the intermediary procurer SECI and the buying entity already signed – provides confidence to developers and minimises the offtaker risk. Power procured by SECI has been provisioned to be sold to Rajasthan Urja Vikas Nigam Limited (RUVNL). Another contributing factor may be that modules for this specific tender will be exempt from safeguard duty (SGD) and basic custom duties (BCD).

Though able to be justified by the returns, there are many significant risks that a large scale solar project faces that must be accounted for. To earn reasonable returns on solar infrastructure projects, it is crucial for developers to factor in the risks and correctly estimate the cost of every component.

Risks that need to be taken into consideration include lesser generation on account of lower radiation than estimated, inadequate operation and maintenance (O&M) practices, equipment failure, floating interest rates that change in line with Reserve Bank of India (RBI) guidelines, a rise in module costs due to various global demand and supply factors, currency fluctuation leading to higher prices for imported modules and inverters, power offtake risk of lossmaking distribution companies (discoms) and curtailment issues.

There are still big question marks over the technologies these projects will adopt and which lenders will back them. Also whether these projects only need financial engineering, or require adoption of new technologies with higher generation, or a mix of both remains to be seen.

This new low tariff will also impact discoms which will likely treat it as a new benchmark. This can further delay the signing of PSAs of previously awarded but yet-to-be signed renewable projects between discoms and SECI. Project quality might also be impacted or compromised by such aggressive tariffs.

Time alone will tell whether a Rs2/kWh tariff is viable but clearly the bidding has demonstrated investor confidence in the Indian solar sector even amidst the pandemic. It sets yet another tough benchmark for the whole industry, but also highlights the cost reduction opportunities for India as the country builds a more sustainable, more domestic-based energy system in its drive towards zero emissions electrification of the economy.

Read the briefing note: Why India’s Solar Power Tariffs Reached an Historic Low

Jyoti Gulia is Founder of JMK Research & Analytics

Vibhuti Garg is an Energy Economist at IEEFA

Related items:

Indian wind-solar hybrid capacity could jump almost 80 times in three years

IEEFA India: Interpreting solar tariff trends

IEEFA: Why India can’t match the Gulf region’s record-low solar tariffs